2010 SC Biz - Issue 2

-

Upload

sc-biz-news -

Category

Documents

-

view

223 -

download

0

description

Transcript of 2010 SC Biz - Issue 2

ALSO IN THIS ISSUE:

A look aheadSanford discusses his

fi nal year in offi ce

S.C. DeliversPorts, Logistics &

Distribution

Doing business in S.C.

The Business Resource Guide looks at key elements that infl uence

economic development decisions

Second time aroundSecond-career lawyers

use prior careers to their advantage

Bi-Lo is backThe grocery store chain

emerges from bankruptcy

Summer 2010

SC Biz News LLC

389 Johnnie Dodds Blvd.

Suite 200

Mt. Pleasant, SC 29464

CHANGE SERVICE REQUESTED

ATTORNEYS AND COUNSELORS AT LAW

Tara E. Nauful, Financial Institutions Team Leader, 1201 Main Street, Columbia, SC 29201

WWW.HSBLAWFIRM.COM CHARLESTON COLUMBIA FLORENCE GREENVILLE MYRTLE BEACH WASHINGTON, DC

BANKRUPTCY DOESN’T HAVE TO BE A DEAD ENDH

They bring an array of skills to matters involving bankruptcies, work-outs and turnarounds, and comple nancial services litigation

They take pride in their ability to provide quality, effective, and practical advice, while keeping the client s economic interests in the forefront of everything they do

TRANSFORMING THE FINANCIAL LANDSCAPE

STAN MCGUFFIN, TARA NAUFUL & BILL SHORT

Shareholders of Haynsworth Sinkler Boyd, A

erti ed Specialists in Bankruptcy Debtor/Creditor

Law by the South Carolina Supreme Court

Listed in the 2010 South Carolina Super Lawyers

2 SC BIZ | www.scbizmag.com

20

D E P A R T M E N T S SPECIAL SECTION PAGE 35

4 | Viewpoint

6 | Upfront

8 | Technovation

10 | Spotlight: Florence

12 | Trends

48 | 1,000 words

V O L . 4 , I S S U E 2 S u m m e r 2 0 1 0

®

CEO and Publisher - Grady Johnson

[email protected] • 843.849.3103

Vice President of Sales - Steve Fields

[email protected] • 843.849.3110

Managing Editor - Andy Owens

[email protected] • 843.849.3141

Special Projects Editor - Allison Cooke Oliverius

[email protected] • 843.849.3149

Senior Copy Editor - Beverly Morgan

[email protected] • 843.849.3115

Staff Writer - Mike Fitts

[email protected] • 803.401.1094, ext. 204

Staff Writer - Ashley Fletcher Frampton

[email protected] • 843.849.3129

Staff Writer - James T. Hammond

[email protected] • 864.235.5677

Staff Writer - Scott Miller

[email protected] • 864.235.5677

Staff Photographer - Leslie Halpern

[email protected] • 843.849.3123

Art Director - Ryan Wilcox

[email protected] • 843.849.3117

Senior Graphic Designer - Jane Mattingly

[email protected] • 843.849.3118

Director of Business Development - Mark Wright

[email protected] • 843.849.3143

Account Executive - Bennett Parks

[email protected] • 843.849.3126

Circulation and Event Manager - Kathy Allen

[email protected] • 843.849.3113

Circulation and Event Assistant - Kim McManus

[email protected] • 843.849.3116

The entire contents of this publication are copyright by SC Biz News LLC with all rights reserved. Any reproduction or use of the content within this publication without per-mission is prohibited. SCBIZ and South Carolina’s Media Engine for Economic Growth are registered in the U.S. Patent and Trademark Office.

Mailing address:

389 Johnnie Dodds Blvd., Suite 200

Mount Pleasant, SC 29464

Phone: 843.849.3100 • Fax: 843.849.3122

www.scbiznews.com

Contents

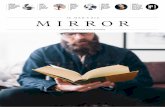

Cover Photo/Leslie Halpern

FEATURES

25

14

18

COVER STORY

Ports, Logistics

& Distribution in

South Carolina

5

P O R T S , L O G I S T I C S & D I S T R I B U T I O N I N S . C .

S.C. Delivers

ISSU

E 2, 2

010

A P U B L I C AT I O N O F S C B I Z N E W S

Flight plan Southwest to serve

South Carolina in 2011 Page 41

$1 billion impactStudy reveals impact of aviation

center on Upstate Page 44

Hot oilS.C. company converts

cooking oil into biodiesel Page 46

SSSSSSSSSSSSStttttttttt

Forty companies have announced this

year that they would either expand

existing operations in South Carolina or

establish new ones. So, what’s attract-

ing these businesses to South Carolina

and persuading them to stay? The Busi-

ness Resource Guide looks at four key

areas and their infl uence on economic

development decisions across the state.

Making a second career of the law Bi-Lo is back

Market Adjustment

BUSINESS RESOURCE GUIDE

2010 List of SC Fastest Growing Companies

The South Carolina’s Fastest-Growing Companies program, the annual exclusive ranking of the Palmetto State’s most dynamic

and successful companies is seeking the state’s best performing companies. This is your chance to be part of this

exclusive group of best-of-breed companies whose achievements have been honored over the past nine years. This year’s

top 25 highest-ranking companies will be honored at South Carolina’s Chamber of Commerce Annual Summit on Nov. 11,

2010 at Wild Dunes Resort near Charleston, S.C.

To learn more about South Carolina’s Fastest-Growing Companies,

or to nominate your organization, visit www.thecapitalcorp.com

or contact Cristina Schleifer at (864) 672-8400.

Nominations will be accepted

May 11, 2010through

June 30, 2010

4 SC BIZ | www.scbizmag.com

one thing, it’s a Republican plan.

It’s “Romneycare,” passed at the federal

level. It’s also modeled partly on earlier Re-

publican initiatives and conservative propos-

als going back as far as Richard Nixon, who,

according to columnist Ben Stein, presented

Congress with a health care reform proposal

even more comprehensive and “socialistic”

than the current law passed by the Demo-

crats.

In an article published in Th e Wall Street

Journal in July 2008, Mitt

Romney touted his Mas-

sachusetts plan as one that

eliminated the “free riders”

who were showing up at the

state’s emergency rooms

without insurance coverage.

(Under a federal law in ef-

fect since 1986, hospitals are

obligated to provide urgent

care to anyone who walks in

the door regardless of their

ability to pay.)

In other words, what was

once a conservative Repub-

lican proposal, having now been passed by

the Democrats with zero Republican sup-

port, has been recast as a socialist, liberal, to-

talitarian move to exert federal control over

health care.

As one spokesman for South Carolina’s

hospitals pointed out, the federal govern-

ment has been infl uential in health care mat-

ters for decades through the Medicare and

I’ll put this right up front so you won’t

have to wonder what I really think: At-

torney General Henry McMaster had the

chance to make a choice between support-

ing the evolution of a modern, 21st-century

South Carolina and a South Carolina still

rooted in the 19th and early 20th centuries,

and he chose the latter.

I, for one, think it was a bad choice. Th e

lawsuit fi led by McMaster and other state at-

torneys general challenges the coverage man-

date in the new federal health

care reform law. If successful,

it will move South Carolina —

and the nation — backward

instead of forward.

Th ere are lots of good rea-

sons for this conclusion. De-

spite its complexity, the new

law creates a framework that

would signifi cantly reduce

the number of people with-

out health care coverage, in-

cluding nearly a half-million

South Carolinians. Is this a

bad thing? Is this something

“we can’t aff ord”?

No, it’s not a bad thing, and we can aff ord

it as well as we can aff ord the present disor-

ganized health care “system,” which is badly

broken and getting worse. Having a half-

million citizens without health care coverage

is a detriment to the state’s future productiv-

ity and prosperity.

When McMaster and the others decided

to pick an ideological fi ght over the mandate,

McMaster seemingly gave little thought to

the possibility that he might be hurting gen-

erations of South Carolinians if he and his

cohorts prevail.

I have spoken to several key hospital

executives around the state, and they all

agree that the new law’s comprehensive re-

forms, which provide greater consumer

rights and expanded access to aff ordable

coverage, would not be possible without the

mandate.

What’s so great about the new law? For

Attorney general puts progress in reverse with health care suit

Bill [email protected]

SUBSCRIPTION INFORMATIONSCBIZ reaches thousands of South Carolina’s top

decision-makers. Add your name to the list by

ordering a print subscription to SCBIZ.

Your subscription also includes SCBIZ Daily. Deliv-

ered to your e-mail inbox each weekday morning,

SCBIZ Daily is your link to statewide business news.

One year for $43.50

NEW SUBSCRIBERS:Subscribe online at

www.scbizmag.com or call

843.849.3116.

CURRENT SUBSCRIBERS:Change your address online

at www.scbizmag.com or call

843.849.3116.

Medicaid programs, as well as programs for

veterans and federal employees, so this is

nothing new.

As he also pointed out, the last dramatic

step in the direction of “socializing” health

care was the expensive and expansive Medi-

care Part D drug program passed by Repub-

licans under George W. Bush.

From my perspective as a former small-

business owner, I can think of nothing worse

for entrepreneurship and small business than

the current insurance market for small-busi-

ness health care coverage. It’s a disaster, and

it inhibits the formation and growth of small

businesses and makes it harder for them to

compete with large, out-of-state businesses

for workers.

Under the new law, insurance companies

won’t be able to discriminate on the basis of

pre-existing conditions, and entrepreneurs

and small businesses will have better access

to group and individual health coverage.

Th at’s a winner in my book. SCBIZ

l

-

-

,

d

l

” d d ll f

Having a half-million citizens without health

care coverage is a detriment to

the state’s future productivity and

prosperity.

V i e w p o i n t

www.nexsenpruet.com

C HARLOTTE | GREENSBORO | RALE IGH

C HARLES TON | COLUMB IA | GREENV I L LE | H I LTON HEAD | MYRT LE BEAC H

205 K ing S t ree t , Su i t e 400, Char le s ton , SC, 29401 - R i c Tapp, Law F i rm Par tner

Boeing and South Carolina.The Dream Continues...

UpfrontR E G I O N A L N E W S | D ATA R E G I O N A L N E W S | D ATA

First Quality largest project ever for Anderson County

ANDERSON – Anderson

County celebrated the largest

economic development announce-

ment in its history when First Quality

Tissue formalized plans to invest

$1 billion and hire 1,000 people.

Th e privately held New York

company announced it will acquire the former Shaw In-

dustries facility near the Anderson Regional Airport to

create up to four paper manufacturing lines. Th e land in-

cludes room for eight lines, though First Quality did not

comment on plans beyond the initial four lines.

Not only is this the largest project for Anderson

County, it’s one of the largest in the Upstate, said Gov.

Mark Sanford. He noted that First Quality’s plan is larger

than the fi rst BMW Manufacturing Co. announcement

in 1992 — to hire 500 people. BMW now employs about

5,000 people.

Th e company will build two “paper machines,” the

fi rst of which will be operational in the third quarter

of next year, the second a year later, said First Quality

representative Frank Ludovina. In addition to the 1,000

new direct jobs, construction will generate an immediate

impact with an additional 550 jobs, the S.C. Department

of Commerce said.

Upstate Midlands Lowcountry

6 SC BIZ | www.scbizmag.com

Mohawk Industries Inc. announces expansion in Marlboro County MARLBORO COUNTY – Mohawk Industries

Inc. will invest $60 million to expand its yarn

and fi ber manufacturing facility in Marlboro

County. Th e company will add 87,500 square

feet of manufacturing space to the facility, along

with additional yarn conversion equipment.

“We have been very pleased with the re-

sults of the Oak River North Extrusion and

Yarn operations,” said Larry Perugini, vice

president of yarn and extrusion manufactur-

ing for Mohawk. “Th e people at the facility

have been key contributors to our company’s

success, and we are grateful for their good

work and dedication.”

Mohawk Industries opened the current

Bennettsville facility in 2006 but has had yarn

manufacturing operations in the area for more

than 50 years. Th e company will add 87,500

square feet of manufacturing space, along

with additional yarn conversion equipment.

Mohawk previously expanded the Oak

River North facility in 2008 and employs more

than 400 workers at the location.

Michelin uses sunfl ower oil for tire performanceGREENVILLE – Have Michelin-rated chefs made an impact on tire design?

It might be the perfect collaboration, as Michelin uses sunfl ower oil to cre-

ate a unique rubber compound in the new Michelin Primacy MXM4 tire.

It turns out that sunfl ower oil enhances the performance of this new

luxury tire in wet and snowy weather.

While the vibrant, strong sunfl ower is recognized worldwide for its

beauty, its benefi ts are not as apparent. The oil from sunfl owers is valued

as a healthy vegetable oil, and sunfl ower seeds are enjoyed as a tasty

snack and nutritious ingredient added to many foods.

So, why would Michelin tire engineers turn to this readily available,

but unusual ingredient as a solution for tire performance?

Because shorter is better, and the use of sunfl ower oil means stop-

ping up to two car lengths shorter — up to 19 feet shorter in wet condi-

tions — than a leading competitor, the company said.

The tire will come in 13 replacement market sizes with rim diameters

ranging from 16 to 19 inches.

largerso

AND

County

onom

t in its

Tissu

$1 bi

The

company announced it will

dustries facility near the A

create up to four paper man

cludes room for eight lines

comment on plans beyond

Not only is this the

County, it’s one of the la

Mark Sanford. He noted

than the fi rst BMW Ma

in 1992 — to hire 500 p

5,000 people.

will

ust

n ountUNTY

0 millio

acturing

mpany w

uring space to t y g

yarn conversion equipment.

een very pleased with the re-

ak River North Extrusion and

ns,” said Larry Perugini, vice

arn and extrusion manufactur-

awk. “Th e people at the facility

y contributors to our company’s

we are grateful for their good

The tire w

19 inches.ranging from 16 to

First Quality ever for Ande

C

eco

ment

T

$

Th

tries Inc.

ty – Mohawk Industries

on to expand its yarn

g facility in Marlboro

will add 87,500 square

ace to the facility, along $6.1billion

The amount Boeing will add to South Carolina’s economy

each year, according to a recent study that also said the

company would add nearly $3 billion to state taxes over

three decades.Source: Miley & Associates Inc.

www.scbizmag.com | Summer 2010 7

Nuclear can provide power, economic punchGOOSE CREEK – Th e Carolinas are

national leaders in nuclear energy,

but only continued investment and

growth will keep it that way. More

development also will mean billions

of dollars for a region stretching from

the Tar Heel State to North Georgia,

according to a group that aims to or-

ganize and promote the carbonless

energy source.

Already, South Carolina is home

to seven nuclear reactors that produce

more than 50% of the state’s power.

Four more reactors are on the way,

including two at S.C. Electric & Gas’

$10 billion V.C. Summer station near

Jenkinsville. Th e fi rst is scheduled to

open in 2016, and the second is set to

follow in 2019.

“Nuclear knowledge here is unpar-

alleled. We either build on it, develop

it and grow the economy, or we lose it,”

said Scott Carlberg, a communication

specialist speaking on behalf of the

Carolinas Nuclear Cluster.

Th e cluster, an arm of New Caroli-

na: South Carolina’s Council on Com-

petitiveness , recently hosted a meeting

in Goose Creek that doubled as a pep

rally and an informational session for

manufacturers and service providers

looking to jump on board the nuclear

bandwagon.

Th e seminar was targeted at manu-

facturing companies — producing

pipes, valves, fi ttings, electrical sys-

tems, HVAC systems and construction

materials — and service providers —

machine shops; electrical, mechani-

cal and HVAC maintenance; waste

cleanup; offi ce maintenance; hazard-

ous materials cleanup; painters; radio-

logical protection; quality control; and

laboratory services.

Representatives from SCE&G,

Westinghouse Electric Co. — the nu-

clear power company that’s also part

of the V.C. Summer contracting team

— and others addressed a full room

of executives eager to join the supply

train of an industry that some experts

predict will grow from $50 billion to

$300 billion over the next 15 years.

S.C. third-most-affordable state in which to own a carSouth Carolina is the third-most-aff ordable

state in which to own a car, according to a study by

Edmunds.com.

Th e survey shows that it costs an average of

$40,763 over a fi ve-year period to own a car in the

Palmetto State. Only New Hampshire and South Da-

kota are more aff ordable.

Owning a vehicle in Alaska, California or Hawaii

costs about $10,000 more per year than it does in

South Carolina.

Th e Edmunds study examines regional fi ve-year

ownership costs, consisting of depreciation, fi nanc-

ing, taxes and fees, insurance premiums, fuel costs,

maintenance and repairs for new and used vehicles.

States with the lowest average vehicle ownership costs in the country

StateTaxes,

Fees DepreciationFinancing,

Interest Insurance Fuel RepairsTrue Cost

to Own

New Hampshire $221 $16,359 $3,998 $5,739 $9,760 $754 $39,136

South Dakota $1,693 $16,417 $4,328 $4,819 $9,892 $831 $40,524

South Carolina $378 $16,329 $4,039 $7,577 $9,217 $777 $40,763

Wisconsin $1,835 $16,423 $4,202 $5,182 $9,899 $966 $41,358

North Dakota $1,896 $16,416 $4,086 $5,694 $10,026 $793 $41,371

States with the highest average vehicle ownership costs in the country

StateTaxes,

Fees DepreciationFinancing,

Interest Insurance Fuel RepairsTrue Cost

to Own

Hawaii $1,787 $17,252 $5,423 $11,078 $12,250 $855 $51,233

California $3,430 $16,355 $5,239 $10,242 $11,180 $1,020 $50,480

Alaska $503 $17,136 $4,532 $11,772 $12,320 $981 $50,078

Nevada $3,805 $16,455 $4,983 $9,325 $10,286 $981 $48,745

Connecticut $2,004 $16,375 $4,761 $10,572 $10,481 $958 $47,990

Companies recognized by site selection magazine COLUMBIA – Trade & Industry Development magazine, a national site selection magazine, honored

three S.C. projects with its Corporate Investment and Community Impact award, the S.C. Department

of Commerce announced.

Th e companies, which were recruited by the Commerce Department in conjunction with local eco-

nomic development allies, are the Boeing Co., Crane Co. and Red Ventures.

Th e honors, known as CiCi Awards, recognize corporations and investments from applicants

throughout the country — more than 1,000 this year, according to the magazine’s editors. Th e award fo-

cuses on company investments and the economic developers responsible for securing the investment.

Th e criteria take into consideration the number of new jobs created, number of current jobs retained

and way the project aff ected the community.

In 2009, Commerce’s recruitment eff orts resulted in companies committing to create 18,004 new

jobs and invest $2.4 billion, the department said.

Boeing, chosen as one of the 15 fi nalists for the Corporate Investment category, plans to create 3,800

jobs and invest approximately $750 million in North Charleston.

Crane Co. announced 1,000 new jobs and a $20 million investment in Barnwell County and Red

Ventures announced 1,000 new jobs and a $20 million investment in Lancaster County. Th ese two com-

panies were chosen as two of the 15 fi nalists for the Community Impact category.

8 SC BIZ | www.scbizmag.com

Te c h n v a t i o n

By Mike Fitts, Staff Writer

Laboratory designed to put nature’s fury in a box

Amid the fi elds and scattered pines of Chester County, a new six-story concrete building juts

out of the landscape. One of its walls is dotted with what looks like a grid of airplane engines, dozens of them.

Th is new facility is unique, in South Carolina and the world, according to its builders. Th e goal: to make homes and businesses safer in the face of potential disaster.

Th e facility is a huge testing labora-tory being constructed by the Institute for Business & Home Safety. It is funded by almost 50 companies in the insurance fi eld, mostly involved in property and casualty lines. Th e arrangement is simi-lar to the Insurance Institute on Highway Safety, which conducts safety crash test-ing on autos and releases the results to the public.

Th e Chester County research center will do the same thing to houses and small commercial buildings.

Th e central lab is designed to subject buildings to some of the most brutal treatment that the climate can dish out. Th e 105 turbine fans will blast high-speed winds through the chamber. Add pumped-in rain and it’s an indoor hur-ricane. Researchers also will be able to shoot realistic hail at roofs or even add burning embers to the winds to test a

home’s potential resistance to a nearby wildfi re.

“We are putting Mother Nature in a big box,” said Julie Rochman, CEO of the institute.

Property insurance businesses have been thinking about such a facility for years as a way to reduce the dam-age that homes and small business suff er — and what the industry must cover, Rochman said.

“We shouldn’t be losing as many homes and businesses as we do today,” she said.

Th e $40 million complex is scheduled to begin testing in the fall.

Th e research done in Chester Coun-ty will change the way homes are built, Rochman said. She was speaking at a tour of the center in March, as it was being completed. Home insurers already are involved in the way building codes are written, and this data will be added to that discussion.

Th e study results and video will be used to help popularize building tech-niques and materials that hold up better to severe weather, Rochman said. Th e results also will be used to see whether

government and private incentives are going to things that actu-ally work, she said.

Th e heavy blows that hurricanes have landed in recent years are a driving force in the lab’s creation, Rochman said. She notes that storms have frequently landed in populated areas and that hurricane-force winds have pushed as far inland as Ohio.

People still need and want to live at the coast, though, and that means a need for insurance, Rochman said.

Th e main laboratory is a vast concrete square, almost 50 yards across and six stories high. One wall, when complete, will feature 105 turbine fans, each with a six-foot opening. At full blast, the fans will be able to generate winds of 140 mph, the force of a strong Category 3 hurricane. Even with the fans off , the lab’s confi guration makes a gentle breeze more forceful; the room is wider on one side than the other, adding force to the winds.

Th e fl oor features a 55-foot turntable so the facility can test a structure at any possible angle. House movers were con-structed so that test buildings could be moved inside gently.

Th e facility will try to use ice balls that approximate the composition of real hail, Rochman said. Right now, tests for hail Rendering above, photo at right/Courtesy of the Institute of Business and Home Safety

Photo/Mike Fitts

sometimes are done with steel balls shot out of guns, a less realistic test.

Th e support structure for the facility also is massive. For wildfi re testing, there will be a 175,000-gallon water tank. Th e site has its own electrical substation, to help meet the massive power demand of those fans. Th e system will draw up to 30 megawatts of electricity — enough to power 9,000 homes.

Th at electricity demand is part of the reason the facility was put in Chester County. Th e institute wanted the lab to be near a source of reliable, renewable energy, so it had to be near a nuclear power plant. Th e facility will have a set schedule with Duke Energy, to prevent problems when it uses so much power then quickly shuts down. It will run only during business hours — power demand is less than in evenings. Duke Energy has been a great partner in the project, Rochman said. “We’re a great customer.”

Th e lab also needed to be more than 100 miles inland, ironically, to help pro-tect it from hurricane damage. And it needed to be near a major air travel hub, in this case Charlotte.

Th e economic development teams in North and South Carolina worked

together to fi nd the right site, Rochman said.

Once the lab is up and running in the fourth quarter, it will employ about 20 people, in addition to the local labor that will be called upon for the construction of homes and small business structures to be tested.

Th at’s not a huge new employer, but Chester County is glad to land the facil-ity, according to County Council Chair-man Carlisle Roddey.

“We don’t get a lot of research” indus-try Roddey said.

Th ere’s also the possibility that other organizations interested in partnering with the institute will want to locate nearby, Rochman said.

People in construction and other fi elds have been contacting the institute to see whether the lab can conduct research they need, Rochman said.

Th ey’ve even had a request to test the connection between two fl oors of a high-rise, she said. And the institute is look-ing into it. Th e laboratory is designed to answer questions that couldn’t previously be tested scientifi cally in the real world, Rochman said.

“We’re just going to keep on asking questions,” she said. SC

BIZ

10 SC BIZ | www.scbizmag.com

FlorenceSpot l ight

By Allison Cooke Oliverius, Special Projects Editor

Florence County offi cials recently cel-

ebrated the news that McCall Farms

Inc. was investing $9 million to ex-

pand its operations and generate 65 new

jobs. Th e company, which farms and cans

tomatoes, corn, squash and other produce,

opened its Florence County facility in 2007

and already employs about 100 workers.

“McCall Farms has deep roots set in the

soil of our area. Th is expansion is a true tes-

tament to their belief in hard work, strong

work ethics and exceptional products,”

Florence County Council Chairman K.G.

“Rusty” Smith said at the announcement.

Th e expansion also is a testament to the

fact that Florence County is just a good

place to do business, Smith said.

“We certainly have what I feel like is one

of the most desirable areas in the whole

Southeast for prospective employers. We

have outstanding infrastructure, good edu-

cation system, some of the fi nest health

care available,” Smith said. “We have com-

mitted employees that will give a hard day’s

work for a day’s pay. We also have a strong

business-minded County Council that has

set up an environment to attract businesses

to the area.”

Team approachPart of that environment is the team

that has been assembled to push economic

development. It includes Florence County

Council, the Florence County Economic

Development Partnership — led by Joe

King — and Florence County Progress, the

private-sector arm of the economic devel-

opment partnership. Th e team also includes

other elected offi cials and a host of local

business owners and organizations.

“We work extremely well together,” Smith

said of the various groups. “I think the key is

teamwork and hard work. I mean, we really

get aft er it, and I think the prospects sense

that we want them here and that we will be

here with them along the way. When we

meet prospects, I think they see the kind of

people we are and they feel a sense of com-

panionship.”

Th is team approach has helped bring

more than 130 companies to the area with a

manufacturing presence, including Du Pont,

ESAB Welding and Cutting, H.J. Heinz Co.,

Honda of South Carolina, GE Healthcare,

Johnson Controls, Monster.com, QVC and

Roche Carolina Inc. In the past fi ve years,

new and expanding businesses have invest-

ed more than $1.1 billion.

Smith fi res off several assets the county

touts to prospects, including Francis Mari-

on University, the Southeastern Institute of

Manufacturing & Technology, strong health

care providers, shovel-ready industrial sites

and more.

He also mentions Pathways for Prog-

ress, a $400 million investment the county

is making to widen all the major roads into

and out of the county to four lanes.

“I think in the business world, Florence

County is becoming a business capital for

South Carolina and beyond,” Smith said.

“It’s been outstanding to see the county’s

progress,” added Smith, who grew up in

Lake City and has served on County Coun-

cil since the 1980s. “You feel a certain level

of pride having worked as part of a team to

transition an area into something that is a

mecca for business.” SCBIZ

Florence Facts

Photos courtesy of the Florence Convention & Visitors Bureau

Florence County population: .... 1,042,01310 largest employersHonda of South Carolina ....................... 1,625Nan Ya Plastics Corp. America .................. 860ESAB Welding and Cutting Products ......... 650Smurfi t-Stone Container Corp. ................. 550Nucor Corp. Vulcraft Division .................... 400QVC Inc. .................................................. 400G.E. Medical Systems .............................. 372Roche Carolina ........................................ 308ACS Technologies .................................... 270Pepsi Cola Bottling Co. ............................ 221

Source: Industrial and manufacturing employers, 2008. Florence County Economic Development Partnership.

www.scbizmag.com | Summer 2010 11

The place for industry.

The place for industry.

PeeDeeElect r ic .com

Pee Dee Touchstone Energy® Commerce CityPee Dee Touchstone Energy® Commerce City

&

INTERSECTION

For more information call Pee Dee Electric Cooperative at 843-665-4070.

121 Edinburgh Court Greenville, SC 29607

phone [864] 232.1491 fax [864] 242.9054

website ypsconst.com

PROJECTThe Carolina First Center

BUILDER Yeargin Potter

Shackelford Construction

ARCHITECT Craig Gaulden Davis

LOCATION Greenville, SC

RESULTS On Time. On Budget.

Meeting Expectations

Trust Commitment Quality Value

Announcing the Grand Opening of OCtech’s newTransportaion and Logistics Center

We are ready and equipped for your training needs with our newstate of the art training facility.

•Truck Driver Training and Refresher Training•Welding •Mechatronics and more

For more information about how we can help your business thriveor to request specialized training, contact OCtech’s CareerTraining and Development Office at (803) 535-1236 or visit ourwebsite at www.octech.edu.

OCtechOrangeburg-Calhoun Technical College

3250 St. Matthews Road, Orangeburg, South Carolina, 29118 www.octech.edu • 1.800.813.6519 • 803.536.0311

12 SC BIZ | www.scbizmag.com

Tr e n d s

Employment

Source: S.C. Employment Security Commission

Source: S.C. Employment Security Commission, April 2010. County rates are not seasonally adjusted

on

Unemployment Rate

Source: S.C. E

Unemp

<<<

<<<

< < <

<<

< <

< < <<

<<

<<

<

<

<

<<

<<

<<

<

<

<<

<<

<

<<<

<<

<

<<<

V

V=

Higher than previous month

Lower

Same

8.7% - 9.9%

10.0% - 11.9%

12.0% - 14.9%

15.0% - 19.9%

20% & higher

J F M A M J J A S O N D

2%

4%

6%

8%

10%

12%

Unemployment rate

S.C. 2010 S.C. 2009 U.S. 2010

*Seasonally adjusted rates.Source: S.C. Employment Security Commission,

U.S. Department of Labor

2010 Net Taxable Sales

County Jan. Feb. March April

Lowcountry

Berkeley $131,399,412 $76,656,048 $111,510,481 $125,179,348

Charleston $488,069,948 $350,746,147 $407,054,781 $491,372,364

Dorchester $50,286,894 $38,643,116 $46,154,550 $52,243,064

Midlands

Lexington $283,644,430 $198,662,881 $230,133,496 $266,549,553

Newberry $20,573,775 $15,207,425 $18,829,933 $20,833,237

Orangeburg $54,797,835 $42,737,124 $50,579,182 $59,950,325

Richland $450,887,163 $355,115,054 $403,674,038 $447,574,415

Sumter $66,443,539 $48,314,324 $59,440,584 $65,749,841

Upstate

Anderson $143,577,950 $94,746,162 $118,213,268 $128,552,976

Greenville $524,582,323 $358,896,988 $447,123,794 $485.889,663

Spartanburg $239,457,485 $162,077,652 $209,756,308 $224,777,549

Statewide $4,608,434,903 $3,280,992,982 $3,972,027,584 $4,563,917,221

Source: S.C. Department of Revenue & Taxation

Hotel Occupancy Rates

Month 2010 2009%

change

Jan. 36.5 36.8 -0.82%

Feb. 45.8 45.6 0.44%

March 54.3 51.2 5.71%

April 60.6 57.7 5.03%

Avg. YTD 49.3 47.8 -3.14%

Source: Smith Travel Research

Employment Jan. ’10 Feb. ’10 March ’10 April ’10

Employed (Total Nonagricultural) 1,785,000 1,795,500 1,811,400 1,822,900

Government 354,300 356,800 357,900 359,800

Leisure & Hospitality 189,900 192,000 196,600 2,075,000

Manufacturing 207,500 207,500 207,300 207,700

Trade, Transportation & Utilities 340,600 341,800 345,800 346,000

Unemployed 273,455 271,140 264,452 250,378

www.scbizmag.com | Summer 2010 13

Economic Development Announcements: Feb. 6, 2010 - May 31, 2010Month New/Expansion Company County Investment Jobs Created

February N Defense Venture Group Lancaster $50 million 220

February E Fisher Barton S.C. Inc. Laurens $2 million 15

February N Solar Energy Initiatives Inc. Williamsburg NP 200

February N Gildan Activewear Berkeley NP 250

February N Bradman Lake York $3.5 million 51

February E American Truetzchler Inc. Greer $3.5 million 30

February E Bosch Rexroth Corp. Greenville $10 million 50

February E U.S. Foodservice Lexington NP 100

March N MTU Detroit Diesel Aiken $45 million 250

March E Republic National Distributing Co. Lexington $11.8 million NP

March N IMO Group Dorchester $47 million 190

March N Moulton Logistics Management Berkeley $25 million 500

March E Caterpillar Newberry NP 500

March E McCall Farms Inc. Florence $9 million 65

March E Leigh Fibers Spartanburg $10.1 million 40

April N Greyne Custom Wood Co. Lancaster $5 million 50

April N Drew Industries Chester $978,300 125

April N Immedion LLC Richland NP 15

April N Charleston Pie Man Georgetown $500,000 80

April E ResMed Spartanburg NP 50

April N Myrtle Beach Recycling Inc. Horry $5 million 15

April N ACAS Landing Gear Marion $5 million 300

April E US Fibers Edgefi eld $10.1 million 85

May N Allegro Industries Pickens $4.53 million 45

May N MCA Sign Co. Aiken $12 million 125

May N Nutramax Laboratories Lancaster $12.5 million 200

May N Alexium Inc. Greenville $8 million 200

May N Strategic Outsourcing Inc. Lancaster $1 mllion NP

May N First Quality Tissue Anderson $1 billion 1,000

May N Quality Software Services Inc. Richland $480,000 70

May E Kaydon Corp. Sumter $8.9 million 75

May N Palmetto State Armory Richland $2.9 million 50

May E Mohawk Industries Inc. Marlboro $60 million NP

Source: S.C. Department of Commerce, NP = Not provided

Airplane Passenger BoardingsAirport Jan. ’09 Feb. ’09 Mar. ’09 Apr. ’09 Q1 ’09 Jan. ’10 Feb. ’10 Mar. ’10 Apr. ’10 Q1 ’10 % chg.*

Charleston International Airport 65,186 67,864 90,074 98,837 321,961 61,659 58,403 82,133 93,059 295,254 -8.20%

GSP International Airport 42,609 39,790 51,444 52,280 186,123 42,682 40,408 51,140 51,653 185,883 -0.10%

Hilton Head Island Airport 2,510 2,976 5,547 6,872 17,905 2,539 2,916 6,044 7,596 19,095 6.60%

Myrtle Beach International Airport 33,781 35,557 59,589 73,563 202,490 33,416 33,385 57,399 69,574 193,774 -4.30%

Columbia Metropolitan Airport 35,661 35,848 42,683 46,290 160,482 35,739 32,645 41,442 44,627 154,453 -3.70%

Total 888,961 848,459 -4.50%

Source: Individual airports. *Represents change from Q1 2009 to Q1 2010.

Attorney J.W. Matthews III looks like

a fi sh out of water at the Associated

Builders and Contractors luncheon,

in his courtroom suit and tie among the

open-collared shirts with construction com-

pany logos.

But Matthews, a licensed professional en-

gineer who built front-line bases for the Air

Force in Bosnia and Saudi Arabia, can talk

the talk with these engineers and builders.

He’s one of a handful of attorneys at

Haynsworth Sinkler Boyd who have built

their practices on prior careers as far-fl ung as

engineering, banking, aviation or education.

Th ey are second-career lawyers, profession-

als in other fi elds who found their ultimate

calling in litigation for those industries.

A 2004 survey by the National Asso-

ciation of Legal Professionals, which polled

2,144 lawyers, concluded that second-career

lawyers have a high level of maturity and a

work ethic that is not compromised by lack of

stamina or inability to adapt to the law fi rm

environment. About one in fi ve of those sur-

veyed felt that the skills of their prior career

off ered an advantage in their legal practice.

Matthews said he always wanted to be a

lawyer. He always felt the tug of advocacy, the

need to take a side in an issue. But a fully paid

Air Force ROTC scholarship at Georgia Tech

that specifi ed a major in engineering made

his fi rst higher education decision for him.

“Th e Air Force needed engineers,” Mat-

thews said, and as a result, he graduated with

a degree in mechanical engineering.

Th e military is oft en a path for these

second-career lawyers, he said, because the

person’s service earns an education benefi t,

whether it is an ROTC scholarship on the

front end or the GI Bill aft er service. Th at

leaves the would-be attorney with the fi nan-

cial obligation for only one professional edu-

cation: law school.

Matthews served for almost six years with

Red Horse, the Air Force counterpart to the

Navy’s Construction Battalion, or Seabees.

He led teams of engineers and combat con-

struction workers in setting up forward bases

for U.S. troops in Bosnia and building re-

placement bases and quarters in Saudi Ara-

bia aft er the Khobar Towers were destroyed

in a 1996 terrorist attack. And he worked

in design and construction management on

large military buildings at Pope Air Force

Base at Fort Bragg, N.C.

He put in the required four years of work

in his engineering fi eld to qualify for the

Professional Engineer license. But when his

14 SC BIZ | www.scbizmag.com

“With a cell phone and a

laptop computer, you can

practice law anywhere.”

John Hodgeattorney, Haynsworth Sinkler Boyd

By James T. Hammond, Staff Writer

military service was done, he answered his

long-felt calling; he enrolled in law school

at the University of Florida. He also felt the

tug of home, so he returned to Greenville and

joined the Haynsworth law fi rm, where he has

worked for a decade and been a shareholder

for about three years.

When he’s not representing the construc-

tion industry, Matthews has a specialty in an

emerging fi eld of law he calls E-discovery.

Documents, contracts and agreements that

once required a signature on a piece of paper

are today consummated and approved by e-

mail. When those transactions are involved

in litigation, all sorts of new issues arise, Mat-

thews said.

“Th e way documents are produced and

distributed has changed because of servers

and cloud computing,” Matthews said. “What

court has jurisdiction over fi les created on

Google Documents, for example. Documents

in litigation in High Point, N.C., may be on a

server in another state.

“We’re fi nding that the way people con-

ceptualize documents is diff erent because of

computers,” he said. “Th e law follows the cul-

ture. Th e fundamental concept of what is true

is changing, and the quantity of communica-

tion has expanded exponentially.”

Haynsworth Sinkler Boyd has other at-

torneys, too, who had careers before they

became lawyers. Joe Clark in Columbia was

a banker; Randy Epting in Columbia was in

public accounting.

Some who had prior careers say that those

experiences are less a factor in their legal ca-

reers than for someone like Matthews but

that they continue to infl uence their lives and

their involvement outside the offi ce.

“It’s hard to say exactly how it continues

to infl uence me, but it defi nitely does,” said

Bachman Smith IV, a Charleston-based attor-

ney with Haynsworth Sinkler Boyd.

Smith makes his practice in litigation in-

volving construction, defense and maritime

issues. He spent some early years working

with a cabinetmaker, likes to work with his

hands and says “construction just makes

sense to me.”

Before going to the University of South

Carolina School of Law, Smith spent about

eight years as a teacher and school admin-

istrator. He left one school where he had

been promoted to administrative jobs so

that he could get back to teaching American

www.scbizmag.com | Summer 2010 15

Top: Bachman Smith (Photo/Leslie

Halpern). Left: John Hodge (Photo

provided). Right: J.W. Matthews (Photo/

Jim Hammond)

16 SC BIZ | www.scbizmag.com

literature at another school.

But with his expectation at the time that

his teacher salary would top out at about

$32,000, he decided on a law career in order

to be able to provide for his own children in

the same fashion as did his lawyer father.

And even though he has not built his

practice on his former career, he said, “It

didn’t take long to see that I needed to fi ll the

void.”

Today, he’s on the board of My Sister’s

House, a nonprofi t organization that serves

victims of domestic violence. Among other

things, he sometimes lectures in schools

about domestic violence.

At age 40, Smith says his life and career

are still a work in progress. He envisions pos-

sibly teaching law someday. “Th e process of

education just makes sense to me,” he said.

John Hodge, 54, also an attorney with the

fi rm, has managed to combine three profes-

sions into a successful legal practice.

He earned his undergraduate degree in

geology from Duke University and worked

in environmental science.

He earned a commercial airline pilot’s li-

cense and fl ew charters and night freight as-

signments while in law school at USC. And

he spent 20 years fl ying for Piedmont Air-

lines and its successor, US Airways.

About fi ve years ago, he retired his pilot’s

wings to focus on a law practice in environ-

mental law and aviation litigation, contracts

and regulatory issues.

During his double life as lawyer and air-

line pilot, he accumulated about 3,000 hours

of fl ight time and oft en found himself jug-

gling court dates with his fl ight assignments.

“With a cell phone and a laptop computer,

you can practice law anywhere,” Hodge said.

But he cautioned that “you can’t let the

technology rule your life or keep you from

having a life.”

Growing up in Spartanburg, Hodge said,

“I was always interested in geology and the

environment before it was cool.”

“I found that the policymakers and gov-

ernment couldn’t talk to the scientists,”

Hodge said. “I wanted to be able to go from

one fi eld to the other and feel comfortable in

both.”

He is currently helping rewrite the aero-

nautics regulations for the state — he said

they have not been updated in years.

And Hodge was instrumental in draft -

ing the agreement to protect 7,500 acres of

wetlands as part of the environmental per-

mitting process for the Vought Aircraft plant

in North Charleston. Th ose permits, which

anticipated future expansion of the indus-

trial plants there, eased the path for Boeing

to select the site for its new aircraft assembly

plant, Hodge said.

“It was a win-win for the business and for

the environment,” Hodge said.

Matthews, the construction lawyer, be-

lieves his earlier career — and those of other

attorneys — “enrich the legal profession.”

“It gives you something you can’t get any

other way than through experience,” Mat-

thews said. SCBIZ

Prior experience of second-career attorneys

Nonprofit organization............................... 6%

Engineering, high-tech or bio-tech .......11.8%

Other business ..................................... 39.5%

Education ..............................................11.2%

Government – non-military ...................10.5%

Source: 2004 National Assocation of

Legal Professionals survey of

1,148 respondents who had a prior career

AIKEN AND EDGEFIELD COUNTIES:WHERE MANUFACTURERS AND TECHNOLOGY MEET

PO Box 1708Aiken, SC 29802www.edpsc.org

Center for Hydrogen Research

www.scbizmag.com | Summer 2010 17

From the publishers ofFor more information, call 843.849.3126

or visit our web site at www.SCJobMarket.com

Why use SCJobMarket.com?SCJobMarket.com is an Internet recruiting

website devoted to connecting local candidates with local employers.

Currently, we have over 135,000 unique site visitors a month and over 18,000

active job seekers registered.

Why use the Internet to recruit employees?

• 83% of job seekers spend more than 8 hours per week online.

• Increase company exposure.

• On average, using the Internet shaves 20 days off company’s hiring cycle.

• Signifi cantly reduces “Cost per Hire.”

Connect with the Best Local Job Candidates.

18 SC BIZ | www.scbizmag.com

By Scott Miller, Staff Writer

Michael Byars joined Bi-Lo a month

before the Mauldin-based gro-

cery chain fi led for bankruptcy in

March 2009.

He knew before accepting the job as presi-

dent and CEO that bankruptcy was a possibil-

ity.

“My past history has been going places

and helping companies improve. I’ve been in

those situations before,” Byars said. “I’d never

been through a bankruptcy, but I looked at

that as an opportunity to grow and learn. And

I believed in Bi-Lo.”

Byars knows the industry. At age 15, the

Gaff ney native got a job as a bagger at Ingles.

He stayed there through high school and into

college, before the fast-expanding Food Lion

chain came to town.

Off ered a dollar more an hour in pay, Byars

took a job with Ingles’ newest competitor in

town. He would spend the next 19 years with

Food Lion and 25 with its parent company,

Delhaize Group — which made an unsuc-

cessful pitch to buy Bi-Lo during bankruptcy

proceedings.

Byars climbed the ladder at Food Lion

from store manager to operations director for

a three-state region. When Delhaize Group

bought Kash n’ Karry in Florida in 1996, By-

ars became COO. Under his leadership, Kash

n’ Karry grew to have 137 stores in the Sun-

shine State with more than 11,100 employees.

In 2004, Byars became president and CEO

of Minyard Food Stores in Dallas; he held that

position for four years.

Th en came the opportunity at Bi-Lo, a

store Byars had shopped at with his grandpar-

ents as a boy.

Byars took over in February 2009. Bi-Lo

fi led for bankruptcy in March of that year

because of an upcoming debt maturity that it

was unable to refi nance.

Bi-Lo emerged from bankruptcy about 14

months later. Th e potential merger with Del-

haize’s Food Lion had fallen through.

“Our fi duciary responsibilities were to

evaluate all options and provide the best re-

turn to our creditors,” Byars said. “We deter-

mined that wasn’t the best route.”

Instead, Bi-Lo’s owner, Lone Star Funds,

Michael Byars brought Bi-Lo back from Chapter 11 bankruptcy. (Photo/provided)

BI-LO IS BACKUnder the leadership of Michael Byars, the grocery store

chain didn’t just survive bankruptcy, ‘we thrived through it’

www.scbizmag.com | Summer 2010 19

made a $150 million equity investment and

remains the majority owner. In addition,

Credit Suisse provided $200 million in com-

mitted term-loan fi nancing and General

Electric Capital has provided a $150 million

revolving credit facility. Th rough its fi nancial

restructuring, Bi-Lo has reduced its funded

indebtedness by approximately $60 million.

A judge confi rmed Bi-Lo’s reorganization

plan April 29, and Bi-Lo offi cially emerged

from Chapter 11 on May 12.

“We didn’t survive bankruptcy; we thrived

through it. We actually made ourselves more

competitive,” Byars said. “You’ve got to have

committed people and a committed brand to

make it through Chapter 11. We were fortu-

nate to have that. We are one of the few retail

groups that made it through bankruptcy.”

In 2008, Bi-Lo had declining sales and

profi ts, Byars said. Th e company reversed that

trend last year while operating under bank-

ruptcy protection. Th e company has not seen

a year-over-year sales increase this strong

since Winn-Dixie pulled out of the S.C. mar-

ket in 2005, Byars said.

“We went from a negative trend in 2008 to

a positive trend in one of the most challenging

economic times this country has seen in quite

some time,” Byars said.

Th e company did so by improving cus-

tomer service and providing more discounts

to customers, he said. Bi-Lo launched a part-

nership with S.C. gas stations that allows

Bi-Lo customers to save on gas, for example. A

new “price lock” program gives customers the

best prices on seasonal items for eight weeks.

Bi-Lo also started a double-coupon program,

launched a Wednesday promotion that gives

senior citizens a 5% discount and began a new

employee training program to improve cus-

tomer service.

“Th e No. 1 thing we set out to do was im-

prove our value proposition,” Byars said. “Our

customers are more savvy today, and they de-

mand value. Th ey want all the value and they

don’t want to give up quality, freshness and

variety.”

And customers have alternative options.

“Th ere’s a supermarket on almost every

corner,” Byars said.

Th at competition has made it diffi cult for

smaller, regional grocery chains to survive.

Byars said he expects more consolidation

within the industry, particularly with more

foreign investment coming into the United

States.

“Th ere has been predictions that there will

be more consolidations, and you’ll probably

see consolidations throughout the Southeast

in the next three to fi ve years,” Byars said.

“Th at doesn’t mean that the regional grocery

stores can’t be successful.”

And it doesn’t mean Bi-Lo won’t remain

independent.

Th e company operates 207 supermarkets

in South Carolina, North Carolina, Georgia

and Tennessee and employs approximately

15,100 people. Th at’s seven fewer stores than

Bi-Lo operated before fi ling for bankruptcy,

and no more stores are expected to be closed,

Byars said. At one time, Bi-Lo employed more

than 17,000 people.

In the next few years, Bi-Lo is unlikely to

build new stores or expand into new markets,

he said. Instead, customers will see refurbished

Bi-Lo stores with an updated color scheme, a

new logo with a leaf replacing the hyphen in

Bi-Lo and new looks for the deli, produce and

bakery departments, he said.

“Th e focus will be on remodels

and updates for two to three

years,” Byars said. SCBIZ

MARKET Ways banks are dealing with surplus property

By Ashley Fletcher Frampton, Staff Writer

20 SC BIZ | www.scbizmag.com

Back when banks owned only a few

pieces of real estate at a time, Donna

Lehmer, asset resolution manager at

First Federal of Charleston, handled much of

the paperwork herself.

Lehmer coordinated with listing agents,

made sure properties were kept up and worked

with closing attorneys to complete the sales.

But the ongoing foreclosure crisis has left

First Federal, like other fi nancial institutions,

with more real estate to juggle, along with

borrower requests for short sales and deeds-

in-lieu-of-foreclosure.

First Federal has responded by increas-

ing staff and outsourcing certain tasks. Other

banks, similarly, have restructured to keep up

with the increased volume of troubled loans

and acquired properties that must be sold.

But while banks are holding more real es-

tate than in years past and using some new

methods to dispose of it, offi cials say they’re

not looking to offl oad it at bargain prices, as

many buyers would like to believe.

‘Hard to be ready’At First Federal, Lehmer’s department has

doubled in size, from fi ve to 10, and has con-

tracted with an outside asset manager who

helps keep tabs on property.

“If you’d have said two years ago that I’d

use an asset manager, I would have laughed at

you,” Lehmer said.

But two years ago, First Federal wasn’t

trying to sell 80 properties at once, as it was

about two months ago. Th e homes, land and

commercial properties stretch from Beaufort

to Wilmington, N.C.

“You fi gure going from 12 the year before

to 80 a year later, it’s hard to be ready for that,”

Lehmer said.

First Federal’s asset manager, located in

Greenville, fi nds listing agents wherever fore-

closed properties are located and handles the

re-keying of locks, lawn maintenance and

other presale tasks. She coordinates with the

dozens of agents and lawyers and others in-

volved — tasks Lehmer said she no longer has

the time to handle.

“My asset manager deals with all of those

people, and I deal with her,” she said.

Lehmer expects an even larger increase

in bank-owned real estate in the coming

months.

“My projection is we’re not going to get our

ADJUSTMENTADJUSTMENT

www.scbizmag.com | Summer 2010 21

big infl ux of inventory until the last three or

four months of this calendar year,” she said.

Th at expectation is based in part on fore-

closure moratoriums put in place early last

year that delayed foreclosure proceedings. It’s

also based on the backlog of properties now

awaiting foreclosure hearings and sales in the

courts.

In February 2009, First Federal was among

fi nancial institutions that halted foreclosures

on owner-occupied homes for a few months

while trying to work with borrowers on loan

modifi cations. First Federal’s moratorium

lasted until May.

About the time that moratorium ended,

the S.C. Supreme Court ordered a temporary

freeze on foreclosures statewide to allow time

for lenders to determine whether residential

loans were eligible for modifi cation under a

new federal program.

Because of those combined delays, proper-

ties now might be as much as 18 to 20 months

past-due at the time the foreclosure is com-

pleted, Lehmer said.

Commercial focusDelays surrounding residential foreclo-

sures won’t have much of an impact on S.C.

Bank and Trust, said Tommy Bouchette, ex-

ecutive vice president for special assets man-

agement.

“We, like many banks, sold those mortgag-

es into secondary markets,” he said.

Because the Columbia-based bank, which

has offi ces around the state, does not own and

service those home loans, it isn’t the fi nancial

institution that winds up foreclosing when the

loans are in default.

But SCBT has changed its operations to

deal with its distressed commercial real estate

loans. Th ose loans cover residential properties

in cases where the bank provided fi nancing to

subdivision developers or speculative build-

ers.

About two years ago, as bank offi cials saw

economic conditions deteriorating, SCBT set

up a special assets department to work with

borrowers to avoid foreclosure. Th e four-per-

son department also manages the foreclosure

process and subsequent eff orts to sell the real

estate once the bank owns it.

Before the economic downturn, SCBT

didn’t need a centralized department to deal

with real estate issues, Bouchette said.

“Each of our regional executives would ba-

sically handle these things,” he said.

Bouchette said SCBT’s real estate owned

Photo/Leslie Halpern

22 SC BIZ | www.scbizmag.com

fl uctuates up and down but isn’t a large

amount relative to the size of the bank. He

said SCBT tries to keep the amount of real es-

tate owned low by working with borrowers to

sell properties, for less than the loan balance

in some cases.

“We put a lot of energy on the front end to

try to get the property liquidated,” Bouchette

said.

SCBT’s ability to meet with borrowers and

fi nd workout strategies is an advantage over

large fi nancial institutions that are servicing

mortgage loans scattered around the country,

he said. Some of those institutions have little

choice but to foreclose and sell properties to

preserve capital, Bouchette said.

But doing so can mean less money for the

bank, in the end.

“Once it becomes a bank-owned property,

it’s harder to get as much,” he said. “Most pro-

spective buyers will off er less.”

Pricing and listingReal estate and banking offi cials say there

is widespread belief among buyers that banks

will accept low off ers for properties because

they are motivated to get rid of them.

But Lehmer said that’s not how it works at

First Federal.

“We’re regulated. I have shareholders to

answer to,” she said. “If I have a property that’s

worth $100,000, I can’t sell it for $50,000.”

Property is listed at appraised values, she

said.

Bank-owned property could be priced low

relative to comparable properties, she said,

because the bank sells the property as is. But

Lehmer said she isn’t giving away real estate.

Th e approach is the same for short sales:

Off ers are matched up against the home’s

value.

“If they’re getting close to it, it makes sense

for us” to accept the off er, Lehmer said. “Banks

do not want to own property. Th at’s the last

thing we want.”

In recent months, Lehmer said First Fed-

eral has had about 25% of its owned real estate

under contract. In March, the bank peaked at

about 40% under contract. Th e soon-to-expire

federal homebuyer tax credits have helped the

bank sell some of its single-family homes, she

said.

While First Federal works with agents

within its markets to list properties, an auction

in March helped fi nd buyers for some proper-

ties that were not moving, Lehmer said.

She said it’s rare these days for a piece of

real estate to fi nd a buyer at counties’ foreclo-

sure sales, which are held monthly — or more

frequently now in some areas because of court

backlogs.

A few years ago, most foreclosure proper-

ties sold that way, Lehmer said. Banks didn’t

foreclose on many properties, and real estate

was appreciating quickly, drawing buyers.

Some banks are selling large numbers of

properties to investors at discounted prices.

But Lehmer said that isn’t a strategy that First

Federal is using.

“Th e reason is, their off ers are low based

on what I can get selling one at a time,” she

said.

Bouchette said the same is true at SCBT.

Selling properties individually can result in

sales prices 30% to 40% higher than selling to

investors in bulk, he said.

SCBT tries to sell through its networks be-

fore listing properties with agents.

“With offi ces all around the state, we ask

our lenders and bankers in those markets to

see if they have people interested. If not, we’ll

list it with a broker, usually in that market,”

he said.

“We’ve been able to move a fair amount of

property internally without having to use any

Realtors,” Bouchette said.

He said SCBT tries to avoid selling prop-

erties at low prices that will bring down sur-

rounding property values.

Cameron Jordan, a spokeswoman for

Winston-Salem-based BB&T, said the bank

lists its properties with outside agents about

90% of the time. BB&T has asset managers

throughout its geographic footprint that work

with agents.

BB&T also prefers not to sell in bulk.

“From time to time we may auction a

home, but bulk sale of properties is not our

preferred method,” Jordan said.

Jordan said BB&T has a loss mitigation

program and tries to keep homeowners in

their homes. But once the bank acquires

homes, it works to sell them.

On the other hand, BB&T might hold

onto lots and land awhile longer, waiting for

a stronger market.

“We believe that houses are organic and

people need to live in them,” Jordan said.

Wachovia spokeswoman Jamie Dexter

said the bank uses Premiere Asset Services,

a division of Wells Fargo Home Mortgage,

to value, manage and dispose of foreclosure

properties.

Premiere Asset Services works with lo-

cal real estate agents to sell homes as soon as

possible, Dexter said. But in many cases, she

said government entities Freddie Mac, Fan-

nie Mae and the U.S. Department of Hous-

ing and Urban Development manage home

sales.

Photo/Leslie Halpern

MARKET ADJUSTMENT

www.scbizmag.com | Summer 2010 23

She declined to discuss whether bank

operations have changed in response to the

foreclosure crisis, saying that information is

proprietary.

Business opportunitiesOne Upstate real estate fi rm is trying to

carve a new niche for itself amid the foreclo-

sure crisis and the burden it has placed on

bank employees.

Th e Marchant Co. recently began market-

ing services beyond simply selling property to

banks, which could stand to outsource some

of their workload.

“Th e amount of real estate that is in some

form of trouble in one way or another is al-

most overwhelming,” said Chuck Werner,

an agent with the Marchant Co. who used to

work in a bank’s special assets division.

Th e Marchant Co. is off ering to manage

properties that have tenants, for example,

or inspect properties regularly and create

monthly reports for banks and their regula-

tors, if needed.

Part of the challenge for banks is that

properties aren’t selling quickly, in general, so

bank-owned inventories are mounting, Wer-

ner said.

If this month’s properties would sell within

60 days, it would be easier for banks to handle

next month’s properties, he said.

“Some banks are getting through this thing

pretty well,” Werner said. “Others are fl oun-

dering as far as being able to handle it and

knowing which way to go.”

Local inventoryGetting a handle on the number of bank-

owned homes in the Charleston market is dif-

fi cult.

Th e Charleston Trident Association of

Realtors’ Multiple Listing Service tracks how

many homes up for sale are owned by banks,

but agents are not required to list them as

such, said Meghan Weinreich, marketing and

communications director.

Many choose not to because of the low of-

fers that oft en follow, she said.

In a recent count, 198 were listed as bank-

owned, but Weinreich said Realtors associa-

tion offi cials feel sure that number is lower

than the true total.

As another indicator, she pointed to data

from the research fi rm RealtyTrac, which re-

cently reported 2,629 distressed properties lo-

cally, including 1,130 in bank ownership. SCBIZ

Orangeburg County... Experience it again for the rst time.

World Class Companies, Education, Recreation,

and Dining

www.fourmoons.com • www.scsu.edu • www.cla in.edu • www.octech.edu • www.husqvarna.com

Orangeburg County Development Commission1.888.761.OCDC (6232) • www.ocdc.com

Edisto Gardens

4 Diamond Dining at Four Moons

World Class Companies

C i iCommission

Specializing in: ClericalMedicalLight IndustrialTemp-to-HireDirect Hire1-800-477-8668

Find Success with GPS.Your Source for Staffi ng.

Locations: Columbia

CharlestonNewberry

OrangeburgCharlie GallmanPresident/Owner

www.scbizmag.com | Summer 2010 25

More than 40 companies have announced this year that they

would either expand existing operations or establish new ones

in South Carolina. At press time, the announcements totaled

approximately $525.8 million in investment and the expected

creation of more than 7,000 jobs, according to the S.C. Department

of Commerce.

So, what’s attracting these businesses to South Carolina and per-

suading them to stay?

Frank Ludovina, president of First Quality Tissue, said his com-

pany was drawn to Anderson County by the “work force, work ethic,

infrastructure, business environment and incentives package made

available from state and local resources.”

First Quality announced plans in May to invest $1 billion to build

four manufacturing lines in Anderson County and hire 1,000 work-

ers.

Marion G. Swink, president of McCall Farms Inc., said the

“excellent business environment and solid labor force” contributed to

his company’s decision to invest an additional $9 million in Florence

County to expand its operations.

In addition to the large announcements, a growing number of

small businesses with potential for growth are taking advantage of in-

cubators all across the state.

Regardless of a company’s size, many of the same factors come into

play when a business owner is considering an investment — ranging

from real estate to infrastructure.

Th e following Business Resource Guide was created to off er a

snapshot of four specifi c areas and the role each plays in economic

development decisions across the state.

In addition, a list has been compiled of several agencies that assist

with economic development eff orts on the state and local levels.

REGIONAL ECONOMIC DEVELOPMENT ALLIANCES

Central SC Alliance1201 Main St., Suite 100

Columbia, SC 29201

Phone: 803-733-1131

Toll Free: 866-278-9098

Fax: 803-733-1125

www.centralsc.org

Charleston Regional Development Alliance5300 International Blvd., Suite 103A

North Charleston, SC 29418

Phone: 843-767-9300

Fax 843-760-4535

www.crda.org

Charlotte Regional Partnership550 S. Caldwell St., Suite 760

Charlotte, NC 28202

Phone: 800-554-4373

Fax: 704-347-8981

www.charlotteusa.com

Economic Development Partnership471 University Parkway

Aiken, SC 29802

Phone: 803-641-3300

www.edpsc.org

Upstate SC AlliancePhone: 864-283-2300

www.upstatescalliance.com

NESA – The North Eastern Strategic AllianceP.O. Box 100547

Florence, SC 29502

Phone: 843-661-4469

www.nesasc.org

SouthernCarolina AllianceSouthern Carolina Business Center

1750 Jackson St., Suite 100,

Barnwell, SC 29812

Phone: 803-541-0023

Fax: 803-541-3322

www.southerncarolina.org

STATEWIDE RESOURCES

Municipal Association of South Carolina1411 Gervais St.

Columbia, SC 29201

Phone: 803-799-9574

Fax: 803-933-1299

www.masc.sc

New Carolina: South Carolina’s Council on Competitiveness1411 Gervais St., Suite 315

Columbia, SC 29201

Phone: 803-760-1400

Fax: 803-760-1401

www.newcarolina.org

Palmetto Institute1411 Gervais St., Suite 450

Columbia, SC 29201

Phone: 803-806-8106

Fax: 803-806-8335

www.palmettoinstitute.org

S.C. Association of Community Development CorporationsP.O. Box 20577

Charleston, SC 29413

Phone: 843-579-9855

Fax: 843-579-0232

www.communitydevelopmentsc.org

S.C. Chamber of Commerce1201 Main St., Suite 1700

Columbia, SC 29201

Phone: 803-799-4601

Fax: 803-779-6043

www.scchamber.net

S.C. Department of Commerce1201 Main St., Suite 1600

Columbia, SC 29201-3200

Phone: 803-737-0400,

Toll-free: 800-868-7232

www.sccommerce.com

S.C. Economic Developers’ Association1122 Lady St., Suite 1115,

Columbia, SC 29201

Phone: 803-929-0305

Fax: 803-252-0589

www.sceda.org

S.C. Jobs – Economic Development Authority1201 Main St., Suite 1600

Columbia, SC 29201

Phone: 803-737-0268

Fax: 803-737-0628

www.scjeda.com

S.C. Power Team1201 Main St., Suite 1710

Columbia, SC 29201-3212

Phone: 803-254-9211

Fax: 803-771-0233

www.southcarolinapowerteam.com

ECONOMIC DEVELOPMENT RESOURCES

COMMERCIAL/INDUSTRIAL SPACE | FINANCE | WORK FORCE | INFRASTRUCTURE

COMMERCIAL/INDUSTRIAL SPACEOverview

Commercial real estate markets remain rel-

atively weak across South Carolina, with pock-

ets of stability and improvement. Tenants have

had the upper hand in many lease transactions

in recent months, and that trend continues in

some markets. Financing for property pur-

chases remains hard to come by, experts say,

and fi nancing for new construction is all but

dried up. But a fi xed supply should lead to

stronger markets in the coming months.

Columbia market trendsBusinesses seeking offi ce space have plenty

of options in the Columbia market, where of-

fi ce vacancy rates are 20.6% in the suburbs and

23.6% downtown, according to commercial

real estate fi rm Colliers Keenan.

Two forces behind the particularly high va-

cancy rate downtown are SCANA Corp.’s

move from its 420,000-square-foot space on

Main Street to a new suburban campus, and

a new offi ce tower at Main and Gervais streets

that has pulled some fi rms out of their former

spaces. Offi ce tenants could continue to fi nd

competitive lease rates this year, especially for

Class “A” space.

Columbia’s industrial market has fared

relatively well during the economic downturn.

Although the area’s vacancy rate (8.5%) is up

compared with recent years, it remains the

lowest among the state’s three major markets.

Th e area’s retail market is weaker, with va-

cancy at nearly 12% in the fi rst part of 2010,

according to Colliers Keenan. Th at’s up from

about 9% at the beginning of 2009. National

retailers exiting large spaces have driven the

increase. Th e market should stabilize this year,

Colliers Keenan forecasts, but vacancy is likely

to remain above 10% into 2011. Th at means

retailers seeking space will fi nd landlords will-

ing to negotiate on lease terms.

Charleston market trendsTh e Charleston offi ce market saw some

improvement in early 2010 aft er months of

declining or fl at activity, according to com-

mercial real estate fi rm Grubb & Ellis WRS.

Vacancy fell to 17.4% from about 20% several

months ago. Th e strengthening is tied to a lack

of new construction, the fi rm said. Lease rates

for Charleston-area offi ce space, though down

20% to 30% from their peak a few years ago,

are stabilizing, and tenants are signing lease

26 SC BIZ | www.scbizmag.com

real e

TOPTEN

Largest Certifi ed Sites in S.C.

A certifi ed site is an industrial tract for which a third party has verifi ed size and boundaries,

environmental and topographical characteristics, land use, utility availability and other key

details, as a way to market the property as shovel-ready. The list below of the 10 largest

certifi ed sites and available acreage is from the S.C. Department of Commerce.

1

Black River Airport Park

1,556 acresSumter County

2

Grist Mill Industrial Park

1,445 acresFlorence County

3

Interstate 95 Mega Site

1,417 acres Sumter and Clarendon

counties

4

Sage Mill East

1,380 acresAiken County

5

Jafza Magna Park Santee

1,322 acresOrangeburg County

Business Resource Guide

6

S.C. Advanced Technology Park

1,250 acresBarnwell County

7

West Annex Industrial Site

1,103 acresOrangeburg County

8

The Matrix Industrial Park

868 acresGreenville County

9

Hunter Industrial Park

815 acresLaurens County

10

Brogdon West Industrial Site

805 acresClarendon County

Business Resource Guide

Columbia’s Highest100 Knox Abbott Drive ............................ $22.00

1201 Main St. ........................................ $21.50

1320 Main St. ........................................ $20.00

1901 Main St. ........................................ $20.00

5 Lake Carolina Way ............................... $20.00

Charleston’s Highest40 Calhoun St., Suite 550 ....................... $34.00

200 Meeting St. ..................................... $32.00

177 Meeting St., Suite 410 ..................... $32.00

151 Meeting St., Suite 400 ..................... $30.00

100 Calhoun St. ..................................... $29.00

40 Calhoun St. ....................................... $29.00