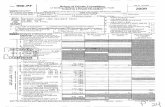

2009 AWMF 990-PF

Transcript of 2009 AWMF 990-PF

-

OMB No. 1545-0052Return of Private FoundationForm 990-PF or Section 4947(a)(1) Nonexempt Charitable Trust

Treated as a Private FoundationDepartment of the TreasuryInternal Revenue Service Note: The foundation may be able to use a copy of this return to satisfy state reporting requirements.

, 2009, and ending , 20For calendar year 2009, or tax year beginningG Check all that apply: Initial return Initial return of a former public charity Final return

Amended return Address change Name changeName of foundation A Employer identification number

Use the IRSlabel.

Otherwise,print

or type.See SpecificInstructions.

Telephone number (see page 10 of the instructions)Number and street (or P.O. box number if mail is not delivered to street address) Room/suite B

If exemption application ispending, check here

C ICity or town, state, and ZIP code m m m m m m mI1. Foreign organizations, check hereD m

2. Foreign organizations meeting the85% test, check here and attachcomputation IH Check type of organization: Section 501(c)(3) exempt private foundation m m m m m m m m m

Other taxable private foundationSection 4947(a)(1) nonexempt charitable trustIf private foundation status was terminatedunder section 507(b)(1)(A), check here

E II Fair market value of all assets at end J Accounting method: Cash Accrual mof year (from Part II, col. (c), line Other (specify) If the foundation is in a 60-month termination

under section 507(b)(1)(B), check hereF

I I(Part I, column (d) must be on cash basis.)16) $ m(d) DisbursementsAnalysis of Revenue and Expenses (The Part I (a) Revenue and (b) Net investment (c) Adjusted net for charitabletotal of amounts in columns (b), (c), and (d)

may not necessarily equal the amounts incolumn (a) (see page 11 of the instructions).)

expenses per income income purposesbooks (cash basis only)1 Contributions, gifts, grants, etc., received (attach schedule) m

if the foundation is not required toattach Sch. BICheck2 m m m m m m m m m m

3 Interest on savings and temporary cash investments4 Dividends and interest from securities m m m m5 a Gross rents m m m m m m m m m m m m m m m m m

b Net rental income or (loss)6 a Net gain or (loss) from sale of assets not on line 10

b Gross sales price for allassets on line 6a

7 Capital gain net income (from Part IV, line 2) m

Rev

enue

8 Net short-term capital gain m m m m m m m m mm m m m m m m m m m m m9 Income modificationsa Gross sales less returns10 m m m m mand allowancesb Less: Cost of goods sold mc Gross profit or (loss) (attach schedule) m m m m

11 Other income (attach schedule) m m m m m m m12 Total. Add lines 1 through 11 m m m m m m m m13 Compensation of officers, directors, trustees, etc. m m14 Other employee salaries and wages m m m m m15 Pension plans, employee benefits m m m m m m16 a Legal fees (attach schedule) m m m m m m m m m

b Accounting fees (attach schedule) m m m m m mc Other professional fees (attach schedule) m m m

17 Interest m m m m m m m m m m m m m m m m m m m18 Taxes (attach schedule) (see page 14 of the instructions)19 Depreciation (attach schedule) and depletion m20 Occupancy m m m m m m m m m m m m m m m m m21 Travel, conferences, and meetings m m m m m m22 Printing and publications m m m m m m m m m m23 Other expenses (attach schedule) m m m m m m24 Total operating and administrative expenses.

Add lines 13 through 23 m m m m m m m m m m

Ope

ratin

g an

d A

dmin

istr

ativ

e Ex

pens

es

25 Contributions, gifts, grants paid m m m m m m m26 Total expenses and disbursements. Add lines 24 and 2527 Subtract line 26 from line 12:

a Excess of revenue over expenses and disbursements m mb Net investment income (if negative, enter -0-)c Adjusted net income (if negative, enter -0-) m m

JSAFor Privacy Act and Paperwork Reduction Act Notice, see page 30 of the instructions. Form 990-PF (2009)9E1410 2.000

THE ANDREW W. MELLON FOUNDATION 13-1879954

140 EAST 62ND STREET, (212) 838-8400

NEW YORK, NY 10065X

X

5,051,529,429.

346,794. 346,794. 0.STMT 135,823,082. 35,823,082. 0.STMT 2

-119,199,870.

193,507. 13,167,338. 0.STMT 3-82,836,487. 49,337,214. 0.

2,803,599. 741,342. 0. 2,062,257.8,201,889. 2,108,886. 0. 5,838,699.3,879,221. 1,003,395. 0. 2,868,745.

336,830. 149,864. 0. 210,920.ATCH 4451,757. 211,404. 0. 283,103.ATCH 5

12,430,579. 11,740,841. 0. 1,809,557.*ATTACHMENT 7 5,183,641. 0. 0. 193,420.

** 118,985. 0. 0. 0.2,637,326. 336,374. 0.

873,015. 134,924. 0. 718,628.788,588. 65,090. 0. 670,316.146,036. 25,687. 0. 85,401.

ATCH 9 2,211,963. 596,764. 0. 1,602,892.

40,063,429. 17,114,571. 0. 16,343,938.214,083,118. 216,162,235.254,146,547. 17,114,571. 0. 232,506,173.

-336,983,034.32,222,643.

0.-0-ATCH 6 ATCH 8* **

43461C 2532

STMT

STMT 20

STMT 7A

STMT 4STMT

STATEMENT 7

STMT 6 STMT 8

-

Application for Extension of Time To File anExempt Organization Return OMB No. 1545-1709

Form 8868(Rev. April 2009)

Department of the TreasuryInternal Revenue Service File a separate application for each return.

If you are filing for an Automatic 3-Month Extension, complete only Part I and check this boxIf you are filing for an Additional (Not Automatic) 3-Month Extension, complete only Part II (on page 2 of this form).

Do not complete Part II unless you have already been granted an automatic 3-month extension on a previously filed Form 8868. Part I Automatic 3-Month Extension of Time. Only submit original (no copies needed).A corporation required to file Form 990-T and requesting an automatic 6-month extension - check this box and completePart I only

All other corporations (including 1120-C filers), partnerships, REMICs, and trusts must use Form 7004 to request an extension oftime to file income tax returns.Electronic Filing (e-file). Generally, you can electronically file Form 8868 if you want a 3-month automatic extension of time to fileone of the returns noted below (6 months for a corporation required to file Form 990-T). However, you cannot file Form 8868electronically if (1) you want the additional (not automatic) 3-month extension or (2) you file Forms 990-BL, 6069, or 8870, groupreturns, or a composite or consolidated From 990-T. Instead, you must submit the fully completed and signed page 2 (Part II) of Form8868. For more details on the electronic filing of this form, visit www.irs.gov/efile and click on e-file for Charities & Nonprofits.Type orprint

Name of Exempt Organization Employer identification number

Number, street, and room or suite no. If a P.O. box, see instructions.File by thedue date forfiling yourreturn. Seeinstructions.

City, town or post office, state, and ZIP code. For a foreign address, see instructions.

Check type of return to be filed (file a separate application for each return):Form 990Form 990-BLForm 990-EZForm 990-PF

Form 990-T (corporation)Form 990-T (sec. 401(a) or 408(a) trust)Form 990-T (trust other than above)Form 1041-A

Form 4720Form 5227Form 6069Form 8870

The books are in the care of

Telephone No. FAX No.

If the organization does not have an office or place of business in the United States, check this boxIf this is for a Group Return, enter the organization's four digit Group Exemption Number (GEN) . If this is

and attach a list with the. If it is for part of the group, check this boxfor the whole group, check this boxnames and EINs of all members the extension will cover.

until 1 I request an automatic 3-month (6 months for a corporation required to file Form 990-T) extension of time

, ,for the organization's return for:

to file the exempt organization return for the organization named above. The extension is

calendar year ortax year beginning , , ., and ending

2 If this tax year is for less than 12 months, check reason: Initial return Final return Change in accounting period

3a If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less anynonrefundable credits. See instructions. $

$

$

3a

3b

3c

b If this application is for Form 990-PF or 990-T, enter any refundable credits and estimated tax paymentsmade. Include any prior year overpayment allowed as a credit.

c Balance Due. Subtract line 3b from line 3a. Include your payment with this form, or, if required, depositwith FTD coupon or, if required, by using EFTPS (Electronic Federal Tax Payment System). Seeinstructions.

Caution. If you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EOfor payment instructions.For Privacy Act and Paperwork Reduction Act Notice, see Instructions. Form 8868 (Rev. 4-2009)

JSA9F8054 2.000

X

THE ANDREW W. MELLON FOUNDATION 13-1879954

140 EAST 62ND STREET,

NEW YORK, NY 10065

X

THOMAS SANDERS, CONTROLLER

212 838-8400

08/16 2010

X 2009

0.

2,773,109.

43461C 2532 V 09-5.2 0.0190138.001

-

Form 990-PF (2009) Page 2Attached schedules and amounts in thedescription column should be for end-of-year amounts only. (See instructions.)

Beginning of year End of yearBalance Sheets Part II (a) Book Value (b) Book Value (c) Fair Market Value

1 Cash - non-interest-bearing m m m m m m m m m m m m m m m m m m2 Savings and temporary cash investments m m m m m m m m m m m

I3 Accounts receivableILess: allowance for doubtful accounts

I4 Pledges receivableILess: allowance for doubtful accounts

5 Grants receivable m m m m m m m m m m m m m m m m m m m m m m6 Receivables due from officers, directors, trustees, and other

disqualified persons (attach schedule) (see page 16 of the instructions)

I7 Other notes and loans receivable (attach schedule)ILess: allowance for doubtful accounts

8 Inventories for sale or use m m m m m m m m m m m m m m m m m m9 Prepaid expenses and deferred charges m m m m m m m m m m m m

a10 Investments - U.S. and state government obligations (attach schedule)Ass

ets

mb Investments - corporate stock (attach schedule) m m m m m m m mc Investments - corporate bonds (attach schedule) m m m m m m m m

11 Investments - land, buildings, Iand equipment: basisLess: accumulated depreciation I(attach schedule)Investments - mortgage loans12 m m m m m m m m m m m m m m m m

13 Investments - other (attach schedule) m m m m m m m m m m m m mLand, buildings, and14 Iequipment: basisLess: accumulated depreciation I(attach schedule)

I15 Other assets (describe )Total assets (to be completed by all filers - see the16instructions. Also, see page 1, item I) m m m m m m m m m m m m mAccounts payable and accrued expenses17 m m m m m m m m m m mGrants payable18 m m m m m m m m m m m m m m m m m m m m m m mDeferred revenue19 m m m m m m m m m m m m m m m m m m m m m m

20 Loans from officers, directors, trustees, and other disqualified persons mMortgages and other notes payable (attach schedule)21 m m m m m

Liab

ilitie

s

IOther liabilities (describe )2223 Total liabilities (add lines 17 through 22) m m m m m m m m m m m

IFoundations that follow SFAS 117, check hereand complete lines 24 through 26 and lines 30 and 31.

24 Unrestricted m m m m m m m m m m m m m m m m m m m m m m m m m25 Temporarily restricted m m m m m m m m m m m m m m m m m m m m26 Permanently restricted m m m m m m m m m m m m m m m m m m m m

Foundations that do not follow SFAS 117,check here and complete lines 27 through 31. I

27 Capital stock, trust principal, or current funds m m m m m m m m m28 Paid-in or capital surplus, or land, bldg., and equipment fund m m m m m29 Retained earnings, accumulated income, endowment, or other funds m m30 Total net assets or fund balances (see page 17 of the

instructions)Net

Ass

ets

or F

und

Bal

ance

s

m m m m m m m m m m m m m m m m m m m m m m m m m31 Total liabilities and net assets/fund balances (see page 17

of the instructions) m m m m m m m m m m m m m m m m m m m m m mAnalysis of Changes in Net Assets or Fund Balances Part III

Total net assets or fund balances at beginning of year - Part II, column (a), line 30 (must agree with1end-of-year figure reported on prior year's return) 1m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mEnter amount from Part I, line 27a2 2m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

IOther increases not included in line 2 (itemize)3 3Add lines 1, 2, and 34 4m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

IDecreases not included in line 2 (itemize)5 5Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b), line 306 m m m m m 6

Form 990-PF (2009)

JSA

9E1420 1.000

13-1879954

3,375,336. 3,526,045. 3,526,045.240,340,944. 311,056,943. 311,056,943.

7,231,315.-97,479,751. 7,231,315. 7,231,315.

977,877. 3,585,490. 3,585,490.** 161,251,316. 139,002,215. 139,002,215.

ATCH 11 1,203,381,686. 1,153,954,930. 1,153,954,930.ATCH 12 260,499,064. 367,119,740. 367,119,740.

ATCH 13 2,374,159,758. 3,018,837,866. 3,018,837,866.64,768,686.17,553,801. 49,852,212. 47,214,885. 47,214,885.

ATCH 14 167,204,739. 0. 0.

4,363,563,181. 5,051,529,429. 5,051,529,429.176,547,850. 21,746,533.52,693,237. 51,106,114.

44,350,000. 274,350,000. STMT 16

273,591,087. 347,202,647.X

4,089,972,094. 4,704,326,782.

4,089,972,094. 4,704,326,782.

4,363,563,181. 5,051,529,429.

4,089,972,094.-336,983,034.

ATTACHMENT 16 958,637,722.4,711,626,782.

ATTACHMENT 17 7,300,000.4,704,326,782.

**ATCH 10

43461C 2532

STMT 10A

STMT 13

STMT 14

STMT 15

STMT 15A

SEE STATEMENT 17

STMT 12

SEE STATEMENT 18

STMT 11

-

Form 990-PF (2009) Page 3Capital Gains and Losses for Tax on Investment Income Part IV

(b) Howacquired

P-PurchaseD-Donation

(c) Date acquired

(mo., day, yr.)(d) Date sold(mo., day, yr.)

(a) List and describe the kind(s) of property sold (e.g., real estate,2-story brick warehouse; or common stock, 200 shs. MLC Co.)

1abcde

(g) Cost or other basis(f) Depreciation allowed (h) Gain or (loss)(e) Gross sales price plus expense of sale(or allowable) (e) plus (f) minus (g)

abcdeComplete only for assets showing gain in column (h) and owned by the foundation on 12/31/69 (l) Gains (Col. (h) gain minus

col. (k), but not less than -0-) or(j) Adjusted basis (k) Excess of col. (i)(i) F.M.V. as of 12/31/69 Losses (from col. (h))as of 12/31/69 over col. (j), if any

abcde

If gain, also enter in Part I, line 72 Capital gain net income or (net capital loss) $m m m m m & 2If (loss), enter -0- in Part I, line 73 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):

If gain, also enter in Part I, line 8, column (c) (see pages 13 and 17 of the instructions). &If (loss), enter -0- in Part I, line 8 3m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income Part V(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank.

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period?If "Yes," the foundation does not qualify under section 4940(e). Do not complete this part.

Yes Nom m m m1 Enter the appropriate amount in each column for each year; see page 18 of the instructions before making any entries.

(a) (d)(b) (c)Base period yearsCalendar year (or tax year beginning in)

Distribution ratioAdjusted qualifying distributions Net value of noncharitable-use assets (col. (b) divided by col. (c))

20082007200620052004

2 Total of line 1, column (d) 2m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m3 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by the

number of years the foundation has been in existence if less than 5 years 3m m m m m m m m m m m4 Enter the net value of noncharitable-use assets for 2009 from Part X, line 5 4m m m m m m m m m m5 Multiply line 4 by line 3 5m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m6 Enter 1% of net investment income (1% of Part I, line 27b) 6m m m m m m m m m m m m m m m m m m m m7 Add lines 5 and 6 7m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m8 Enter qualifying distributions from Part XII, line 4 8m m m m m m m m m m m m m m m m m m m m m m m m m

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate. See thePart VI instructions on page 18.

JSA Form 990-PF (2009)9E1430 1.000

13-1879954

SEE PART IV SCHEDULE

-126,946,018.

X

281,992,855. 5,269,927,050. 0.053510311,805,609. 5,789,052,567. 0.053861196,116,195. 5,080,496,944. 0.038602216,501,242. 4,610,613,331. 0.046957196,373,928. 4,217,512,984. 0.046562

0.239492

0.047898

4,282,271,004.

205,112,217.

322,226.

205,434,443.

233,771,173.

43461C 2532

- SEE STMT 2A

-

Form 990-PF (2009) Page 4Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see page 18 of the instructions) Part VI

7I and enter "N/A" on line 1.Exempt operating foundations described in section 4940(d)(2), check here1a m m mDate of ruling or determination letter: (attach copy of ruling letter if necessary - see instructions)

*b Domestic foundations that meet the section 4940(e) requirements in Part V, check 18Ihere and enter 1% of Part I, line 27b m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mc All other domestic foundations enter 2% of line 27b. Exempt foreign organizations enter 4%

of Part I, line 12, col. (b)9

2Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-)2 m m m3Add lines 1 and 23 m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m44 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) m m m55 Tax based on investment income. Subtract line 4 from line 3. If zero or less, enter -0- m m m m m m m m m m m m m

6 Credits/Payments:6aa 2009 estimated tax payments and 2008 overpayment credited to 2009 m m m m6bb Exempt foreign organizations-tax withheld at source m m m m m m m m m m m m m6cc Tax paid with application for extension of time to file (Form 8868) m m m m m m m6dd Backup withholding erroneously withheld m m m m m m m m m m m m m m m m m m

7Total credits and payments. Add lines 6a through 6d7 m m m m m m m m m m m m m m m m m m m m m m m m m m m m m8Enter any penalty for underpayment of estimated tax. Check here8 if Form 2220 is attached m m m m m m mI 99 Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed m m m m m m m m m m m m m m m mIOverpayment. If line 7 is more than the total of lines 5 and 8, enter the amount overpaid 1010 m m m m m m m m m m

I11 Enter the amount of line 10 to be: Credited to 2010 estimated tax IRefunded 11Statements Regarding Activities Part VII-A

Yes NoDuring the tax year, did the foundation attempt to influence any national, state, or local legislation or did it1a1aparticipate or intervene in any political campaign? m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see page 191bof the instructions for definition)? m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

If the answer is "Yes" to 1a or 1b, attach a detailed description of the activities and copies of any materialspublished or distributed by the foundation in connection with the activities.

1cc Did the foundation file Form 1120-POL for this year? m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m md Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year:

I I(2) On foundation managers.$ $(1) On the foundation.Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposede

I $on foundation managers.2Has the foundation engaged in any activities that have not previously been reported to the IRS?2 m m m m m m m m m m m m m m m m

If "Yes," attach a detailed description of the activities.Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of3

3incorporation, or bylaws, or other similar instruments? If "Yes," attach a conformed copy of the changes m m m m m m m m m m m m m4a4a Did the foundation have unrelated business gross income of $1,000 or more during the year? m m m m m m m m m m m m m m m m m4bIf "Yes," has it filed a tax return on Form 990-T for this year?b m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m5Was there a liquidation, termination, dissolution, or substantial contraction during the year?5 m m m m m m m m m m m m m m m m m m

If "Yes," attach the statement required by General Instruction T.Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either:6

% By language in the governing instrument, or% By state legislation that effectively amends the governing instrument so that no mandatory directions that

6conflict with the state law remain in the governing instrument? m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m77 Did the foundation have at least $5,000 in assets at any time during the year? If "Yes," complete Part II, col. (c), and Part XV. m m

8a Enter the states to which the foundation reports or with which it is registered (see page 19 of the

Iinstructions)b If the answer is "Yes" to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General

(or designate) of each state as required by General Instruction G?If "No," attach explanation 8bm m m m m m m m m m m m m m m m m m9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942(j)(3) or

4942(j)(5) for calendar year 2009 or the taxable year beginning in 2009 (see instructions for Part XIV on page27)? If "Yes," complete Part XIV 9m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

10 Did any persons become substantial contributors during the tax year? If "Yes," attach a schedule listing theirnames and addresses 10m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

Form 990-PF (2009)

JSA9E1440 1.000

13-1879954

322,226.X

322,226.0.

322,226.

2,773,109.0.0.

2,773,109.

2,450,883.2,450,883.

X

X

X

X

XXX

X

XX

NY,

X

X

X

43461C 2532

-

Form 990-PF (2009) Page 5Statements Regarding Activities (continued) Part VII-A

11

1213

11

12

13

14

15

At any time during the year, did the foundation, directly or indirectly, own a controlled entity within themeaning of section 512(b)(13)? If "Yes," attach schedule (see page 20 of the instructions)Did the foundation acquire a direct or indirect interest in any applicable insurance contract beforeAugust 17, 2008?Did the foundation comply with the public inspection requirements for its annual returns and exemption application?Website addressThe books are in care ofLocated atSection 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 - Check here

m m m m m m m m m m m m m m m m m mm m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

m m m m mII ITelephone no.

II ZIP + 4 Im m m m m m m m m m m m m m m m m mIand enter the amount of tax-exempt interest received or accrued during the year m m m m m m m m m m m m m m m m m m 15Statements Regarding Activities for Which Form 4720 May Be Required Part VII-B

Yes NoFile Form 4720 if any item is checked in the "Yes" column, unless an exception applies.1a During the year did the foundation (either directly or indirectly):

Yes No(1) Engage in the sale or exchange, or leasing of property with a disqualified person? m m m m m m m m(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from) a

Yes Nodisqualified person? m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mYes No(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person? m m m m m m mYes No(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? m m m m m m m m

(5) Transfer any income or assets to a disqualified person (or make any of either available forYes Nothe benefit or use of a disqualified person)? m m m m m m m m m m m m m m m m m m m m m m m m m m m

(6) Agree to pay money or property to a government official? ( Exception. Check "No" ifthe foundation agreed to make a grant to or to employ the official for a period after

Yes Notermination of government service, if terminating within 90 days.) m m m m m m m m m m m m m m m mb If any answer is "Yes" to 1a(1)-(6), did any of the acts fail to qualify under the exceptions described in Regulations

1bm m m m m m m m m msection 53.4941(d)-3 or in a current notice regarding disaster assistance (see page 20 of the instructions)?IOrganizations relying on a current notice regarding disaster assistance check here m m m m m m m m m m m m m

c Did the foundation engage in a prior year in any of the acts described in 1a, other than excepted acts, that1cwere not corrected before the first day of the tax year beginning in 2009? m m m m m m m m m m m m m m m m m m m m m m m m m m m

2 Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a privateoperating foundation defined in section 4942(j)(3) or 4942(j)(5)):

a At the end of tax year 2009, did the foundation have any undistributed income (lines 6d andYes Nom m m m m m m m m m m m m m m m m m m m m m m m m6e, Part XIII) for tax year(s) beginning before 2009?

IIf "Yes," list the years , , ,b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2)2bto all years listed, answer "No" and attach statement - see page 20 of the instructions.) m m m m m m m m m m m m m m m m m m m m

c If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

I , , ,3a Did the foundation hold more than a 2% direct or indirect interest in any business

Yes Noenterprise at any time during the year? m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mb If "Yes," did it have excess business holdings in 2009 as a result of (1) any purchase by the foundation or

disqualified persons after May 26, 1969; (2) the lapse of the 5-year period (or longer period approved by theCommissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest; or (3) the lapseof the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Form 4720, to determine if thefoundation had excess business holdings in 2009.) 3bm m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

4a4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes? m m m m m m m mb Did the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its

charitable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2009? m m m m m m 4bForm 990-PF (2009)

JSA

9E1450 1.000

13-1879954

X

XX

WWW.MELLON.ORGTHOMAS SANDERS, CONTROLLER 212-838-8400

140 EAST 62ND STREET, NEW YORK, NY 10065

X

XX

X

X

X

X

X

X

X

X

X

43461C 2532

STMT 18A & 18B

-

Form 990-PF (2009) Page 6Statements Regarding Activities for Which Form 4720 May Be Required (continued) Part VII-B

5 a During the year did the foundation pay or incur any amount to:Yes No(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? m m m m m m

(2) Influence the outcome of any specific public election (see section 4955); or to carry on,Yes Nodirectly or indirectly, any voter registration drive? m m m m m m m m m m m m m m m m m m m m m m m mYes No(3) Provide a grant to an individual for travel, study, or other similar purposes? m m m m m m m m m m m m

(4) Provide a grant to an organization other than a charitable, etc., organization described inYes Nosection 509(a)(1), (2), or (3), or section 4940(d)(2)? (see page 22 of the instructions) m m m m m m m

(5) Provide for any purpose other than religious, charitable, scientific, literary, or educationalpurposes, or for the prevention of cruelty to children or animals? Yes Nom m m m m m m m m m m m m m m m m

b If any answer is "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described inRegulations section 53.4945 or in a current notice regarding disaster assistance (see page 22 of the instructions)? 5b

6b

7b

m m m m m m mIOrganizations relying on a current notice regarding disaster assistance check here m m m m m m m m m m m m m m m

c If the answer is "Yes" to question 5a(4), does the foundation claim exemption from the taxYes Nobecause it maintained expenditure responsibility for the grant? m m m m m m m m m m m m m m m m m m m

If "Yes," attach the statement required by Regulations section 53.4945-5(d).

6 a

b

Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiumson a personal benefit contract?Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract?If "Yes" to 6b, file Form 8870.At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction?If yes, did the foundation receive any proceeds or have any net income attributable to the transaction?

Yes Nom m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mm m m m m m m m m m m m

7 a Yes Nom mb m m m m m m m m m m m m m

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,and Contractors

Part VIII 1 List all officers, directors, trustees, foundation managers and their compensation (see page 22 of the instructions).

(c) Compensation(If not paid, enter

-0-)

(d) Contributions toemployee benefit plans

and deferred compensation

(b) Title, and averagehours per week

devoted to position(a) Name and address (e) Expense account,other allowances

2 Compensation of five highest-paid employees (other than those included on line 1 - see page 23 of the instructions).If none, enter "NONE."

(d) Contributions toemployee benefit

plans and deferredcompensation

(a) Name and address of each employee paid more than $50,000(b) Title, and average

hours per weekdevoted to position

(c) Compensation (e) Expense account,other allowances

Total number of other employees paid over $50,000 Im m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mForm 990-PF (2009)

JSA

9E1460 1.000

13-1879954

X

XX

X

X

X

X

XX

X

SEE STATEMENT 18A2,683,599. 349,947. 120,000.

SEE STATEMENT 18B1,549,839. 392,545. 45,000.

59

43461C 2532

STMT 21

-

Form 990-PF (2009) Page 7Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,and Contractors (continued)

Part VIII

3 Five highest-paid independent contractors for professional services (see page 23 of the instructions). If none, enter "NONE."(a) Name and address of each person paid more than $50,000 (b) Type of service (c) Compensation

Total number of others receiving over $50,000 for professional services Im m m m m m m m m m m m m m m m m m m m m m m m m m mSummary of Direct Charitable Activities Part IX-A

List the foundation's four largest direct charitable activities during the tax year. Include relevant statistical information such as the numberof organizations and other beneficiaries served, conferences convened, research papers produced, etc. Expenses

1

2

3

4

Summary of Program-Related Investments (see page 23 of the instructions) Part IX-B Describe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2. Amount

1

2

All other program-related investments. See page 24 of the instructions.

3

Total. Add lines 1 through 3 Im m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mForm 990-PF (2009)

JSA

9E1465 1.000

13-1879954

ATTACHMENT 18 5,774,683.

25

RESEARCH ACTIVITIES - SEE STATEMENT 18C

706,281.

THE FOUNDATION MADE A LOAN TO NONPROFIT FINANCE FUND TO FUNDAND MANAGE A "CAPITAL POOL" USED SOLELY TO MAKEINTEREST-FREE UNSECURED LOANS TO ARTS ORGANIZATIONS. 1,000,000.THE FOUNDATION MADE A LOAN TO THE METROPOLITAN MUSEUM OF ARTFOR THE PURPOSE OF STRENGTHENING THE MUSEUM'S FELLOWSHIPPROGRAM FOR 2009-10, 2010-11, AND 2011-12. 265,000.

NONE

1,265,000.

43461C 2532

SEE STATEMENT 19

-

Form 990-PF (2009) Page 8Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,see page 24 of the instructions.)

Part X

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc.,purposes:Average monthly fair market value of securitiesAverage of monthly cash balancesFair market value of all other assets (see page 24 of the instructions)Total (add lines 1a, b, and c)Reduction claimed for blockage or other factors reported on lines 1a and1c (attach detailed explanation)

1a1b1c1d

abcde

m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mm m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

m m m m m m m m m m m m m m m m m m mm m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

1e234

Acquisition indebtedness applicable to line 1 assetsSubtract line 2 from line 1dCash deemed held for charitable activities. Enter 1 1/2 % of line 3 (for greater amount, see page 25of the instructions)Net value of noncharitable-use assets. Subtract line 4 from line 3. Enter here and on Part V, line 4Minimum investment return. Enter 5% of line 5

23

456

m m m m m m m m m m m m m m m m m m m m mm m m m m m m m m m m m m m m m m m m m m m m m m m m m

m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

5m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

6m mm m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

Distributable Amount (see page 25 of the instructions) (Section 4942(j)(3) and (j)(5) private operating Part XI Ifoundations and certain foreign organizations check here and do not complete this part.)

11 Minimum investment return from Part X, line 6 m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m2a2b

2 a Tax on investment income for 2009 from Part VI, line 5 m m m m m m m mb Income tax for 2009. (This does not include the tax from Part VI.) m m m

2c3

c Add lines 2a and 2b m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m3 Distributable amount before adjustments. Subtract line 2c from line 1 m m m m m m m m m m m m m m m m m m4 Recoveries of amounts treated as qualifying distributions 4

56

7

m m m m m m m m m m m m m m m m m m m m m m m m m5 Add lines 3 and 4 m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m6 Deduction from distributable amount (see page 25 of the instructions) m m m m m m m m m m m m m m m m m m7 Distributable amount as adjusted. Subtract line 6 from line 5. Enter here and on Part XIII,

m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m mline 1Qualifying Distributions (see page 25 of the instructions) Part XII

1 Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes:Expenses, contributions, gifts, etc. - total from Part I, column (d), line 26Program-related investments - total from Part IX-BAmounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc.,purposesAmounts set aside for specific charitable projects that satisfy the:Suitability test (prior IRS approval required)Cash distribution test (attach the required schedule)Qualifying distributions. Add lines 1a through 3b. Enter here and on Part V, line 8, and Part XIII, line 4Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment income. Enter 1% of Part I, line 27b (see page 26 of the instructions)Adjusted qualifying distributions. Subtract line 5 from line 4

ab

1a1b

2

m m m m m m m m m m m m m m m m m2

m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

3m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m

ab

3a3b4

56

m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m45

m m m m m m m m m m m m m m m m m m m m m m m m m m mm m m m m m

6m m m m m m m m m m m m m m m m m m m m m m mm m m m m m m m m m m m m m m m m m m m m m m

Note: The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundationqualifies for the section 4940(e) reduction of tax in those years.

Form 990-PF (2009)

JSA

9E1470 1.000

13-1879954

4,339,296,647.3,086,606.5,100,000.

4,347,483,253.

0.4,347,483,253.

65,212,249.4,282,271,004.

214,113,550.

214,113,550.322,226.

322,226.213,791,324.

491,993.214,283,317.

214,283,317.

232,506,173.1,265,000.

0.

0.0.

233,771,173.

322,226.233,448,947.

43461C 2532

-

Form 990-PF (2009) Page 9Undistributed Income (see page 26 of the instructions) Part XIII

(b)(a) (c) (d)Years prior to 2008Corpus 2008 20091 Distributable amount for 2009 from Part XI,

line 7 m m m m m m m m m m m m m m m m m m m m mUndistributed income, if any, as of the end of 2009:2

a Enter amount for 2008 only m m m m m m m m m mTotal for prior years: 20 ,20 20b ,

3 Excess distributions carryover, if any, to 2009:a From 2004 m m m m m mb From 2005 m m m m m mc From 2006 m m m m m md From 2007 m m m m m me From 2008 m m m m m mf Total of lines 3a through e m m m m m m m m m m m

4 Qualifying distributions for 2009 from Part XII,

Iline 4: $a Applied to 2008, but not more than line 2a m m mb Applied to undistributed income of prior years (Election

required - see page 26 of the instructions) m m m m m mc Treated as distributions out of corpus (Election

required - see page 26 of the instructions) m m m md Applied to 2009 distributable amount m m m m me Remaining amount distributed out of corpus m m

5 Excess distributions carryover applied to 2009 m(If an amount appears in column (d), the sameamount must be shown in column (a).)

6 Enter the net total of each column asindicated below:Corpus. Add lines 3f, 4c, and 4e. Subtract line 5a

Prior years' undistributed income. Subtractbline 4b from line 2b m m m m m m m m m m m m m m

c Enter the amount of prior years' undistributedincome for which a notice of deficiency has beenissued, or on which the section 4942(a) tax hasbeen previously assessed m m m m m m m m m m m m

d Subtract line 6c from line 6b. Taxableamount - see page 27 of the instructions m m m m

e Undistributed income for 2008. Subtract line4a from line 2a. Taxable amount - see page27 of the instructions m m m m m m m m m m m m mUndistributed income for 2009. Subtract lines4d and 5 from line 1. This amount must bedistributed in 2010

f

m m m m m m m m m m m m m m m7 Amounts treated as distributions out of corpus

to satisfy requirements imposed by section170(b)(1)(F) or 4942(g)(3) (see page 27 of theinstructions) m m m m m m m m m m m m m m m m m m

8 Excess distributions carryover from 2004 notapplied on line 5 or line 7 (see page 27 of theinstructions) m m m m m m m m m m m m m m m m m m

9 Excess distributions carryover to 2010.Subtract lines 7 and 8 from line 6a m m m m m m m

10 Analysis of line 9:a Excess from 2005 m m mb Excess from 2006 m m mc Excess from 2007 m m md Excess from 2008 m m me Excess from 2009 m m m

Form 990-PF (2009)

JSA

9E1480 1.000

13-1879954

214,283,317.

07 06 05

0.0.0.

14,126,851.22,976,499.

37,103,350.

233,771,173.

214,283,317.19,487,856.

56,591,206.

0.

56,591,206.

0.0.

14,126,851.22,976,499.19,487,856.

43461C 2532

-

Form 990-PF (2009) Page 10Private Operating Foundations (see page 27 of the instructions and Part VII-A, question 9) Part XIV

1 a If the foundation has received a ruling or determination letter that it is a private operating

Ifoundation, and the ruling is effective for 2009, enter the date of the ruling m m m m m m m m m m m m mb Check box to indicate whether the foundation is a private operating foundation described in section 4942(j)(3) or 4942(j)(5)

Tax year Prior 3 years2 a Enter the lesser of the ad-justed net income from PartI or the minimum investmentreturn from Part X for eachyear listed

(e) Total(a) 2009 (b) 2008 (c) 2007 (d) 2006

m m m m m m mb 85% of line 2a m m m m mc Qualifying distributions from Part

XII, line 4 for each year listed mAmounts included in line 2c notused directly for active conductof exempt activities

d

m m m m me Qualifying distributions made

directly for active conduct ofexempt activities. Subtract line2d from line 2c m m m m m m

3 Complete 3a, b, or c for thealternative test relied upon:

a "Assets" alternative test - enter:(1) Value of all assets m m m

Value of assets qualifying(2)under section4942(j)(3)(B)(i) m m m m m

"Endowment" alternative test-enter 2/3 of minimum invest-ment return shown in Part X,line 6 for each year listed

b

m mc "Support" alternative test - enter:

Total support other thangross investment income(interest, dividends, rents,payments on securitiesloans (section 512(a)(5)),or royalties)

(1)

m m m m m mSupport from generalpublic and 5 or moreexempt organizations asprovided in section 4942(j)(3)(B)(iii)

(2)

m m m m m mLargest amount of sup-port from an exemptorganization

(3)

m m m m mGross investment income(4) m

Supplementary Information (Complete this part only if the foundation had $5,000 or more in assetsat any time during the year - see page 28 of the instructions.)

Part XV

Information Regarding Foundation Managers:1a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation

before the close of any tax year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of theownership of a partnership or other entity) of which the foundation has a 10% or greater interest.

Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:2

ICheck here if the foundation only makes contributions to preselected charitable organizations and does not acceptunsolicited requests for funds. If the foundation makes gifts, grants, etc. (see page 28 of the instructions) to individuals ororganizations under other conditions, complete items 2a, b, c, and d.

a The name, address, and telephone number of the person to whom applications should be addressed:

b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines:

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or otherfactors:

JSA Form 990-PF (2009)9E1490 1.000

13-1879954NOT APPLICABLE

NONE

NONE

ATTACHMENT 19

SEE STATEMENT 19A

NONE

THE FOUNDATION DOES NOT MAKE GRANTS TO INDIVIDUALS.

43461C 2532

SEE STATEMENT 19A

-

Form 990-PF (2009) Page 11Supplementary Information (continued) Part XV

3 Grants and Contributions Paid During the Year or Approved for Future PaymentIf recipient is an individual,show any relationship toany foundation manageror substantial contributor

Foundationstatus ofrecipient

Recipient Purpose of grant orcontribution AmountName and address (home or business)

a Paid during the year

ITotal m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m 3ab Approved for future payment

ITotal m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m 3bForm 990-PF (2009)

JSA9E1491 1.000

13-1879954

SEE STATEMENT 20 216,162,235.

216,162,235.

SEE STATEMENT 20 47,795,200.

47,795,200.

43461C 2532

GRANT PAYABLE AND COMMITTED AS OF 12/31/09 90,671,672GRANTS APPROPRIATED IN PRIOR YEARS, UNPAID AS OF 12/31/09 (47,876,472)GRANTS APPROPRIATED IN 2009, UNPAID AS OF 12/31/09 47,795,200

-

Form 990-PF (2009) Page 12Analysis of Income-Producing Activities Part XVI-A

(e)Enter gross amounts unless otherwise indicated. Unrelated business income Excluded by section 512, 513, or 514 Related or exemptfunction income(a) (b) (d)(c)

Exclusion code (See page 28 ofthe instructions.)Business code Amount Amount1 Program service revenue:abcdefg Fees and contracts from government agencies

2 Membership dues and assessments m m m m m3 Interest on savings and temporary cash investments4 Dividends and interest from securities m m m m5 Net rental income or (loss) from real estate:

a Debt-financed property m m m m m m m m mb Not debt-financed property m m m m m m m

6 Net rental income or (loss) from personal property mOther investment income7 m m m m m m m m m m

8 Gain or (loss) from sales of assets other than inventory9 Net income or (loss) from special events m m m

10 Gross profit or (loss) from sales of inventory m m11 Other revenue: a

bcde

12 Subtotal. Add columns (b), (d), and (e) m m m m13 Total. Add line 12, columns (b), (d), and (e) 13m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m(See worksheet in line 13 instructions on page 28 to verify calculations.)

Relationship of Activities to the Accomplishment of Exempt Purposes Part XVI-B Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly tothe accomplishment of the foundation's exempt purposes (other than by providing funds for such purposes). (Seepage 29 of the instructions.)

Line No.

L

Form 990-PF (2009)JSA9E1492 1.000

13-1879954

14 346,794.14 35,823,082.

525990 -6,706,468. 14 6,899,975.18 -119,199,870.

-6,706,468. -76,130,019.-82,836,487.

NOT APPLICABLE

43461C 2532

-

FORM 990-PF - PART IVCAPITAL GAINS AND LOSSES FOR TAX ON INVESTMENT INCOME

PDate Date soldorKind of Property Description

acquiredDGross sale Depreciation Excess of GainCost or FMV Adj. basisprice less allowed/ FMV over orother as of as of

expenses of sale adj basis (loss)allowable basis 12/31/69 12/31/69

JSA9E1730 1.000

THE ANDREW W. MELLON FOUNDATION 13-1879954

TOTAL GAIN (LOSS) ............................................... -126946018

43461C 2532

STMT 2A

-

THE ANDREW W. MELLON FOUNDATION

13-1879954

STATEMENT 1

FORM 990PF, PART I - INTEREST ON TEMPORARY CASH INVESTMENTS

REVENUE

AND

NET

ADJUSTED

EXPENSES

INVESTMENT

NET

DESCRIPTION

PER BOOKS

INCOME

INCOME

INTEREST BEARING ACCOUNTS

346,794.

346,794.

0.

TOTAL

346,794.

346,794.

0.

ATTACHMENT 1

43461C 2532

STATEMENT

1

-

THE ANDREW W. MELLON FOUNDATION

13-1879954

STATEMENT 2

FORM 990PF, PART I - DIVIDENDS AND INTEREST FROM SECURITIES

REVENUE

AND

NET

ADJUSTED

EXPENSES

INVESTMENT

NET

DESCRIPTION

PER BOOKS

INCOME

INCOME

INTEREST ON BONDS & NOTES

17,460,455.

17,460,455.

0.

INTEREST ON GOVERNMENT OBLIGATIONS

1,356,134.

1,356,134.

0.

INTEREST ON GOVERNMENT SECURITIES

111,381.

111,381.

0.

DIVIDENDS

16,895,112.

16,895,112.

0.

TOTAL

35,823,082.

35,823,082.

0.

ATTACHMENT 2

43461C 2532

STATEMENT

2

-

TheAndrewW.MellonFoundationForm990PFCalendarYear2009131879954

SUMMARYCapitalGainsandLosseson

InvestmentPropertyPartI,Line7andPartIV

Statement2APart1

Page1of1

a) Kind of Propertyb) How

Acquiredc) Date

Acquiredd) Date

Sold e) Proceeds g) Cost or Other

Basis h) Gain (Loss) Stocks:AXIOM Part 2 Page 81 274,063,701 278,659,124 (4,595,423) BARCLAYS Part 3 Page 1 25,796,187 25,616,840 179,347 DODGE&COX Part 4 Page 36 55,527,568 118,059,703 (62,532,135) DECCAN Part 5 Page 1 47,643,600 36,088,074 11,555,526 FRONTIER Part 6 Page 16 23,625,800 27,538,131 (3,912,331) GRANTHAM MAYO MUTUAL FUND Part 7 Page 1 68,072,258 112,356,553 (44,284,295) GRANTHAM MAYO INTL. Part 8 Page 70 141,689,797 169,641,635 (27,951,838) IRIDIAN Part 9 - Page 35 27,384,405 37,342,211 (9,957,806) JPMORGAN Part 10 Page 5 17,714,603 4,307,319 13,407,284 JOHN BRISTOL Part 11 Page 8 48,300,283 56,353,046 (8,052,763) MORGAN STANLEY Part 12 Page 19 12,887,423 15,774,189 (2,886,766) NORTHERN TRUST Part 13 Page 1 109,391 - 109,391 SOUTH EASTERN Part 14 Page 3 50,149,259 69,103,122 (18,953,863) SPEARS GRISANTI Part 15 Page 6 102,900,216 102,088,056 812,160 WESTPORT Part 16 Page 1 5,192,780 527,876 4,664,904 WESTWOOD Part 17 Page 7 4,770,051 7,291,671 (2,521,620) STANDISH Part 22 Page 1 42,488 - 42,488 PIMCO INV. GRADE Part 23 Page 6 260,775 169,978 90,797 PIMCO Part 24 Page 38 541,406 619,872 (78,466)

906,671,991 1,061,537,400 (154,865,410)

Bonds:US Treasury (see part 1A page 1) 1,347,809,912 1,345,617,976 2,191,935

Other Bonds and Notes (see Part 1A page 1) 692,348,233 693,189,043 (840,810)

Other Fixed Income (see part 1A p 1) 1,821,736,236 1,821,725,912 10,324 3,861,894,380 3,860,532,931 1,361,449

Options (see part 1A page 2) 5,181,380 646,816 4,534,564

Other Gains (see part 1B page 13) 22,023,378 22,023,378 Total 4,795,771,129 4,922,717,147 (126,946,018)

990PFPartIVSTMT2ACapitalGainsSchedulesSTMT2APart1

-

TheAndrewW.MellonFoundationForm990PFCalenderYear2009131879954

CapitalGainsandLossesonInvestmentPropertyPartI,Line7andPartIV

Statement2APart1A1of2

(a) Property Sold(b) How Acquired

(c) Date Acquired (d) Date Sold

(e)Gross Sales Price

(g)Cost or Other Basis Plus Expense of Sale (h) Gain (Loss)

Other Stock:

Fixed Income:US Treasury Bonds and Notes:PIMCO Part 24 Page 48 909,208,842 908,854,061 354,781 PIMCO INVT. GRADE Part 23 Page 4 20,385,273 20,773,158 (387,885) Standish Part 22 Page 8 12,059,128 11,790,488 268,640 Standish TIPS Part 20 Page 1 9,527,323 9,440,742 86,581 Standish Liquidity Part 19 Page 3 396,629,346 394,759,527 1,869,818 Total US Treasury Bonds and Notes 1,347,809,912 1,345,617,976 2,191,935

Other Bonds and Notes:

Bonds and Notes PIMCO Part 24 Page 39 77,786,992 79,475,292 (1,688,300) Asset-backed securities PIMCO Part 24 Page 37 330,890,579 329,316,869 1,573,710 Bonds and Notes PIMCO. Invt. Grade Part 23 Page 1 25,282,989 24,570,223 712,766 Asset-backed securities PIMCO Int. Grade Part 23 Page 6 166,305 171,964 (5,658) Bonds and Notes Standish Part 22 Page 8 16,479,786 17,941,678 (1,461,892) Asset-backed securities Standish Part 22 Page 5 18,502,826 20,891,743 (2,388,917) Bonds and Notes Standish Collateral Part 21 Page 4 429,000 429,001 (1) Asset-backed securities Standish Collateral Part 21 Page 2 2,488,685 2,490,402 (1,718) Bonds and Notes Standish Liquidity Part 19 Page 4 19,055,700 18,825,610 230,090 Asset-backed securities Standish Liquidity Part 19 Page 2 179,245,726 178,487,554 758,172 Bonds Morgan Stanley Part 12 Part 19 737,696 640,049 97,647 David Kempner Opportunity Fund Part 18 Page 1 21,281,948 19,948,658 1,333,291 Total Other Bonds and Notes 692,348,233 693,189,043 (840,810)

Other Fixed Income:US Treasury Bills John Bristol Part 11 Page 8 2,951,169 2,951,169 - US Treasury Bills Standish Collateral Part 21 Page 4 11,694,128 11,687,176 6,952 US Treasury Bills Standish Liquidity Part 19 Page 4 220,285,324 220,285,324 (0) US Treasury Bills PIMCO Part 24 Page 56 1,883,681 1,883,575 106 Commercial Paper PIMCO Part 24 Page 56 1,119,919,650 1,119,919,649 1 US Treasury Bills PIMCO Invt. Grade Part 23 Page 6 39,892,466 39,891,684 782 Commercial Paper PIMCO Invt. Grade Part 23 Page 6 180,498,745 180,499,171 (426) Commercial Paper Standish Collateral Part 21 Page 3 33,558,315 33,555,322 2,994 Commercial Paper Standish Liquidity Part 19 Page 4 211,052,758 211,052,843 (85) Total Other Fixed Income 1,821,736,236 1,821,725,912 10,324

STMT2APart1A990PFPartIVSTMT2ACapitalGainsSchedules

-

TheAndrewW.MellonFoundationForm990PFCalenderYear2009131879954

CapitalGainsandLossesonInvestmentPropertyPartI,Line7andPartIV

Statement2APart1A2of2

(a) Property Sold(b) How Acquired

(c) Date Acquired (d) Date Sold

(e)Gross Sales Price

(g)Cost or Other Basis Plus Expense of Sale (h) Gain (Loss)

Options:Standish Part 22 Page 8 61,856 143,347 (81,491) PIMCO Invt. Grade Part 23 Page 3 508,932 313,518 195,414 PIMCO Part 24 Page 67 4,610,592 189,951 4,420,641

5,181,380 646,816 4,534,564

STMT2APart1A990PFPartIVSTMT2ACapitalGainsSchedules

-

TheAnd

rewW.M

ellonFoun

datio

nForm

990

PFCalend

arYear

2009

1318

7995

4CapitalG

ains

andLosses

onInvestmen

tPrope

rty

PartI,Line

7andPartIV

Statem

ent2

APart1B

Page

1of

13

Tota

l Am

ount

per

B

ooks

Rec

lass

ified

to

Oth

er In

com

e on

Ta

x R

etur

n

Cap

ital G

ains

per

B

ooks

afte

r R

ecla

ssifi

catio

n

Amou

nt P

er K

1 or

O

ther

Tax

In

form

atio

nO

ther

Gai

ns -

Lim

ited

Liqu

idity

Inve

stm

ents

:Ac

cel V

III L

P35

6,46

9.00

(8

7,72

3.00

)

444,

192.

00

441,

932.

00Ac

cel I

X L

P17

2,28

2.00

(1

61,7

40.0

0)

334,

022.

00

336,

746.

00Ab

ingw

orth

V30

,862

.30

(7,7

51.4

8)

38

,613

.78

7,29

9.00

Abr

ams

II6,

673,

289.

00

6,

673,

289.

00

(2

37,3

01.0

0)Ad

amas

5,43

7,58

8.00

(201

,334

.00)

5,

638,

922.

00

33

4,05

4.00

Adve

nt V

II, L

P-

Adve

nt V

III, L

P(1

90,7

43.0

0)

31,0

81.0

0

(2

21,8

24.0

0)

(237

,479

.00)

Adve

nt R

ealty

II, L

P-

TA IX

, LP

3,58

7,13

2.00

99,1

20.0

0

3,

488,

012.

00

3,

589,

479.

00TA

Adv

ent X

, LP

(90,

960.

00)

(9

0,96

0.00

)TA

Sub

ordi

nate

d D

ebt F

und

LP56

3,18

3.00

29

,590

.00

533,

593.

00

557,

239.

00TA

Sub

ordi

nate

d D

ebt F

und

II, L

P44

1,47

6.00

44

0,61

4.00

86

2.00

3,48

8.00

Aisl

ing

Cap

ital I

II(2

04,7

69.0

0)

(204

,769

.00)

AIG

Asi

an In

frast

ruct

ure

Fund

913.

00

1,

057.

00

(144

.00)

(1

44.0

0)AI

G A

sian

Infra

stru

ctur

e Fu

nd II

, LP

1,43

5.00

10

7.00

1,32

8.00

1,

328.

00Al

tira

Tech

nolo

gy F

und

V, L

P(3

71,8

29.0

0)

(371

,829

.00)

Arch

light

AE

P F

eede

r Fun

d III

, LLL

C93

8,46

2.00

93

8,46

2.00

47

,037

.00

Arch

light

AEP

Feed

erFu

ndIII

,LLL

C93

8,46

2.00

938,

462.

0047

,037

.00

Arch

light

AEP

Fee

der F

und

IV, L

LLC

3,09

6,93

4.00

3,09

6,93

4.00

1,28

1,48

7.00

Auro

ra E

quity

Par

tner

s, L

. P.

522.

00

52

2.00

Auro

ra E

quity

Par

tner

s II,

L. P

.19

9,78

5.00

19

9,78

5.00

Auro

ra E

quity

Par

tner

s IIl

, LP

(sta

rt da

te 1

0/13

/200

4)(4

,037

,513

.00)

(259

,744

.00)

(3

,777

,769

.00)

(3,7

77,7

69.0

0)Av

anti

(201

,331

.45)

(2

01,3

31.4

5)Av

enue

Spe

cial

Situ

atio

ns F

und,

IV L

P(2

61,4

08.0

0)

(261

,408

.00)

45

5,08

4.00

Aven

ue A

sia

Spec

ial S

ituat

ion

IV L

P(9

99,9

96.0

0)

(999

,996

.00)

1,

306,

673.

00Av

enue

Spe

cial

Situ

atio

ns F

und,

V L

P(6

00,0

00.0

0)

(600

,000

.00)

1,

576,

246.

00Av

enue

Eur

ope

Situ

atio

ns F

und,

V L

P(6

08,9

72.8

4)

(608

,972

.84)

2,

217,

462.

00AE

A - L

Q L

LC-

3,

341.

00AE

A - A

SC In

vest

ors,

LP

-A

EA

- H

RD

Inve

stor

s II,

LP

-

990PF

STMT2A

CapitalG

ains

Sche

dules

STMT2A

Part1B

-

TheAnd

rewW.M

ellonFoun

datio

nForm

990

PFCalend

arYear

2009

1318

7995

4CapitalG

ains

andLosses

onInvestmen

tPrope

rty

PartI,Line

7andPartIV

Statem

ent2

APart1B

Page

2of

13

Tota

l Am

ount

per

B

ooks

Rec

lass

ified

to

Oth

er In

com

e on

Ta

x R

etur

n

Cap

ital G

ains

per

B

ooks

afte

r R

ecla

ssifi

catio

n

Amou

nt P

er K

1 or

O

ther

Tax

In

form

atio

nAE

A -

IAG

Inve

stor

s II,

LP

-AE

A -

LFD

Inve

stor

s II

LP-

AEA

- IO

N In

vest

ors

II, L

P-

AEA

- M

BI I

nves

tors

, LP

-AE

A -

NB

X In

vest

ors

II, L

P-

AEA

- PLI

Inve

stor

s-

AEA

- SSC

I Inv

esto

rs, L

P-

AEA

- TP

H In

vest

ors

II, L

P-

AEA

- TR

N In

vest

ors

II, L

P-

AEA

- V

NI I

nves

tors

II, L

P-

ABR

Y S

enio

r Equ

ity II

, LP

264,

594.

00

264,

653.

00

(59.

00)

32,5

13.0

0AB

RY

Adva

nced

Sec

uriti

es1,

281,

669.

00

(1

03,9

03.0

0)

1,38

5,57

2.00

794,

746.

00AB

RY

Partn

ers

VI(1

27,6

81.0

0)

(193

,119

.00)

65

,438

.00

98,2

00.0

0Ba

in E

urop

e(5

00,8

76.4

4)

(500

,876

.44)

Bain

Cap

ital A

sia

1,57

0.00

1,

623.

00

(53.

00)

Bain

Cap

ital F

und

VII,

LP(1

,099

,861

.00)

(356

,932

.00)

(7

42,9

29.0

0)

(1,1

46,5

46.0

0)B

ain

Cap

ital F

und

VIII

, LP

(sta

rt da

te 6

/11/

2004

)(6

01,2

02.0

0)

(581

,902

.00)

(1

9,30

0.00

)

(143

,567

.00)

Bai

n C

apita

l (TR

U) V

III, L

P-

Bai

n C

apita

l AIV

(LO

EW

S) I

I, LP

(see

Bai

n V

III)

-Ba

inC

apita

lVen

ture

Fund

2005

398

746

00(2

2531

900

)62

406

500

623

750

00Ba

inC

apita

lVen

ture

Fun

d20

0539

8,74

6.00

(225

,319

.00)

624,

065.

0062

3,75

0.00

Bain

Cap

ital V

entu

re F

und

2007

(318

,821

.00)

(3

18,8

21.0

0)Ba

upos

t19

,211

,865

.67

19,2

11,8

65.6

7

28

9,54

3.00

BC E

urop

ean

Cap

ital V

II-9

LP(1

,776

,507

.55)

(1,7

76,5

07.5

5)

(2

,486

,055

.00)

BC E

urop

ean

Cap

ital V

III-9

(290

,967

.32)

(2

81,2

11.0

2)

(9,7

56.3

0)

(4

82,8

11.0

0)B

ench

mar

k C

apita

l Par

tner

s II,

LP

592.

00

(8

67.0

0)

1,45

9.00

1,

461.

00B

ench

mar

k C

apita

l Par

tner

s III

, LP

34,9

96.0

0

(2

,061

.00)

37,0

57.0

0

22

,943

.00

Benc

hmar

k C

apita

l Par

tner

s IV

, LP

786,

322.

00

(272

,689

.00)

1,

059,

011.

00

(1

79,3

52.0

0)

Benc

hmar

k C

apita

l Par

tner

s V,

LP

(sta

rt da

te 6

/22/

2004

)78

9,20

3.00

(2

52,7

54.0

0)

1,04

1,95

7.00

1,06

4,38

0.00

Benc

hmar

k C

apita

l VI

19,5

07.0

0

(4

55,6

08.0

0)

475,

115.

00

485,

935.

00Be

nchm

ark

Euro

pe I,

LP

317,

203.

00

(169

,326

.00)

48

6,52

9.00

53

7,74

7.00

Benc

hmar

k Eu

rope

II, L

P(2

47,3

99.0

0)

(261

,265

.00)

13

,866

.00

(1,0

86,9

22.0

0)

990PF

STMT2A

CapitalG

ains

Sche

dules

STMT2A

Part1B

-

TheAnd

rewW.M

ellonFoun

datio

nForm

990

PFCalend

arYear

2009

1318

7995

4CapitalG

ains

andLosses

onInvestmen

tPrope

rty

PartI,Line

7andPartIV

Statem

ent2

APart1B

Page

3of

13

Tota

l Am

ount

per

B

ooks

Rec

lass

ified

to

Oth

er In

com

e on

Ta

x R

etur

n

Cap

ital G

ains

per

B

ooks

afte

r R

ecla

ssifi

catio

n

Amou

nt P

er K

1 or

O

ther

Tax

In

form

atio

nBe

nchm

ark

Euro

pe II

I, LP

(454

,917

.00)

(4

00,4

98.0

0)

(54,

419.

00)

(5

7,55

3.00

)B

enne

t Res

truct

urin

g Fu

nd, L

P(4

47,0

45.0

0)

1,87

5,21

7.00

(2,3

22,2

62.0

0)B

enne

tt R

estru

ctur

ing

Fund

II, L

P-

Bro

adre

ach

RE

IT II

(1,8

02,9

26.0

0)

(1

,802

,926

.00)

Broo

ksid

e C

apita

l Par

tner

s Fu

nd, L

P7,

651,

428.

00

7,

651,

428.

00Ba

in C

apita

l Par

tner

s IX

Coi

nves

tmen

t, LP

(5,6

59.0

0)

(5

,659

.00)

Bai

n C

apita

l (S

Q) V

III, L

P-

Bain

Cap

ital P

artn

ers

IX, L

P(4

87,9

12.0

0)

56,6

03.0

0

(5

44,5

15.0

0)

(544

,515

.00)

Bain

Cap

ital P

artn

ers

X(3

85,0

37.0

0)

(398

,403

.00)

13

,366

.00

Bain

Cap

ital P

artn

ers

X C

oinv

estm

ent

(20,

235.

00)

(2

0,23

5.00

)Ba

in C

apita

l Spe

cial

Situ

atio

ns X

-C

aden

t Ene

rgy

Par

tner

s I,

LP(1

94,9

10.0

0)

(194

,910

.00)

Cad

ent E

nerg

y P

artn

ers

II, L

P(1

96,9

85.0

0)

(196

,985

.00)

Cad

mus

Cap

ital F

und,

Ltd

.-

Can

dove

r 199

7 U

S #2

Lim

ited

Partn

ersh

ip(1

,614

.85)

(1,6

14.8

5)C

ando

ver P

artn

ers

Lim

ited

2001

Fun

d(1

,096

,020

.79)

(1,8

10,0

28.7

2)

71

4,00

7.93

(2

,024

,485

.00)

Can

dove

r 200

5 Fu

nd U

S #

3 LP

(3,8

87,4

86.3

1)

(1

57,2

27.8

5)

(3,7

30,2

58.4

6)

(3

,548

,904

.00)

Can

dove

r 200

8(1

00,1

84.9

9)

(98,

507.

69)

(1

,677

.30)

15,8

53.0

0C

anyo

n Jo

hnso

n(4

23,0

02.0

0)

(423

,002

.00)

Cen

terb

ridge

Cap

italP

artn

ers

LP99

890

300

(723

748

00)

172

265

100

(13

640

00)

Cen

terb

ridge

Cap

italP

artn

ers,

LP

998,

903.

00(7

23,7

48.0

0)1,

722,

651.

00(1

3,64

0.00

)C

ente

rbrid

ge C

apita

l Par

tner

s AI

V I,

LP-

Cen

terb

ridge

Cap

ital P

artn

ers

AIV

II, L

P-

2,

311.

00C

ente

rbrid

ge C

apita

l Par

tner

s AI

V III

, LP

-

(73,

636.

00)

Cen

terb

ridge

Cap

ital P

artn

ers

Deb

t Acq

uisi

tion

-

1,10

9,34

0.00

CC

G In

vest

men

t Fun

d, L

P(4

76,0

39.2

3)

(238

,031

.53)

(2

38,0

07.7

0)

(241

,458

.00)

CC

G In

vest

men

ts B

VI F

und,

LP

3,51

3,57

2.35

108,

807.

87

3,40

4,76

4.48

3,57

8,43

8.00

CC

G In

vest

men

ts, L

LC (s

tart

date

6/7

/200

4)-

Cla

yton

Dub

ilier &

Ric

e V

(2,9

18.0

0)

(2

,918

.00)

Cla

yton

Dub

ilier &

Ric

e VI

(42,

580.

00)

(4

2,58

0.00

)

22,4

23.0

0C

lear

wat

er II

I-

Con

vexi

ty B

Sha

res

13,9

29,8

20.0

8

13

,929

,820

.08

Con

vexi

ty E

Sha

res

-

990PF

STMT2A

CapitalG

ains

Sche

dules

STMT2A

Part1B

-

TheAnd

rewW.M

ellonFoun

datio

nForm

990

PFCalend

arYear

2009

1318

7995

4CapitalG

ains

andLosses

onInvestmen

tPrope

rty

PartI,Line

7andPartIV

Statem

ent2

APart1B

Page

4of

13

Tota

l Am

ount

per

B

ooks

Rec

lass

ified

to

Oth

er In

com

e on

Ta

x R

etur

n

Cap

ital G

ains

per

B

ooks

afte

r R

ecla

ssifi

catio

n

Amou

nt P

er K

1 or

O

ther

Tax

In

form

atio

nC

row

Hol

ding

s R

ealty

Par

tner

s III

-A(6

,247

,766

.00)

(6,2

74,8

93.0

0)

27

,127

.00

Cro

w H

oldi

ngs

Rea

lty P

artn

ers

IV-A

(314

,548

.00)

(3

14,5

48.0

0)

5,19

2.00

Cyp

ress

Rea

lty V

I(1

57,9

40.0

0)

(157

,940

.00)

Dec

can

II1,

002,

187.

78

-

1,

002,

187.

78

76

2,88

1.00

Elec

tra E

urop

ean

Fund

II(6

,543

,895

.10)

(6,5

43,8

95.1

0)

(5

,888

,185

.00)

Elev

atio

n Pa

rtner

s, L

P(3

38,3

72.0

0)

(325

,111

.00)

(1

3,26

1.00

)

(13,

491.

00)

Ener

vest

Ene

rgy

439,

287.

00

439,

287.

00E

QT

IV, L

P(2

46,8

76.4

3)

(346

,115

.22)

99

,238

.79

EQT

V, L

P(2

67,2

67.6

0)

(411

,088

.47)

14

3,82

0.87

Elev

atio

n D

unde

e Pa

rtner

s, L

P-

Eur

opa

III(1

45,2

82.8

1)

(145

,282

.81)

Fara

llon

Cap

ital O

ffsho

re In

vest

ors

-

109,

051.

00Fa

rallo

n C

apita

l Ins

titut

iona

l-

Fraz

ier V

I(1

,192

,085

.00)

(445

,301

.00)

(7

46,7

84.0

0)

(632

,268

.00)

Frem

ont S

trate

gic

Pro

perty

Par

tner

s II,

LP

132,

978.

00

132,

978.

00

FSP

P II

Mun

oz R

iver

a, L

LC -

Frem

ont R

ealty

Cap

ital,

LP

-G

ener

al A

tlant

ic -

GET

CO

170,

976.

00

170,

976.

00G

ener

al A

tlant

ic -

Latin

Am

eric

a18

7,32

7.00

(5

,426

.00)

192,

753.

00G

lAtl

tiB

d(

)G

ener

al A

tlant

ic -

Berm

uda

310,

638.

00

(25,

756.

00)

33

6,39

4.00

35

8,71

5.00

Gen

eral

Atla

ntic

- Be

rmud

a II

(3,3

68.0

0)

(3

,368

.00)

Gen

eral

Atla

ntic

- 79

(537

.00)

(5

37.0

0)G

ener

al A

tlant

ic -

80(5

29.0

0)

(529

.00)

Gen

eral

Atla

ntic

- 81

207,

553.

00

(4,2

39.0

0)

21

1,79

2.00

16

7,97

5.00

Gen

eral

Atla

ntic

- 82

630,

308.

00

(597

.00)

63

0,90

5.00

63

0,90

5.00

Gen

eral

Atla

ntic

- LL

C-

Gen

eral

Atla

ntic

- 83

1,95

3,36

3.00

(32,

462.

00)

1,

985,

825.

00

1,

957,

760.

00G

ener

al A

tlant

ic -

8437

4,47

1.00

(1

9,54

7.00

)

394,

018.

00

374,

665.

00G

ener

al A

tlant

ic -

8531

1,20

9.00

31

1,20

9.00

Gen

eral

Atla

ntic

- 86

(120

.00)

(1

20.0

0)G

ener

al A

tlant

ic -

83-

990PF

STMT2A

CapitalG

ains

Sche

dules

STMT2A

Part1B

-

TheAnd

rewW.M

ellonFoun

datio

nForm

990

PFCalend

arYear

2009

1318

7995

4CapitalG

ains

andLosses

onInvestmen

tPrope

rty

PartI,Line

7andPartIV

Statem

ent2

APart1B

Page