2008 Wunderkinder Foundation 990

-

Upload

mrspanstreppon -

Category

Documents

-

view

182 -

download

0

description

Transcript of 2008 Wunderkinder Foundation 990

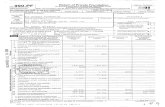

` Return of Private Foundation OMB No 1545-0052

Form 990-PEor Section 4947(a)(1) Nonexempt Charitable Trust

Department of line Treasury Treated as a Private FoundationInternal Revenue Service (77) Note : The foundation maybe able to use a copy of this return to satisfy state reporting requirements

2007For calendar year 2007, or tax year beginning DEC 1, 2007 , and ending NOV 30, 2008e .....b nu rhof .s nn h,• [ 1 1-I,or 1M.- I

r-1

I C,nol rntnrn 1

I^

1 Amon,lerl rnfi„n F__1 A,1,lrecc nhonnn F__1 nlnrr,n nhnnno

Use the IRS Name of foundation A Employer identification number

label. HE WUNDERKINDER FOUNDATIONOtherwise , O BRESLAUER RUTMAN & ANDERSON , LLC 95-4016320

print Number and street (or P O box number if mail is not delivered to street address) Room/suite B Telephone numberor type . 11400 W. OLYMPIC BLVD. 550 ( 310 ) 481-3513

See SpecificInstructions

City or town, state, and ZIP code C If exemption application is pending , check here.OS ANGELES , CA 90064-1551 D 1 • Foreign organizations, check here

H Check type of organization: ® Section 501(c)(3) exempt private foundation 2. Foreign organizations meeting the 85% test,check here and attach computation

Section 4947 ( a )( 1 ) nonexemp t charitable trust 0 Other taxable p rivate foundation rivate foundation status was terminatedE IfI Fair market value of all assets at end of year J Accounting method: ® Cash 0 Accrual

punder section 507(b)(1)(A), check here

(from Part fl, col (c), line 16) 0 Other (specify) F If the foundation is in a 60-month termination$ 5 6 5 2 6 2 8 4 (Part 1, column (d) must be on cash basis) under section 507( b )( 1 B ), check here loo,

I Analysis of Revenue and ExpensesPart (a) Revenue and (b) Net investment (c) Adjusted net ( d ) Disbursements(The total of amounts in columns (b), (c), and (d) may notnecessarily equal the amounts in column (a)) expenses per books income income for charitable purposes

(cash basis only)

1 Contributions, gifts, grants, etc., received 659 , 307

2 Check ►LJ if the foundation is not required to attach Sch B

3 cashnvestmentssand temporary

160 , 849. 160 , 849. Statement 14 Dividends and interest from securities 135 , 225. 135 , 225. Statement 25a Gross rents

b Net rental income or Coss)

68 Net gain or (loss) from sale of assets not on line 10 38 , 939 , 005. DM b Gross sales price for all 40 , 352 , 561.assets on line ea

Z)41 7 Capital gain net income (from Part IV, line 2) 38 , 939 , 005. N8 Net short-term capital gain 9

9 Income modifications01-

NGross sales less returns

10a and allowances

b Less Cost of goods sold

c Gross profit or (loss)

11 Other income

12 Total. Add lines 1 throw h 11 39 , 894 , 386. 39 , 235 , 079. 0.13 Compensation of officers, directors, trustees, etc 0. - 0. 0. 0.

14 Other employee salaries and wages

15 Pension plans, employee benefits

16a Legal fees Stmt 3 600. 0. 0. 0.

M b Accounting fees Stmt 4 3 , 550. 0. 0. 0.W c Other professional fees

> 17 Interest

b 18 Taxes Stmt 5 1 , 330 , 000. 0. 0. 0.19 Depreciation and depletion

E 20 Occupancy

a 21 Travel, conferences, and meetings

2 Printing and publications

3 Other expenses Stmt 6 779. 0. 0. 0.t Q2 4 Total operating and administrative

expenses . Add lines 13 through 23 1 , 334 , 929. 0. 0. 0.25 Contributions, gifts, grants paid 10 , 337 , 832. 10 , 337 , 832.26 Total expenses and disbursements.

Add lines 24 and 25 11 672 761. 0. 0. 10 337 832.27 Subtract line 26 from line 12:

a Excess of revenue over expenses and disbursements 28 , 221 , 625.b Net investment income (if negative , enter -0-) 1 39 , 235 , 079. 1

C^ c Adjusted net income ( if negative , enter -0- ) 0

LHA For Privacy Act and Paperwork Reduction Act Notice , see the instructions Form 990-PF (2007)72350102-20-08

1 \(J^CJJ`J

14050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101 ^,

THE WUNDERKINDER FOUNDATIONFntm 40n-PFP00417'i r1 /n DDDCT _ TTTDD DTTmura*T r_ r*mDV Cr T T_T_n 0IZZ _nn1 CIA') n Pano9

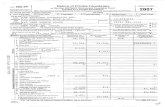

Balance Sheets A^chedschedules andamounts Inthedescdptlon Beginning of year End of yearPart II column should be for end-at -year amounts only (a) Book Value (b) Book Value (c) Fair Market Value

1 Cash - non-interest-bearing

2 Savings and temporary cash investments 30 , 210 , 816. 4 , 306 , 264. 4 , 306 , 264.3 Accounts receivable ►

Less: allowance for doubtful accounts ►4 Pledges receivable ►

Less: allowance for doubtful accounts ►5 Grants receivable

6 Receivables due from officers, directors, trustees, and other

disqualified persons

7 Other notes and loans receivable ►

Less: allowance for doubtful accounts ►

Y 8 Inventories for sale or use

9 Prepaid expenses and deferred charges

10a Investments -U.S. and state government obligations Stmt 9 24 , 118 , 960. 25 , 594 , 113. 25 , 720 , 020.b Investments - corporate stock 758 , 714.c Investments - corporate bonds

11 Investments - land, buildings , and equipment basis ►

Less accumulated depreciation ►

12 Investments - mortgage loans

13 Investments - other Stmt 10 0. 26 000 000. 26 000 000.14 Land, buildings, and equipment: basis ►

Less accumulated depreciation ►

15 Other assets (describe ► Statement 11 ) 89 , 644. 23 334 051. 500 000.

16 Total assets to be com p leted b all filers 55 , 178 , 134. 79 , 234 , 428. 56 , 526 , 284.17 Accounts payable and accrued expenses

18 Grants payable

m 19 Deferred revenue

20 Loans from officers , directors , trustees, and other disqualified persons

21 Mortgages and other notes payable

22 Other liabilities (describe ►

23 Total liabilities ( add lines 17 throu Q h 22 ) 0. 0.

Foundations that follow SFAS 117, check here ► 0and complete lines 24 through 26 and lines 30 and 31

24 Unrestricted

25 Temporarily restricted

co 26 Permanently restricted

Foundations that do not follow SFAS 117, check here ► EFOLL and complete lines 27 through 310

27 Capital stock, trust principal, or current funds 0. 0.

28 Paid-in or capital surplus, or land, bldg., and equipment fund 0. 0.

a 29 Retained earnings, accumulated income, endowment, or other funds 55 , 178 , 134. 79 234 ,428.1

Z 30 Total net assets or fund balances 55 , 178 , 134. 79 , 234

L 428.131 Total liabilities and net assets/fund balances 55 , 178 , 134. 79 . 234 . 428 .

Part Ill Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year - Part II, column ( a), line 30

(must agree with end - of-year figure reported on prior year's return)

2 Enter amount from Part I, line 27a

3 Other increases not included in line 2 (itemize ) ► NON-DEDUCTIBLE CONTRIBUTIONS

4 Add lines 1, 2, and 3

5 Decreases not included in line 2 ( itemize ) ► See Statement 86 Total net assets or fund balances at end of year (line 4 minus line 5) - Part II. column ( b). line 30

709.

723511Form 990-PF (2007)

02-2o-08

214050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONFol m 990-PF'(2007) C / O BRESLAUER RUTMAN & ANDERSON , LLC 95-4016320 Page 3Part IV Capita l Gains and Losses for Tax on Investment Income

(a) List and describe the kind(s) of property sold (e.g., real estate,2 -story brick warehouse; or common stock, 200 shs. MLC Co.)

(b How acquiredPurchase

D Donation

(c Date acquired^mo., day, yr.)

(d) Date sold(mo., day, yr.)

la

b See Attached Statementsc

d

e

(e) Gross sales price (f) Depreciation allowed(or allowable)

(g) Cost or other basisplus expense of sale

(h) Gain or (loss)(e) plus (f) minus (g)

a

b

c

d

e 40 , 352 , 561. 1 1 1 , 413 , 556. 38 939 005.Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69 (I) Gains (Col. (h) gain minus

F.M.V. as of 12/31/69(i)(1) Adjusted basisas of 12/31/69

(k) Excess of col. (i)over col. (I), if any

c ol. (k), but not less than -0Losses (from col. (h))

-) or

a

b

c

d

e 38 939 005.

2 Capital net income or net capital lossIf gain, also enter in Part I, line 7

gain ( ) If (loss) enter -0- in Part I line 7) 2 38 , 939 , 005.

3

,,

Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):If gain, also enter in Part I, line 8, column (c)If (loss), enter -0- in Part I, line 8 3 N /A

I Part V I Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940( d)(2) applies, leave this part blank.

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? 0 Yes ® No

If "Yes," the foundation does not qualify under section 4940(e). Do not complete this part.1 Enter the appropriate amount in each column for each year; see instructions before making any entries.

Base period yearsCalendar year ( orr tax year beg innin g m Adjusted qualifying distributions Net value of noncharitable-use assets

Di)divided

ratio(col. (b) divided by col. (c))

2006 8 , 624 , 506 . 50 744 069. .1699612005 5 , 215 , 016. 13 481 156. .3868372004 10 700 123. 17 505 427. .6112462003 407 897. 14 455 072. .0282182002 150 000. 2 , 821 , 969. .053154

2 Total of line 1, column (d) 2 1.2494163 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5,

the foundation has been in existence if less than 5 years

or by the number of yea rs

3 . 2 4 9 8 8 3

4 Enter the net value of noncharitable-use assets for 2007 from Part X, line 5 4 56 , 603 , 087.

5 Multiply line 4 by line 3 5 14 , 144 , 149.

6 Enter 1% of net investment income (1% of Part I, line 27b) 6 392 , 351.

7 Add lines 5 and 6 7 14 , 536 , 500.

8 Enter qualifying distributions from Part XII, line 4 8 10 , 337 , 832.

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate.See the Part VI instructions.

723521 /02-20-08 Form 990-PF (2007)

314050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONForm 990-PF (2007) C / O BRESLAUER RUTMAN & ANDERSON LLC 95-4016320 Page 4Part VI Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948 - see instructions)

la Exempt operating foundations described in section 4940(d)(2), check here ►U and enter 'N/A' on line 1.

Date of ruling letter: (attach copy of ruling letter if necessary-see instructions)

b Domestic foundations that meet the section 4940(e) requirements in Part V, check here ►0 and enter 1% 1 784 , 702.of Part I, line 27b

c All other domestic foundations enter 2% of line 27b. Exempt foreign organizations enter 4% of Part I, line 12, col. (b)

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) 2 0.

3 Add lines 1 and 2 3 784 , 702.

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) 4 0.

5 Tax based on investment income . Subtract line 4 from line 3. If zero or less, enter -0- 5 784 , 702.

6 Credits/Payments:

a 2007 estimated tax payments and 2006 overpayment credited to 2007 6a 908 , 717.b Exempt foreign organizations - tax withheld at source 6b

c Tax paid with application for extension of time to file (Form 8868) 6c

d Backup withholding erroneously withheld 6d

7 Total credits and payments. Add lines 6a through 6d 7 908 , 717.

8 Enter any penalty for underpayment of estimated tax. Check here ® if Form 2220 is attached 8

9 Tax due . If the total of lines 5 and 8 is more than line 7, enter amount owed ► 9

10 Overpayment . If line 7 is more than the total of lines 5 and 8, enter the amount overpaid ► 10 124 , 015.11 Enter the amount of line 10 to be: Credited to 2008 estimated tax jo^ 12 4 015. Refunded Poo, 11 0.

Part VII-A Statements Regarding Activities

Is During the tax year, did the foundation attempt to influence any national, state, or local legislation or did it participate or intervene in Yes No

any political campaign? la X

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see instructions for definition)? lb X

If the answer is "Yes" to la or 1b, attach a detailed description of the activities and copies of any materials published or

distnbuted by the foundation in connection with the activities

c Did the foundation file Form 1120-POL for this year? 1c X

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year:

(1) On the foundation. ► $ 0 . (2) On foundation managers. Poo. $ 0.

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed on foundation

managers. ► $ 0.

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? 2 X

If "Yes," attach a detailed descnption of the activities

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of incorporation, or

bylaws, or other similar instruments? If "Yes, " attach a conformed copy of the changes 3 X

4a Did the foundation have unrelated business gross income of $1,000 or more during the year? 4a X

b If "Yes," has it filed a tax return on Form 990 -T for this year? N/A

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year?

If "Yes, " attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either:

• By language in the governing instrument, or

• By state legislation that effectively amends the governing instrument so that no mandatory directions that conflict with the state law

remain in the governing instrument?

7 Did the foundation have at least $5,000 in assets at any time during the year?

If "Yes, " complete Part ll, col (c), and Part XV

8a Enter the states to which the foundation reports or with which it is registered (see instructions) ►

b If the answer is 'Yes' to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General (or designate)

of each state as required by General Instruction G? If No, " attach explanation

9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942(l)(3) or 4942(l)(5) for calendar

year 2007 or the taxable year beginning in 2007 (see instructions for Part XIV)? If "Yes, " complete Part XIV

0 no anv norcnnc harnma mhztnntI3i rnntrihntnrc rliinnn tho thy vaar9 . _ _..__^ a.. .... .^ .. -------

72353102-20-08

Form 990-PF (2007)

414050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONFofm 990-PF'2007) CIO BRESLATTER RTTTMAN & ANDERSON. LLC 95-4016320 Page 5

Part VII -A I Statements Regarding Activities (continued)

1la At any time during the year, did the foundation, directly or indirectly, own a controlled entity within the meaning of section 512(b)(13)?

If 'Yes,' attach schedule. (see instructions)

b If 'Yes, did the foundation have a binding written contract in effect on August 17, 2006, covering the interest, rents, royalties, and

annuities described in the attachment for line 1la? N/A

12 Did the foundation acquire a direct or indirect interest in any applicable insurance contract?

13 Did the foundation comply with the public inspection requirements for its annual returns and exemption application?

Website address ► N/A

14 The books are in care of ► BRESLAUER RUTMAN & ANDERSON , LLC Telephone no. ► ( 310) 481-3513

Locatedat ' 11400 W. OLYMPIC BLVD. , STE. 550 , LOS ANGELES , CA ZIP+ 4 '90064-1551

15 Section 4947 ( a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 - Check here ► EA

Part VII- B Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column , unless an exception applies. Yes No

la During the year did the foundation (either directly or indirectly):

(1) Engage in the sale or exchange, or leasing of property with a disqualified persons F-1Yes ® No

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from)

a disqualified person? 0 Yes ® No

(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person? Yes ® No

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? 0 Yes ® No

(5) Transfer any income or assets to a disqualified person (or make any of either available

for the benefit or use of a disqualified person)? 0 Yes ® No

(6) Agree to pay money or property to a government officials (Exception . Check "No"

if the foundation agreed to make a grant to or to employ the official for a period after

termination of government service, if terminating within 90 days.) 0 Yes ® No

b If any answer is 'Yes" to la(1)-(6), did any of the acts fail to qualify under the exceptions described in Regulations

section 53.4941(d)-3 or in a current notice regarding disaster assistance (see page 22 of the instructions)? N/A 1b

Organizations relying on a current notice regarding disaster assistance check here ►c Did the foundation engage in a prior year in any of the acts described in la, other than excepted acts, that were not corrected

before the first day of the tax year beginning in 20079 Ic X

2 Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a private operating foundation

defined in section 4942(j)(3) or 4942(1)(5)):

a At the end of tax year 2007, did the foundation have any undistributed income (lines 6d and 6e, Part XIII) for tax year(s) beginning

before 2007? = Yes ® No

If -Yes; list the years ►b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2) (relating to incorrect

valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2) to all years listed, answer 'No" and attach

statement - see instructions.) N/A 2b

c If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

►3a Did the foundation hold more than a 2% direct or indirect interest in any business enterprise at any time

during the year? Yes ® No

b If "Yes; did it have excess business holdings in 2007 as a result of (1) any purchase by the foundation or disqualified persons after

May 26, 1969; (2) the lapse of the 5-year period (or longer period approved by the Commissioner under section 4943(c)(7)) to dispose

of holdings acquired by gift or bequest; or (3) the lapse of the 10-, 15-, or 20-year first phase holding period? (Use Schedule C,

Form 4720, to determine if the foundation had excess business holdings in 2007) N/A 3b

4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes? 4a

b Did the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable purpose that

had not bee n removed from jeop ardy befo re the fi rst day of the tax year beginning in 20079 4b

Form 990-PF (2007)

72354102-20-07

514050929 796879 95-4016320 2007. 07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONC / O BRESLAUER RUTMAN & ANDERSON , LLC 95-4016320 Pae6

Part VII=B Statements Regarding Activities for Which Form 4720 May Be Required (continued)

5a During the year did the foundation pay or incur any amount to:

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? 0 Yes ® No

(2) Influence the outcome of any specific public election (see section 4955 ); or to carry on, directly or indirectly,

any voter registration drive? 0 Yes ® No

(3) Provide a grant to an individual for travel , study, or other similar purposes 0 Yes ® No

(4) Provide a grant to an organization other than a charitable , etc., organization described in section

509(a )( 1), (2), or (3 ), or section 4940(d)(2)9 0 Yes ® No

(5) Provide for any purpose other than religious , charitable, scientific, literary , or educational purposes, or for

the prevention of cruelty to children or animals2 0 Yes ® No

b if any answer is 'Yes' to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described in Regulations

section 53.4945 or in a current notice regarding disaster assistance ( see instructions)? N/A 5b

Organizations relying on a current notice regarding disaster assistance check here ► LIc If the answer is 'Yes' to question 5a(4), does the foundation claim exemption from the tax because it maintained

expenditure responsibility for the grant? N/A 0 Yes LI No

If "Yes, " attach the statement required by Regulations section 53 4945-5(d).

6a Did the foundation , during the year, receive any funds, directly or indirectly , to pay premiums on

a personal benefit contract2 Yes No

b Did the foundation , during the year, pay premiums , directly or indirectly , on a personal benefit contract2 6b X

If you answered " Yes" to 6b, also file Form 8870

7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction? 0 Yes ® No

b If yes,did the foundation receive any proceeds or have any net income attributable to the transaction2 N/A 7b

Part VIII Information About Officers, Directors, Trustees, Foundation Managers, Highly0 Paid Employees, and Contractors1 List all officers. directors. trustees. foundation manaaers and their compensation.

(a) Name and address(b) Title, and average

hours per week devotedto p osition

(c) Compensation

(If not paid ,enterp0

(md1,Contnbutionstoe poyeebeerritplans

comansa^on

(e) Exp enseaccount, otherallowances

GERALD BRESLAUER PRES, DIRECT.11400 W. OLYMPIC BLVD. , STE. 550LOS ANGELES , CA 90064 0.50 0. 0. 0.MICHAEL RUTMAN SEC,TREAS,DI11400 W. OLYMPIC BLVD. , STE. 550LOS ANGELES , CA 90064 0.50 0. 0. 0.TAMMY ANDERSON SST. SECRETA RY11400 W. OLYMPIC BLVD. , STE. 550LOS ANGELES , CA 90064 0.50 0. 0. 0.BRUCE RAMER DIRECTOR132 SOUTH RODEO DR. ,BEVERLY HILLS , CA 90210 0.00 0. 0. 0.2 Compensation of five highest-naid emolovees (other than those included on line 11. If none- enter "NONE-"

(a) Name and address of each employee paid more than $50,000(b) Title and average

hours per weekdevoted to p osition

(c) Compensation(d)Contributions to

a p and deterred pla ns

compensation

(e) Expenseaccount, otherallowances

NONE

Total number of other employees paid over $50,000 ► 1 0Form 990-PF (2007)

72355102-20-08

614050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONFdrm 990-PP (2007) C/O BRESLAUER RUTMAN & ANDERSON, LLC 95-4016320 Page 7

Part Vlll Information About Officers , Directors , Trustees, Foundation Managers, HighlyPaid Employees, and Contractors (continued)

3 Five highest -paid independent contractors for professional services . If none, enter "NONE."

(a) Name and address of each person paid more than $50,000 (b) Type of service (c) Compensation

NONE

Total number of others receivin g over $50 , 000 for p rofessional services ► 0Part IX-A Summary of Direct Charitable Activities

List the foundation's four largest direct charitable activities during the tax year. Include relevant statistical information such as thenumber of organizations and other beneficiaries served, conferences convened, research papers produced, etc. Expenses

N /A

2

3

4

Part IX-B Summary of Program- Related InvestmentsDescribe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2. Amount

1 N / A

2

All other program-related investments. See instructions.

3

Total. Add lines 1 throu gh 3 ► 0.

Form 990-PF (2007)

72358102-20-08

714050929 796879 95 - 4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONFohm 990-PF'(2007) C/O BRESLAUER RUTMAN & ANDERSON, LLC 95-4016320 Page 8

Part X Minimum Investment Return (All domestic foundations must complete this part Foreign foundations, see instructions)

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc., purposes:

a Average monthly fair market value of securities

b Average of monthly cash balances

c Fair market value of all other assets

d Total (add lines la, b, and c)

e Reduction claimed for blockage or other factors reported on lines la and

1c (attach detailed explanation) le

2 Acquisition indebtedness applicable to line 1 assets

3 Subtract line 2 from line ld

4 Cash deemed held for charitable activities. Enter 1 1/2% of line 3 (for greater amount, see instructions)

5 Net value of noncharitable - use assets . Subtract line 4 from line 3. Enter here and on Part V, line 4

6 Minimum investment return Enter 5% of line 5

Part XIDistributable Amount (see instructions) (Section 4942(j)(3) and (1)(5) private operating foundations and certainforeign organizations check here ► j and do not complete this part.)

1 Minimum investment return from Part X, line 6 1

2a Tax on investment income for 2007 from Part VI, line 5 2a 784 , 702.

b Income tax for 2007. (This does not include the tax from Part VI.) 2b

c Add lines 2a and 2b 2c

3 Distributable amount before adjustments. Subtract line 2c from line 1 3

4 Recoveries of amounts treated as qualifying distributions 4

5 Add lines 3 and 4 5

6 Deduction from distributable amount (see instructions) 6

7 Distributable amount as adjusted. Subtract line 6 from line 5. Enter here and on Part XIII, line 1 7

5,266,439.6,198,624.6,000,000.7,465,063.

0.7,465,063.

861,976.6,603,087.2,830,154.

2,830,154.

784,702.2,045,452.

0.2.045.452.

Part XII Qualifying Distributions (see instructions)

1 Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes:

a Expenses, contributions, gifts, etc. - total from Part I, column (d), line 26 la 10 , 337 , 832.b Program-related investments - total from Part IX-B lb 0.

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc., purposes 2

3 Amounts set aside for specific charitable projects that satisfy the:

a Suitability test (prior IRS approval required) 3a

b Cash distribution test (attach the required schedule) 3b

4 Qualifying distributions . Add lines la through 3b. Enter here and on Part V, line 8, and Part XIII, line 4 4 10 , 337 , 832.5 Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment

income. Enter 1% of Part I, line 27b 5 0.

6 Adjusted qualifying distributions . Subtract line 5 from line 4 6 10 , 337 , 832.Note : The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for the section

4940(e) reduction of tax in those years

Form 990-PF (2007)

72357102-20-08

814050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONForm 990-PF'(2007) C/O BRESLAUER RUTMAN & ANDERSON, LLC 95-4016320 Page 9

Part XI16 Undistributed Income (see instructions)

(a) (b) (c) (d)Corpus Years prior to 2006 2006 2007

1 Distributable amount for 2007 from Part XI,

llne7 2 , 045 , 452.2 Undistributed income , if any, as of the end of 2008

a Enter amount for 2006 only 0.

b Total for prior years:

0.3 Excess distributions ca rryover, if any, to 2007:

a From 2002 28 , 127.b From 2003 11 , 790.

c From 2004 9 , 876 , 708.d From 2005 4 , 581 , 385.e From 2006 7 , 021 , 664.f Total of lines 3a throu gh e 21 , 519 , 674.

4 Qualifying distributions for 2007 from

Part Xl1,line 10 337 832.a Applied to 2006, but not more than line 2a 0.

b Applied to undistributed income of prior

years (Election required - see instructions) 0.

c Treated as distributions out of corpus

(Election required - see instructions) 0.

d Applied to 2007 distributable amount 2 0 4 5 4 5 2.e Remaining amount distributed out of corpus 8 , 292 , 380.

5 Excess distributions carryover applied to 2007 0. 0.(if an amount appears in column (d), the same amountmust be shown in column (a) )

6 Enter the net total of each column asindicated below:

a Corpus Add lines 3f, 4c, and 4e Subtract line 5 29 , 812 , 054 .b Prior years' undistributed income. Subtract

line 4b from line 2b 0.

c Enter the amount of prior years'undistributed income for which a notice ofdeficiency has been issued, or on whichthe section 4942(a) tax has been previouslyassessed 0

d Subtract line 6c from line 6b. Taxable

amount - see instructions 0e Undistributed income for 2006. Subtract line

4a from line 2a. Taxable amount - see instr. 0

f Undistributed income for 2007. Subtract

lines 4d and 5 from line 1. This amount must

be distributed in 2008 0

7 Amounts treated as distributions out of

corpus to satisfy requirements imposed by

section 170(b)(1)(F) or 4942(g)(3) 0

8 Excess distributions carryover from 2002

not applied on line 5 or line 7 28 , 127.

9 Excess distributions carryover to 2008

Subtract lines 7 and 8 from line 6a 29 , 783 , 927.10 Analysis of line 9:

a Excess from 2003 11 7 9 0 .b Excess from 2004 9 , 876 , 708.c Excess from 2005 4 , 581 , 385.d Excess from 2006 7 , 021 , 664.e Excess from 2007 8 , 292 , 380. 1

Form 990-PF (2007)72358102-20-08

914050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONirm 990-P' (2007) C/O BRESLAUER RUTMAN & ANDERSON . LLC 95- 4016320 Page 10Part XIV I Private Operating Foundations (see instructions and Part VII-A, question 9) N/A

1 a if the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2007, enter the date of the ruling ►b Check box to indicate whether the foundation is a Drivate ooeratma foundation described in section

2 a Enter the lesser of the adjusted net

income from Part I or the minimum

investment return from Part X for

each year listed

b 85% of line 2a

c Qualifying distributions from Part XII,

line 4 for each year listed

d Amounts included in line 2c not

used directly for active conduct of

exempt activities

e Qualifying distributions made directly

for active conduct of exempt activities.

Subtract line 2d from line 2c3 Complete 3a, b, or c for the

alternative test relied upon:a 'Assets' alternative test - enter:

(1) Value of all assets

(2) Value of assets qualifyingunder section 4942(j)(3)(B)(i)

b "Endowment* lternative test - enter2/3 of minimum investment returnshown in Part X, line 6 for each yearlisted

c "Support' alternative test - enter:

(1) Total support other than grossinvestment income (interest,dividends, rents, payments onsecurities loans (section512(a)(5)), or royalties)

(2) Support from general publicand 5 or more exemptorganizations as provided insection 4942(I)(3)(B)(uQ

(3) Largest amount of support from

an exempt organization

( 4 ) Gross investment incomePart XV Supplementary Info (Comp p y ad $5,000 or more in assets

at any time during the year-see the instructions.)

1 Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any taxyear (but only if they have contributed more than $5,000). (See section 507(d)(2).)

None

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership orother entity) of which the foundation has a 10% or greater interest.

None2 Information Regarding Contribution , Grant, Gift, Loan, Scholarship , etc., Programs:

Check here 10, I-if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. Ifthe foundation makes gifts, grants, etc. (see instructions) to individuals or organizations under other conditions, complete items 2a, b, c, and d.

a The name, address, and telephone number of the person to whom applications should be addressed:

b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines:

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors:

723601/02-20-08Form 990-PF (2007)

4942(j)(3) or I-I 4942(1)(5)

Tax year Prior 3 years

(a) 2007 (b) 2006 (c) 2005 (d) 2004 ( e) Total

rmation lete this art onl if the foundation h

1014050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONFoYm 990-PP (2007) C / O BRESLAUER RUTMAN & ANDERSON LLC 95-4016320 Page 11Part XV Supplementary Information (continued)

3 Grants and Contributions Paid Durin cai the Year or Approved for Future Pa ment

Recipient If recipient is an individual,show any relationship to Foundation Purpose of grant or

f td status of contribution AmountName and address (home or business) any ion manageroun a

or substantial contributor recipient

a Paid dunng the year

SEE STATEMENT A ATTACHED 10337832.

Total ► 3a 10337832.b Approved for future payment

SEE STATEMENT B ATTACHED 10604666.

Total ► 3b 1 10604666.723811 /02-20-08 Form 990-PF (2007)

1114050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATIONForm 990-PF (2007) C/O BRESLAUER RUTMAN & ANDERSON, LLC 95-4016320 Page 12

PartXVI-A Analysis of Income-Producing Activities

Enter

1 Pro

a

b

c

d

e

f

9

2 Me

3 Int

inv

4 Div

5 Net

a

b

6 Net

pro

7 Ot

8 Gai

tha

9 Net

10 Gr

11 Ot

a

b

c

d

e

12 Subtotal.

Total . Add line 12, columns (b), (d), and (e) 13 39,23T,-079.

(See worksheet in line 13 instructions to verify calculations.)

Part XVI-B Relationship of Activities to the Accomplishment of Exempt Purposes

gross amounts unless otherwise indicated Unrelated business income Exclu ded by section 512 , 513 , or 514 (e).

gram service revenue:

(a)Businesscode

(b)Amount

1Eccr„-$ioncode

(d )Amount

Related or exemptfunction income

Fees and contracts from government agencies

mbership dues and assessments

Brest on savings and temporary cashestments 14 160 , 849.idends and interest from securities 14 135 , 225.rental income or (loss) from real estate:

Debt-financed property

Not debt-financed property

rental income or (loss) from personal

perty

er investment income

n or (loss) from sales of assets other

ninventory 14 38 , 939 , 005.income or (loss) from special events

ss profit or (loss) from sales of inventory

er revenue:

Add columns (b), (d), and (e) 0. 3 9 2 3 5 0 7 9.

t

t

o

h

t

o

h

0.

1214050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

02-20oe Form 990-PF (2007)

THE WUNDERKINDER FOUNDATIONForm 990-PF (2007) C/O BRESLAUER RUTMAN & ANDERSON, LLC 95-4016320 Pag e 13Part XVII Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Did the organization directly or indirectly engage in any of the following with any other organization described in section 501(c) of Yes No

the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations?

a Transfers from the reporting foundation to a nonchantable exempt organization of.

(1) Cash 1a 1 X

(2) Other assets UP ) X

b Other transactions:

(1) Sales of assets to a noncharitable exempt organization lb ( l ) X

(2) Purchases of assets from a nonchantable exempt organization lb ( 2 ) X

(3) Rental of facilities, equipment, or other assets lb ( 3 ) X

(4) Reimbursement arrangements 1b ( 4 ) X

(5) Loans or loan guarantees lb ( 5 ) X

(6) Performance of services or membership or fundraising solicitations lb ( 6 ) X

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees 1c X

d If the answer to any of the above is 'Yes,' complete the following schedule. Column (b) should always show the fair market value of the goods, ot

or services given by the reporting foundation. If the foundation received less than fair market value in any transaction or sharing arrangement, sh

her ass

ow in

ets,

(a) Name of organization (b) Type of organization (c) Description of relationship

N /A

Under penalties of perjury, I declare that I have examined this return , including accompanying schedules and statements , and to the best of my knowledge and belief, it is true, correct,

and complete Declaration of (other than taxpayer or fiduciary) is based on all information of which preparer has any knowledge

ature of offs or trustee D

Preparer's^_co

signature ,^ ^

ay Flrm ' sname(oryours ESLAU R RUTMAN& ANDERa j it self-employed ), 11400 W. OLYMPIC BLVD . ,'

add ress , and zlPcooe LOS ANGELES , CA 90064-1

72362202-20-08

14050929 796879 95-4016320 2007.07000

2a Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described

in section 501 ( c) of the Code ( other than section 501(c)(3 )) or in section 527? 0 Yes OX No

b If 'Yes, ' complete the followinQ schedule.

Schedule B(Form 990, 990-E2,or 990-PF)Department of the TreasuryInternal Revenue Service

Schedule of Contributors

Supplementary Information for

line 1 of Form 990, 990-EZ, and 990-PF (see instructions)

Name of organization

THE WUNDERKINDER FOUNDATION

Organization type (check one):

Filers of: Section:

Form 990 or 990-EZ = 501 (c)( ) (enter number) organization

0 4947(a)(1) nonexempt charitable trust not treated as a private foundation

0 527 political organization

Form 990-PF ® 501 (c)(3) exempt private foundation

0 4947(a)(1) nonexempt charitable trust treated as a private foundation

501(c)(3) taxable private foundation

OMB No 1545-0047

2007

Employer identification number

Check if your organization is covered by the General Rule or a Special Rule. (Note : Only a section 501(c)(7), (8), or (10) organization can check boxes

for both the General Rule and a Special Rule-see instructions)

General Rule-

For organizations filing Form 990, 990-EZ, or 990-PF that received, during the year, $5,000 or more (in money or property) from any one

contributor. (Complete Parts I and II )

Special Rules-

For a section 501 (c)(3) organization filing Form 990 , or Form 990- EZ, that met the 33 1 /3% support test of the regulations under

sections 509(a)(1)/170 (b)(1)(A)(vl), and received from any one contributor , during the year , a contribution of the greater of $5,000 or 2%

of the amount on line 1 of these forms (Complete Parts I and II )

For a section 501(c)(7), (8), or ( 10) organization filing Form 990 , or Form 990 - EZ, that received from any one contributor , during the year,

aggregate contributions or bequests of more than $1,000 for use exclusively for religious, charitable , scientific , literary , or educational

purposes , or the prevention of cruelty to children or animals . (Complete Parts I, II, and III )

For a section 501 (c)(7), (8), or (10) organization filing Form 990, or Form 990-EZ, that received from any one contributor, during the year,

some contributions for use exclusively for religious, charitable, etc., purposes, but these contributions did not aggregate to more than

$1,000 (If this box is checked, enter here the total contributions that were received during the year for an exclusively religious,

charitable, etc , purpose. Do not complete any of the Parts unless the General Rule applies to this organization because it received

nonexclusively religious, charitable, etc , contributions of $5,000 or more during the year) 101. $

Caution : Organizations that are not covered by the General Rule and/or the Special Rules do not file Schedule B (Form 990, 990-EZ, or 990-PF), but

they must check the box in the heading of their Form 990, Form 990-EZ, or on line 2 of their Form 990-PF, to certify that they do not meet the filing

requirements of Schedule B (Form 990, 990-EZ, or 990-PF)

LHA For Paperwork Reduction Act Notice , see the Instructions Schedule B ( Form 990 , 990-EZ , or 990 - PF) (2007)

for Form 990, Form 990- EZ, and Form 990-PF.

723451 12-27-07

1414050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

Schedule B (Form 990, 990-EZ, or

Name of organization

THE WUNDERKINDER FOUNDATION

Part I Contributors (See Specific Instructions.)

of Part I

Employer identification number

(a)

No.

(b)

Name , address, and ZIP + 4

(c)

Aggregate contributions

(d)

Type of contribution

1 AMBLIN ENTERTAINMENT, INC. Person

11400 W. OLYMPIC BLVD., SUITE 550 $ 4,463.PayrollNoncash

LOS ANGELES, CA 90064-1551(Complete Part II if thereis a noncash contribution.;

(a)

No.

(b)

Name , address, and ZIP + 4

(c)

Aggregate contributions

(d)

Type of contribution

2 DW LIPS, LP Person

11400 W. OLYMPIC BLVD., SUITE 550 $ 654,844.Payroll

Noncash FX1

LOS ANGELES, CA 90064-1551(Complete Part II if thereis a noncash contribution.;

(a)

No.

(b)

Name, address, and ZIP + 4

(c)

Aggregate contributions

(d)

Type of contribution

3 Person Ell

$

Payroll

Noncash

(Complete Part 11 if thereis a noncash contribution.)

(a)

No.

(b)

Name , address, and ZIP + 4

(c)

Aggregate contributions

(d)

Type of contribution

4 Person EY1

$

Payroll

Noncash

(Complete Part II if thereis a noncash contribution.)

(a)

No.

(b)

Name, address, and ZIP + 4

(c)

Aggregate contributions

(d)

Type of contribution

Person 0

$

Payroll

Noncash

(Complete Part II if thereis a noncash contribution.)

(a)

No.

(b)

Name , address, and ZIP + 4

(c)

Aggregate contributions

(d)

Type of contribution

Person

$

Payroll

Noncash

(Complete Part II if thereis a noncash contribution )

723452 12-27-07 Schedule B ( Form 990 . 990-EZ . or 990 - PF) (2007)

1514050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

Schedule B (Form 990, 990-EZ, or

Name of organization

THE WUNDERKINDER FOUNDATION

Part II Noncash Property (See Specific Instructions.)

of 1 of Part II

Employer identification number

(a)

No.

from

Part 1

(b)Description of noncash property given

(C)

FMV (or estimate)

(see instructions )

(d)Date received

600,000 SHARES, DREAMWORKS ANIMATION2 SKG, COMMON STOCK

$ 05/23/08

(a)

Part IDescription of noncash property given

or estimate)FMV (or

(see instructions)Date received

(a)

Part IDescription of noncash property given

(c)

FMV (oror estimate)

(see instructions)Date received

(a)

No.

from

Part I

(b)Description of noncash property given

(C)

FMV (or estimate)

(see instructions)

(d)Date received

(a)

from

Part IDescription of noncash property given

FMV (or(esctions )

(see instructions)Date received

No.

from

Part IDescription of noncash property given

(c)FMV (or estimate)

(see instructions)Date received

723453 12-27-07 Schedule B (Form 990 , 990-EZ , or 990 -13F) (2007)

1614050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATION Continuation for 990-PF, Part IV

C / O BRESLAUER RUTMAN & ANDERSON LLC 95-4016320 Page 1 of 2Part IV Capital Gains and Losses for Tax on Investment Income

(a) List and describe the kind ( s) of property sold, e . g., real estate ,2-story brick warehouse; or common stock , 200 shs. MLC Co.

( b How acquired

D - Donation

( c) Date acquired(mo., day, yr .)

( d) Date sold( mo., day, yr.)

la DREAMWORKS ANIMATION SKG 25000 SHARES D 11 / 05 / 07 05 / 13 / 08b DREAMWORKS ANIMATION SKG 50000 SHARES D 11 / 05 / 07 05 / 14 / 08c DREAMWORKS ANIMATION SKG 50000 SHARES D 11 / 05 / 07 05 / 15 / 08d DREAMWORKS ANIMATION SKG 45000 SHARES D 11 / 05 / 0 05 16 08e DREAMWORKS ANIMATION SKG 70000 SHARES D 11 / 05 / 07 05 / 19 / 08I DREAMWORKS ANIMATION SKG 50000 SHARES D 11 / 05 / 07 05 / 20 / 08DREAMWORKS ANIMATION SKG 6700 SHARES D 11 / 05 / 07 05 / 21 / 08

h DREAMWORKS ANIMATION SKG 50000 SHARES D 11 / 05 / 07 05 / 27 / 08i DREAMWORKS ANIMATION SKG 40000 SHARES D 11 / 05 / 07 05 / 28 / 08DREAMWORKS ANIMATION SKG 70000 SHARES D 11 / 05 / 07 05 / 29 / 08

k DREAMWORKS ANIMATION SKG 43300 SHARES D 11 / 05 / 07 05 / 30 / 08I DREAMWORKS ANIMATION SKG 400 SHARES D 11 / 05 / 07 08 / 07 / 08m DREAMWORKS ANIMATION SKG 60000 SHARES D 11 / 05 / 07 08 / 08 / 08n DREAMWORKS ANIMATION SKG 16640 SHARES D .11 / 0 5 8 / 11 / 08o DREAMWORKS ANIMATION SKG 28360 SHARES D 111 / 0,; / n7 08 / 11 / 08

(e) Gross sales price ( f) Depreciation allowed(or allowable )

( g) Cost or other basisplus expense of sale

( h) Gain or (loss)(e) plus ( f) minus (g)

a 757 236. 26 , 502. 730 734.b 1 , 524 , 561 . 53 , 004. 1 , 471 , 557.c 1 , 515 , 936 . 53 , 004. 1 , 462 , 932 .d 1 , 358 , 988. 47 , 704. 1 , 311 , 284.e 2 , 157 , 206 . 74 , 206. 2 , 083 , 000.f 1 , 511 , 216. 53 , 004. 1 , 458 , 212.

201 229. 7 , 103. 194 126.h 1 , 514 , 601 . 53 , 004. 1 , 461 , 597.

1 , 217 , 173. 42 , 403 . 1 , 174 , 770.2 , 171 , 444. 74 , 206. 2 , 097 , 238.

k 1 , 355 , 663 . 45 , 902. 1 , 309 , 761.1 12 , 384. 424. 11 , 960.m 1 , 859 , 149 . 63 , 605. 1 , 795 , 544.n 517 109. 17 , 640. 499 469.o 881 322. 30 , 952. 850 370.

Complete only for assets showing gain in column ( h) and owned by the foundation on 12/31/69 (I) Losses ( from col. (h))

(i) F.M.V. as of 12/31/69(j) Adjusted basisas of 12/31/69

( k) Excess of col. (i)over col. (t), if any

Gains (excess of col. (h) gain over col. (kbut not less than '-O-u)

),

a 730 734.b 1 , 471 , 557.c 1 , 462 , 932.d 1 , 311 , 284.e 2 , 083 , 000.

1 , 458 , 212.194 126.

h 1 , 461 , 597.1 , 174 , 770.2 , 097 , 238.

k 1 , 309 , 761.1 11 , 960.m 1 , 795 , 544.n 499 469.0 850 370.

2 Capital gain net income or capital loss)(net )am, also enter

C If ?loss ) enter °-0in Part I, line 7" in Part I line 7 2

3

, ,

Net short-term capital gain or ( loss) as defined in sections 1222(5 ) and (6):If gain, also enter in Part I, line 8, column (c).If (loss), enter '- 0" in Part I , line 8

Jp3

72359104-27-07

1714050929 796879 95 - 4016320 2007 . 07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATION Continuation for 990-PF, Part IV

C / O BRESLAUER RUTMAN & ANDERSON , LLC 95-4016320 Page 2 of 2Part IV I Capital Gains and Losses for Tax on Investment Income

(a) List and describe the kind(s) of property sold, e.g., real estate,2-story brick warehouse; or common stock, 200 shs. MLC Co.

(b1 How acquired

D - Donation

(c1 Date acquired(mo., day, yr.)

(d) Date sold(mo., day, yr.)

la DREAMWORKS ANIMATION SKG 706330 SHARES D 05 / 23 / 58 08 / 11 / 08b

c

d

ef

h

k

mn

0

(e) Gross sales price (f) Depreciation allowed(or allowable)

(g) Cost or other basisplus expense of sale

(h) Gain or (loss)(e) plus (f) minus (g)

a 21 797 344. 770 893. 21 , 026 , 451.b

c

d

ef

h

k

m

n

0Complete only for assets showing gain in column (h) and owned by the foundation on 12/31/69 (I) Losses (from col. (h))

(i) F.M.V. as of 12/31/69(j) Adjusted basisas of 12/31/69

(k) Excess of col. (i)over col. (I), if any

Gains (excess of col. (h) gain over col. (k),but not less than '-0')

a 21 026 451.b

c

d

e

f

h

k

mn

0

2 Capital gain net income or net capital loss)gein,also enter in Part I, line 7

( ) { If (loss) enter'-0 ' in Part I line 7 2 38 , 939 , 005.,,

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6): 1If gain, also enter in Part I, line 8, column (c). JIf (loss), enter'-0' in Part I, line 8

p

3 N /A

72359104-27-07

1814050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATION C/O BRESLAUE 95-4016320

Form 990-PF Interest on Savings and Temporary Cash Investments Statement 1

Source Amount

DREYFUS GOV'T PRIME MMF 134,605.GOLDMAN SACHS BNK 26,234.MORGAN STANLEY - CREDIT INTEREST 10.

Total to Form 990-PF, Part I, line 3, Column A 160,849.

Form 990-PF Dividends and Interest from Securities Statement 2

Capital Gains Column (A)Source Gross Amount Dividends Amount

COMERICA BANK 60,848. 0. 60,848.COMERICA BANK 17,485. 0. 17,485.MORGAN STANLEY - US TREASURYBILLS 262. 0. 262.US TREASURY STRIPS 56,630. 0. 56,630.

Total to Fm 990-PF, Part I, In 4 135,225. 0. 135,225.

Form 990-PF Legal Fees Statement 3

Description

LEGAL FEES

To Fm 990-PF, Pg 1, In 16a

(a) (b)Expenses Net Invest-Per Books ment Income

600. 0.

600. 0.

(c)Adjusted

Net Income

0.

0.

(d)CharitablePurposes

0.

0.

19 Statement(s) 1, 2, 314050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATION C/O BRESLAUE

Form 990-PF Accounting Fees Statement 4

Description

CERTIFIED AUDIT

To Form 990-PF, Pg 1, In 16b

(a) (b)Expenses Net Invest-Per Books ment Income

3,550. 0.

3,550. 0.

Form 990-PF Taxes Statement 5

Description

FEDERAL EXCISE TAX

To Form 990-PF, Pg 1, In 18

(a) (b) (c)Expenses Net Invest- AdjustedPer Books ment Income Net Income

1,330, 000. 0. 0.

1,330, 000. 0. 0.

Form 990-PF Other Expenses Statement 6

Description

CA FILING FEEANNUAL REGISTRATION FEEINSURANCE

To Form 990-PF, Pg 1, In 23

(a) (b)Expenses Net Invest-Per Books ment Income

(c)Adjusted

Net Income

0.

0.

(c)Adjusted

Net Income

95-4016320

(d)CharitablePurposes

0.

0.

(d)CharitablePurposes

0.

0.

(d)CharitablePurposes

10. 0. 0. 0.300. 0. 0. 0.469. 0. 0. 0.

779. 0. 0. 0.

Footnotes Statement 7

20 Statement(s) 4, 5, 6, 714050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATION C/O BRESLAUE

LOSSES ASSOCIATED WITH B. MADOFF SECURITIES PONZI SCHEME

WUNDERKINDER FOUNDATION DISCOVERED ON DECEMBER 11, 2008INVESTMENTS IT MADE WITH B. MADOFF SECURITIES WAS PARTOF A PONZI SCHEME. 4,168,281 IN INCOME REPORTED IN PREVIOUSYEARS WAS NON-EXISTENT AND THE FOUNDATION IS PLANNING TOFILE AMENDED RETURNS TO RECOVER TAXES PAID ON THATINVESTMENT INCOME. TAX YEAR ENDED 11/30/04 IS CLOSED BYSTATUTE. ACCORDINGLY 333,894 IN INCOME EARNED THAT YEARTOGETHER WITH THE ORIGINAL NET INVESTMENT IN THE AMOUNT OF23,000,000 IS SHOWN ON THE BALANCE SHEET AS AN ASSET.THE VALUE OF THIS ASSET IS LISTED AT 500,000 WHICH ISTHE AMOUNT RECOVERED BY THE FOUNDATION FROM THE SIPC IN2009.

95-4016320

21 Statement(s) 714050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

THE WUNDERKINDER FOUNDATION C/O BRESLAUE 95-4016320

Form 990-PF Other Decreases in Net Assets or Fund Balances Statement 8

Description Amount

PREVIOUS YEARS B. MADOFF PONZI SCHEME INCOME 4,168,281.

Total to Form 990-PF, Part III, line 5 4,168,281.

Form 990-PF U.S. and State/City Government Obligations Statement 9

U.S. Other Fair MarketDescription Gov't Gov't Book Value Value

U.S. TREASURY STRIPS XU.S. TREASURY BILLS X

Total U.S. Government Obligations

Total State and Municipal Government Obligations

Total to Form 990-PF, Part II, line 10a

594,696.24,999,417.

25,594,113.

25,594,113.

720,270.24,999,750.

25,720,020.

25,720,020.

Form 990-PF Other Investments Statement 10

DescriptionValuationMethod

PARTNERSHIP INVESTMENT COST

Total to Form 990-PF, Part II, line 13

Fair MarketBook Value Value

26,000,000. 26,000,000.

26,000,000. 26,000,000.

Form 990-PF Other Assets Statement 11

Description

INTEREST RECEIVABLEASSETS INVESTED WITH B. MADOFFSECURITIES LLC - SEE STATEMENT 7ATTACHED

To Form 990-PF, Part II, line 15

Beginning ofYr Book Value

89,644.

0.

89,644.

End of Year Fair MarketBook Value Value

157. 0.

23,333,894. 500,000.

23,334,051. 500,000.

22 Statement(s) 8, 9, 10, 1114050929 796879 95-4016320 2007.07000 THE WUNDERKINDER FOUNDATION 95-40101

WUNDERKINDER FOUNDATION 11/30/2008

FORM 990-PF, PART XV, LINE 3GRANTS AND CONTRIBUTIONS PAID DURING THE YEAR

Relationship If Foundation Purpose of Amount

Recipient Name and address Recipient Is An Status or ContributionIndividual Recipient

AMERICAN FILM INSTITUTE 501 (c)(3) Educational 50,000

2021 N Western Avenue, Los Angeles, CA 90027

AMERICAN MUSEUM OF NATURAL HISTORY 501(c)(3) Educational 50,000

Central Park West at 79th Street, New York, NY 10024-5192AMERICAN PATRONS OF THE TATE GALLERY 501(c)(3) Educational 5,000

1285 6th Avenue, 35th Floor, New York, NY 10019

ANGELS AT RISK 501(c)(3) Educational 50,000

115 Barringto Walk, Los Angeles, CA 90049

ART SHARE LOS ANGELES 501(c)(3) Educational 10,000

801 East 4th Place, Los Angeles, CA 90013BOY SCOUTS OF AMERICA 501(c)(3) Educational 250,000

2401 West Maple Road, Omaha, NE 68164BROWN UNIVERSITY 501 (c)(3) Educational 150,000

One Prospect Street, Campus Box 1860, Providence, RI 02912

CALIFORNIA STATE SUMMER SCHOOL ARTS FOUNDATION 501(c)(3) Educational 5,000

1875 Century Park East, Suite 700, Los Angeles, CA 90067

CALIFORNIA STATE UNIVERSITY, LONG BEACH 501(c)(3) Educational 410,000

1250 N Bellflower Blvd, Long Beach, CA 90840CEDARS-SINAI MEDICAL CENTER 501(c)(3) Medical Research 500,000

P 0 Box 48750, Room 2416, Los Angeles, CA 90048CENTER THEATRE GROUP 501(c)(3) Educational 10,000

601 West Temple Street, Los Angeles, CA 90012CHILDREN'S ACTION NETWORK 501(c)(3) Educational 13,532

10951 West Pico Blvd., Ste 206, Los Angeles, CA 90064

CHILDREN'S BUREAU 501(c)(3) Educational 500,000

PO Box 1031, Bridgehampton, NY 11932DOCTORS WITHOUT BORDERS 501 (c)(3) Support for the poor 25,000

333 7th Avenue, 2nd Floor, New York, NY 10001-5004DONORSCHOOSE INC 501(c)(3) Educational 25,000

c/o Bob Daly, 10877 Wilshire Blvd., Suite 610, Los Angeles, CA

EDGEMAR CENTER FOR THE ARTS 501(c)(3) Educational 10,000

2437 Main Street, Santa Monica, CA 90405ENTERTAINMENT INDUSTRY FOUNDATION 501(c)(3) Educational 50,000

100 Universal City Plaza, Universal City, CA 91608Education Through Music - Los Angeles 501(c)(3) Educational 1,000

P 0 Box 464279, Los Angeles, CA 90048FEMINIST MAJORITY FOUNDATION 501(c)(3) Educational 10,000

433 South Beverly Drive, Beverly Hills, CA 90212FIRST PRESBYTERIAN NURSERY SCHOOL 501(c)(3) Educational 25,000

1248 Second Street, Santa Monica, CA 90401GEFFEN PLAYHOUSE 501(c)(3) Arts 35,000

10886 Le Conte Avenue, Los Angeles, CA 90024GUCCI FOUNDATION 501(c)(3) Support for the Poor 50,000

17-19 Marble Avenue, Pleasantville, NY 10570GUILD HALL OF EAST HAMPTON 501 (c)( 3 ) Educational 50,000

Page 1 of 4

STATEMENT A

WUNDERKINDER FOUNDATION 11/30/2008

FORM 990-PF, PART XV, LINE 3GRANTS AND CONTRIBUTIONS PAID DURING THE YEAR

Relationship If Foundation Purpose of Amount

Recipient Name and address Recipient Is An status or ContributionIndividual Recipient

158 Main Street, New Hampton, NY 11937

HOMEBOY INSDUSTRIES 501(c)(3) Job Training 25,000

130 W. Bruno Street, Los Angeles, CA 90012HOMIES UNIDOS 501(c)(3) Educational 10,000

1625 W Olympic Blvd., Suite 706, Los Angeles, CA 90015HUBBS-SEAWORLD RESEARCH INSTITUTE 501 (c)(3) Educational 5,000

2595 Ingraham Street, San Diego, CA 92109

HUMAN RIGHTS WATCH 501(c)(3) Educational 150,000

350 5th Avenue, 34th Floor, New York, NY 10118

INNER CITY FILMMAKERS 501(c)(3) Educational 10,000

3000 W Olympic Bvd., Santa Monica, CA 90404

INTERNATIONAL MEDICAL CORPS 501(c)(3) Support of the Poor 300,000

1919 Santa Monica Blvd , Suite 400, Santa Monica, CA 90404

JUVENILE DIABETES FOUNDATION INERNATIONAL 501(c)(3) Medical Research 50,000

120 Wall Street, New York, NY 10005KING BAUDOUIN FOUNDATION UNITED STATES 501(c)(3) Educational 5,000

10 Rockefeller Plaza, 16th Floor, New York, NY 10020

LAMP COMMUNITY 501(c)(3) Medical Research 8,334

527 Crocker Street, Los Angeles, CA 90013LOS ANGELES HOMELESS SERVICES COALITION 501(c)(3) Support for the Poor 25,000

1328 Westwood Blvd, #20, Los Angeles, CA 90024

LOS ANGELES PHILARMONIC ASSOCIATION 501(c)(3) Support of the Arts 33,334

151 South Grand Avenue, Los Angeles, CA 90012

LOS ANGELES POLICE FOUNDATION 501(c)(3) Educational 8,333

555 S. Flower Street, Ste 1680, Los Angeles, CA 90086MARIN SERVICES FOR WOMEN 501(c)(3) Support for the Poor 25,000

1251 South Eliseo Drive, Greenbrae, CA 94904MARLBOROUGH SCHOOL 501(c)(3) Educational 1,002,000

250 S . Rossmore Avenue, Los Angeles, CA 90004

MIDNIGHT MISSION 501(c)(3) Educational 1,000

601 So. San Pedro Street, Los Angeles, CA 90014MIND & LIFE INSTITUTE 501(c)(3) Arts 25,000

589 West Street, Louisville, CO 80027

MOTION PICTURE AND TELEVISION FUND 501(c)(3) Arts 100,000

222 12 Ventura Blvd, #300, Woodland Hills, CA 91364MUSEUM OF JEWISH HERITAGE 501(c)(3) Arts 25,000

36 Battery Place, New York, NY 10280MUSIC FOR ALL, INC. 501(c)(3) Arts 1,000

39 West Jackson Place, Suite 150, Indianapolis, IN 46225

NEW ROADS SCHOOL 501(c)(3) Educational 25,000

110 1 17th Street NW, Washington DC 20036

NEW VISIONS FOUNDATION 501(c)(3) Educational 666,666

3131 Olympic Blvd., Santa Monica, CA 90404

NEW YORK RESTORATION PROJECT 501(c)(3) Educational 25,000

254 West 31st Street, New York, NY 10001

Page 2 of 4

STATEMENT A

WUNDERKINDER FOUNDATION 11/30/2008

FORM 990-PF, PART XV, LINE 3GRANTS AND CONTRIBUTIONS PAID DURING THE YEAR

Relationship If Foundation Purpose of Amount

Recipient Name and address Recipient Is An Status or ContributionIndividual Recipient

NORMAN ROCKWELL MUSEUM 501(c)(3) Educational 20,000

9 Glendale Road , Stockbridge , MA 01262OCEANA 501(c)(3) Environment 75,000

1350 Connecticut Avenue NW, 5th Floor, Washington , DC 20036

OPCC 501(c)(3) Support for the Poor 10,000

1453 16th Street, Santa Monica , CA 90404ORCHARD GROUP, INC. 501 (c)(3) Educational 1,000

51 Middlesex Street , Unit 101, North Chelmsford , MA 01863OUTFEST 501(c)(3) Eductional 15,000

3470 Wilshire Blvd, Ste 10022 , Los Angeles , CA 90010PEACE OVER VIOLENCE 501(c)(3) Eductional 15,000

605 W Olympic Blvd., Ste 400, Los Angeles , CA 90015PLANNED PARENTHOOD HUDSON PECONIC 501(c)( 3) Educational 5,000

70 Maple Avenue , Smithtown , NY 11787PLANNED PARENTHOOD LOS ANGELES 501(c)(3) Educational 175,000

1920 Marengo St, Los Angeles , CA 90033PROGRESSIVE JEWISH ALLIANCE 501 (c)(3) Educational 7,500

5870 W Olympic Blvd., Los Angeles , CA 90036RAND CORPORATION 501(c )(3) Educational 5,000

1776 Main Street , PO Box 2138 , Santa Monica , CA 90407RETREAT DOMESTIC VIOLENCE SERVICES 501(c)(3) Educational 10,000

13 Goodfriend Dr, East Hampton , NY 11937REVLON RUN/WALK FOR WOMEN 501(c )(3) Cancer Research 500

1201 West 5th Street , Suite T-700, Los Angeles , CA 90017RIGHTEOUS PERSONS FOUNDATION 501(c)(3) Educational 4,034,000

11400 W Olympic Blvd., Ste . 550, Los Angeles , CA 90064ROBERT F KENNEDY MEMORIAL 501(c)(3) Educational 5,000

1367 Connecticut Avenue , Suite 200 , Washington , DC 20036THE ROSS SCHOOL 501(c)( 3) Educational 10,000

18 Goodfriend Dr, East Hampton , NY 11937SHAKESPEARE FESTIVAL LA 501(c)(3) Arts 200,000

9911 W. Pico Blvd, Ste 1530 , Los Angeles , CA 90035SHARE INC. 501(c)(3) Support for the Poor 25,000

P.O. Box 1342 , Beverly Hills , CA 90213SHOE4AFRICA 501(c)(3) Support for the Poor 125,000

SOMALI MAM FOUNDATION 501(c)(3) Support fot the Poor 25,000

3680 Miller Court , Wheat Ridge , CO 80033SOUTHAMPTON HOSPITAL FOUNDATION 501(c)(3) Medical 5,000240 Meeting House Lane , Southampton , NY 11968TEMPLE EMMANUEL 501(c)(3 ) Religious 188,4088844 Burton Way, Bevely Hills, CA 90211THE ELLEN P HERMANSON FOUNDATION 501(c)(3 ) Educational 10,000130 West 42nd Street , Suite 801 , New York, NY 10036THE HAMPTON SYNAGOGUE 501(c)( 3 ) Relig ious 3,600

Page 3 of 4

STATEMENT A

WUNDERKINDER FOUNDATION 11/30/2008FORM 990-PF, PART XV, LINE 3GRANTS AND CONTRIBUTIONS PAID DURING THE YEAR

Relationship If Foundation Purpose of AmountRecipient Name and address Recipient Is An Status or Contribution

Individual Recipient

134 Sunset Avenue, Westhampton Beach, NY 11978THE JACKIE ROBINSON FOUNDATION 501(c)(3) Educational 5,000One Hudson Square, 75 Varick St , 2nd Floor, New York, NY 10013THE NATURE CONSERVANCY 501(c)(3) Environment 5,000P O. Box 5125, East Hampton, NY 11937THE OVARIAN RESEARCH FUND 501(c)(3) Cancer Research 10,000One Pennsylvania Plaza, Ste 1400, New York, NY 10122THE PERLMAN MUSIC PROGRAM 501(c)(3) Arts 100,00019 West 69th Street #501, New York, NY 10023THE STELLA ADLER STUDIO OF ACTING 501 (c)(3) Arts 50,00031 West 27th Street, 3rd Floor, New York, NY 10001U S HOLOCAUST MEMORIAL MUSEUM 501(c)(3) Educational 150,000100 R. Wallenberg Place SW, Washington, DC 20024-2126THE WONDER OF READING 501(c)(3) Educational 10,0005371 Wilshire Blvd., Suite 210, Los Angeles, CA 90048UCLA FOUNDATION/JOEL SIEGEL SCHOLARSHIP 501(c)(3) Educational 5,000103 East Melnitz Hall, Los Angeles, CA 90095UNIVERSITY OF ARKANSAS 501(c)(3) Cancer Research 50,0004301 West Markham Street #816, Little Rock, AR 72205UPWARD BOUND HOUSE 501(c)(3) Support of the Poor 5,0001104 Washington Avenue, Santa Monica, CA 90403VISTA DEL MAR CHILD AND FAMILY SERVICES 501(c)(3) Educational 5,0003200 Motor Avenue, Los Angeles, CA 90034WESTSIDE CHILDREN'S CENTER 501(c)(3) Educational 25,00012120 Wagner Street, Culver City, CA 90230WILDWOOD SCHOOL 501(c)(3) Educational 127,62512201 Washington Place, Los Angeles, CA 90066WOMEN'S CARE COTTAGE 501(c)(3) Educational 5,0006180 Laurel Cyn Blvd., Ste. 375, North Hollywood, CA 91606WOMENS MEDIA CENTER 501(c)(3) Educational 5,000

-1 1 10,337,832

Page 4 of 4

STATEMENT A

THE WUNDERKINDER FOUNDATION

95-4016320

11/30/2008

FORM 990PF, PART XV(B) - APPROVED FOR FUTURE PAYMENT

STATEMENT B

RECIPIENT RELATIONSHIP STATUS PURPOSE AMOUNT

US HOLOCAUST MEMORIAL MUSEUM NONE 501(C)(3) EDUCATIONAL 750,000

100 Raul Wallenberg Place, Washington, DC 20024

CEDARS-SINAI MEDICAL CENTER NONE 501(C)(3) MEDICAL 2,500,000

8700 Beverly Blvd., Suite 2416; Los Angeles, CA 90048 RESEARCH

CALIFORNIA STATE UNIVERSITY, LONG BEACH NONE 501(C)(3) EDUCATIONAL 388,000

1250 N Bellflower Blvd , Long Beach, CA 90840

CHADDOCK SCHOOL OF QUINCY NONE 501(C)(3) EDUCATIONAL 1,120,000

205 South 24th Street, Quincy, IL 62301

MARLBOROUGH SCHOOL NONE 501(C)(3) EDUCATIONAL 2,000,000

250 S Rossmore, Los Angeles, CA 90004

TEMPLE EMANUEL NONE 501(C)(3) RELIGIOUS 180,000

8844 Burton Way, Beverly Hill, CA 90211

NEW VISIONS SCHOOL NONE 501(C)(3) EDUCATIONAL 666,666

3131 Olympic Blvd., Santa Monica, CA 90404

POMONA COLLEGE NONE 501(C)(3) EDUCATIONAL 1,000,000

550 North College Avenue, Claremont, CA 91711

YALE UNIVERSITY, YALE SCHOOL OF MEDICINE NONE 501( C )(3) EDUCATIONAL 2,000,000

333 Cedar Street, New Haven, CT 06510

STATEMENT B