2 AMBAVADLAHMEDABAD -I - Central Excise, Ahmedabad€¦ · · 2014-10-31DIVISION— III, 2ND...

Transcript of 2 AMBAVADLAHMEDABAD -I - Central Excise, Ahmedabad€¦ · · 2014-10-31DIVISION— III, 2ND...

OFFICE OF DEPUTY COMMISSIONER OF CENTRAL EXCISE,

DIVISION— III, 2ND FLOOR, CENTRAL EXCISE BHAVAN, NW POLYTECHNIC, AMBAVADLAHMEDABAD -I

cfral. Sit 4410/By R.P.A.D.

1:FT.F1JENo.Ch.32/3-8/N114/AR-111/14-15 311t31 *t Sr/Date of Order: 10.10.2014

.711 .1,8 a artairmatc of I ssuc: I0.122014

49

NU 4i I cf/Passed by Mahesh Kumar, Deputy Commissioner, Central Excise, Division-Ill,

Ahmedabad-I

,3:17 .311-it +145441- MP/05/DC/ 2014-15 .

art) a at 3-1—a dicfl t, 3-# ctl d d 51

sr-cw aliclr t.i

I. this copy is granted free of charge for private use of the person(s) to whom it is sent.

3Fra-3r tit 3i#jdre *Y8ftTzrf&-a- arr-A-Rr 31N -d( artR -),

3c414 ser*, tats-3c414 tc.-cr) LsIt Ni74-17dTgr, 3rtaT3rar3 -300?t,

t.v.e f 31-011N tithdr t/ 3 4ci 3f c VCiWR ITT 3Ut r a-ratrc OA - artrar

37). slob C,50 Oa a antEr * atra-R. a a ,thrfi $Ff

117 T. R- 00 dei 0- .m-rr

2. Any person deeming himself aggrieved by this order may appeal against this order inform EA-1 to the Commissioner (Appeals), Central Excise, 7 1 Eloor, Central Excise

Bhavan, Near Polytechnic, Ambawadi, Ahmedabad-380015. 'ale Appeal must be filed within 60 clays from the date of receipt of this Order by post or by party. It should hear Court fee stamp of 2-00 only.

ctd 3rdta a1 eat at mitt"- 5tr-? a1 c1$a a ofirlf 3 T IT{ -ti-Lr

.X414 (31itrg) qQ4cHictelt, Roo¢ fazia-r a * 34 4+.14 (R)

l'aireare 450t1 e 4-draTT ?thlr .31 I 04 a nit TriZT 4c1 a

tic-40-1 441 Mir/

The appeal should be filed in EA-1 in duplicate. It shall be signed by the Applicant/s specified in sub-rule (2) of Rule 3 of the Central Excise (Appeals) Rules, 2001. It shall be accompanied with the following:

S. 3otcr 3111-irg 171 . fau 4 crf4Trr (3s1,4 it M-6 3# 3TrtU a ud Stara OA Vri'87 1 u itFK 3P4LR 4 eo 9-241 3c rI 3i1tU

Cr 3 WIT Cfs. 11T T.7- 00 1117 0-+0.-0e1 44 41c■ch itTh—C 3Ta3ZT el II 00-11

4. A copy of the accompanied Appeal and two copies of the decision of which one shall be Certified copy of the Order against and the other copy of the Order, which must bear

Court fee stamp of 2-00. 5. An appeal against this order shall lie before the Commissioner (Appeal) on payment of

7.52o of the dun, demanded where duty or duty and penalfi are in dispute or penalty, are in dispute or penalty, where penalty alone is in dispute.

Sub:- Show Cause Notice No.Ch.32/3-8/MIL/AR-I11/ 14-15 dated 30.063014 issued against M/s.Meghamani Industries Ltd, (Unit-II), Plot No.27, Phase-I, ClIDC, Vatva, Ahmedabad 382 445 for wrong availment of Cenvat Credit of Service tax On Commission paid to Foreign/Local sales Commission Agents for Rs.2,22,243/-

2

Brief facts of the case:

NI/s. Meghmani Industries Limited, Unit — II, Plot No.27, Phase-I, G.I.D.C., Vatva, Ahmedabad

(hereinafter referred to as "the said assessee"), arc registered with the Central Excise and are holding

registration No. AABCM0535GXIN1002 for the manufacture of Agro Chemicals falling under Ch. 38 and

Reactive Dyes, Solvent Dyes and Optical Brightening Agents (OBAs), falling under Chapter 32 of the First

Schedule to the Central Excise Tariff Act, 1985.

2. It appeared that the said assessee had wrongly taken the Cenvat credit of Service Tax paid on Commission

paid to commission agent for sale of finished goods cleared to their customers during the period from Mai, 2013

to December, 2011 'Ihe information regarding availment of Cenvat Credit of Service lax (From May, 2013 to

December, 2013) paid on Commission paid to Sales Commission Agents (Foreign/Local) was provided by the

said assessee vide their letter dated 18.03.2014 in response to letter F.No.AR-III/MIL/Sales Comm./SCN/2013

dated 23.12.2013 issued by the Superintendent, Central Excise, Range-III, Division-Ill, Ahmedabad-I. In the said

letter the said assessee had provided entry wise details of Cenvat Credit taken in respect of Service Tax paid on

commission paid to Sales (Commission) Agents (Foreign/Local)) for sale of their finished goods amounting to

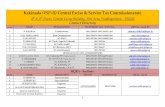

Rs.2,22,243/ - . The summary of such wrongly availed Cenvat credit is as under:-

PERIOD : MAY, 2013 TO DECEMBER, 2013 (Figures in Rs.)

SI. No.

RG 23 A Pt.II Entry

No

Date of RG 23 A Pt. II Entry

Type of Commission on which Service Tax was paid and Cenvat

Credit was availed

Amt. of Cenvat Credit availed (Rs.)

Service Tax

Edu. Cess

Higher Edu. Cess

Total

1 325 04.07.2013 Foreign Sales Commission

44,048 881 440 45,369

(-'I 899 23.10.2013 Foreign Sales Commission

5,276 106 53 5,435

3 1260 31.12.2013 Foreign Sales Commission

166,446 3,329 1,664 1,71,439

Total 2,15,770 4,316 2,157 2,22,243

3. The lion'ble High Court of Gujarat in case of Commissioner of Central Excise, .Ahmedabad-II V/s. NI/s.

Cadila Health Care Ltd., 2013 (30) SLR 3 (Gu) has held that the "commission agent is directly swerved with the sales

rather than sale promotion and a.r such the calla provided such commiscion agent would not Mil within the murky of the meth/

or inclusive part Mahe definition of input service as laid down in rade 20) of the Cenvat Credit Rule 2004': Further, I loifible

CESTAT, Ahmedabad, in the case of Commissioner of Customs & Central Excise, Surat-II Vs. Astik Dyestuff

Pvt. Ltd, vide Order No. A/10339/WZB/AHD/2013 dated 01.03.2013, held that The law laid down by 1-Ion/le

High Cowl of Gujrat in the case of Cadda Healthcare (Supra) is squarely applicable to the farts of the present case. No diclindion

can be made between the COMmunOn paid to 'brag?, agent and the agent operating within the le;-atom of India because nature of

service' provided by both the categories of the agents are same. Consequently, Cenvat credit would not be admissible in burnt ol

commission paid to Local Sales (Commission)Agents".

4. The definition of the term "input service" as given at Rule 2(1) of Cenvat Credit Rules, 2(04 is reproduced

as under:

"input service" means any service,-

used by a provider of taxable service for providing an output service; or

3

(it) used by the manufacturer, whether directly or indirectly, in or in relation to the manufacture

of final products and clearance of final products and clearance of final products up to the

place of removal,

and includes services used in relation to setting up, modernization, renovation or repairs of a factory, premises of

provider of output service or an office relating to such factory or premises, advertisement or sales promotion,

marker research, storage up to the place of removal, procurement of inputs, activities relating to business, such as

accounting, auditing, financing, recruitment and quality control, coaching and training, computer networking,

credit rating, share registry and security, inward transportation of inputs or capital goods and outward

transportation up to the place of removal;

As per the definition of input service any service used by the manufacturer, is required to have a nexus with

the manufacture of the final product and clearance of the final product up to the place of removal. Place of

removal is well defined in Section 4(3)(c)of the Central Excise Act,1944 and the services which are enumerated in

the inclusive clause, which applies both, in the context of the provider of output services as well as the

manufacture, cannot be read de boo the meaning of input sen-ice under Rule 2()of Cenvat Credit Rules, 2011{

Therefore, all the activities relating to business, which are input services used by the manufacturer in relation to the

manufacture of final product and clearance of the final product up to the place of removal alone would appear to

be eligible. After the final products are cleared from the place of removal, there will be no scope for subsequent

use of service to be treated as input services. Therefore, services utilized beyond the stage of manufacturing and

clearance of the goods from the factory cannot be treated as input services. It appeared that for the purpose of

ascertaining the admissibility of Cenvat Credit on services, the nature of service availed should he in consonance

with the above parameters. Hence, the said assessee appeared to have wrongly availed Cenvat Credit of Sen-ice tax

paid on the commission paid to commission agent for sale of finished goods cleared to their customers contrary to

the provisions of Rule 3 of Cenvat Credit Rules, 2004 read with Rule 20) (ii) of the Cenvat Credit Rules, 2004,

which needs to be recovered from them along with interest.

Further, the provisions of Rule 3(1) of Cenvat Credit Rules, 2004, allowing a manufacturer or producer of

final product or a provider of taxable service to take Cenvat Credit of various duties/taxes leviable under different

provisions of law are read as underE

"RULE 3. CENVAT Credit (1)3 manbEcturer or pooducer odlinat products or a mocbdo of a+b/r :CIThr bob,

be allowed to take credit (hereinafter referred to ac the CENT EIT CREDIT) o/

(+11

(in)

(h)

(t'ia)

(tbi)

(vita)

(nun)

(ix) the service tax leviable under section 66 of the Finance Act; and

(x)

(ra)

4

paid on-

(f) any input or capital goods received in the factory of manufacture of final product or premises of the provider of output

goyim on or after the 10th day, of September, 2004; and

at) any input service received by the maniac/mutter of final product or by the provider of output sad n on or alter the 10M day of September, 2004.

including)* said duties, or tax. or ass paid on any input or input service, ar the vase may he, used at the mamadture of intermediate products, by ajob-worker availing the benefit of exemption specified in the nomhation of Me Government of India in the Ministry of Finance (Department of Revenue). No. 214186- Central Eva e. dated the 25th Manh, 1986. published in the Gazelle of India vide number 6..S.R. 547 (E), dated the 25th A ,larch, 1986. and received by the

manufacturer for use in, or in relation to, the manufacture of final product, on or after the 10th day of

September, 2004."

It appeared that services of sales commission agent used by the manufacturer are used neither directh nor

indirectly, in or in relation to the manufacture of final products. Therefore, the said assessee appeared to have

wrongly availed Cenvat credit of Service Tax paid on commission paid to sales commission agent which does not

fall within the purview of definition of input service. The said service appeared to be availed by the said assessee

after the clearance of finished goods from the factory gate i.e. beyond the place of removal. Since the services of

sales commission agent do not have any relation with the manufacturing activity and also do not appear to fall

within the ambit of definition of input services as defined under Rule 2(1) of Genstar Credit Rules, 2004, the

manufacturer shall not be allowed to take credit on such ineligible sun- ice as per Rule 3 of Cenvat Credit Rules,

2004.

Further, services of the Sales (Commission) Agent also do not appear to fall under the category of sales

promotion. As per the definition of commission agent defined under clause (a) to the Explanation under section

65(19) of the Act, a commission agent is a person who acts on behalf o (another person and causes sale or

purchase of goods. In other words, the commission agent appears to be directly responsible for selling or

purchasing on behalf of another person and that such activity cannot be considered as sales promotion. There

appears to be a clear distinction between sales promotion and sale. A commission agent is directly concerned with

sales rather than sales promotion. Therefore, the service provided by commission agent does not fall within the

purview of the main or inclusive part of the definition of 'input service' as laid down in rule 2(I) of the Rules and

the said assessee did appear to be eligible for CENVAT credit in respect of the service tax paid on commission

paid to commission agents.

9. Rule 9(6) of the Cenvat Credit Rules, 2004 stipulates that the burden of proof regarding admissibility of

Cenvat Credit shall lie upon the manufacturer or provider of output service taking such credit, In this era of self

assessment, the onus of taking legitimate Cenvat Credit has been passed on to the assessee in terms of the said

rules. In other words, it is the responsibility of the assessee to take Cenvat Credit only if the same is admissible. In

the instant case, the credit taken in respect of services availed beyond the factory gate appeared to he inadmissible

in as much as the same do not fall within the ambit of the definition of 'input services' as specified under Rule 20)

of the Cenvat Credit Rules, 2004. Thus, it appeared that the said assessee knew that the services in respect of

which they had taken Cenvat Credit were the services availed beyond the factory gate and related to sales which in

turn did not have any relation whatsoever in or in relation to manufacture of goods. Further, the services provided

by commission agent have been held to be concerned with sales and not sales promotion by the llonble I high

Court of Gujarat in the case of GCE, Ahmedabad-11 NI/s Cadila I healthcare Limited, supra. Also Rule 2_ (I) of

Cenvat Credit Rules, 2004 defining what constitutes an input service, does not include Services related with sales

in the definition of 'Input Services'.

5

10. Rule 14 of the Cenvat Credit Rules, 2004 provides that where the Cenvat Credit has been taken and

utilized wrongly or has been erroneously refunded, the same along with interest shall be recovered brain the

manufacturer and the provisions of Sections 11A and 11AA of the Central Excise Act, 1944 shall apply nada&

muiandis for effecting such recoveries. It, therefore, appeared that an amount of Rs.2,22243/- taken and utilized

as Cenvat Credit on Sales Commission which they were not entitled for, is recoverable from the said assessee

along with interest under Rule 14 of the Cenvat Credit Rules, 2004 read with the provisions of Section 11A and

Section 1 I AA of the Central Excise Act, 1944.

11. The credit taken and utilized on the service tax paid on commission paid to Sales Commission Agents

appeared to be inadmissible under the provisions of Rule 2(I) of the Cenvat Credit Rules, 2004 in as much as the

same does not fall within the ambit of the definition of 'Input Services'; Rule 3(1) of the Cenvat Credit Rules,

2004 in as much as they have taken ineligible credit on the service i.e. commission paid to Sales Commission

Agents which has no relation with the manufacture of final products; Rule 9(6) of the Cenvat Credit Rules, 2004

in as much as they have failed to discharge the obligation cast on them to take eligible Cenvat Credit.

12. According to Sub-Rule 1 of Rule 15 of Cenvat Credit Rules, 2004 "if any honor; takes or refine , Gaut hficlit in

respect of nput or capilal,goodr or input sermon. ?prone) or in con/calm/inn of o/ Ut pr r 2.'/921 or tht , e 0 7(4% , . tbcn, d/hikt g00(1,

shall he liable to confiscation and such heron. Auk he Icahle m a peocub not e.teedinn the club Or nadir,. hen On fiat , load/ 01'

service", as the case may be, or two thousand ;Vans, Iv& lawn idgreater.'

13. Therefore, Show Cause Notice No.01.32/3-8/M11./AR-111/14-15 dated 30.06.2014 was issued to NI/s.

Meghmani Industries Limited, Unit —11, Plot No.27, Phase-1, G.I.D.C., Van-a, Ahmedabad, as to why:

CO wrongly availed Cenvat credit of Rs.2,22,243/ - (inclusive of Education Cess and Higher Education

Cess) for the period from May'2013 to December, 2013, should not be disallowed and recovered from

them under the provisions of Rule 14 of Cenvat Credit Rules, 2004 read with the proviso to Section

11A(1) of Central Excise Act,1944;

(ti) Interest should not be charged & recovered for wrong availment of Cenvat Credit under Rule 14 of the Cenvat Credit Rules, 2004 read with the provisions of Section 11 A A of the Central Excise Act, 1944.

(iii) Penalty should not be imposed upon them under the provisions of Rule 15(1) of Cenvat credit Rules,

2004.

DEFENCE REPLY

14. The assessee vide letter date 21.07.2014, in reply to the Show Cause Notice, submitted that the SCN

issued based on the decision of Hon'ble High Court of Gujarat in the matter of Commissioner of Central Excise,

Ahmedabad-II Vs. Cadila Healthcare Limited-2013(30) STR 3 (Guj), in which it has been held that the Commission

agent is directly concerned with the sales rather than sales promotion and as such the service provided by such

commission agent would not fall within the preview of the main or inclusive part of the definition of input services

as laid down in rule 2 0) of Cenvat Credit Rules, 2004. Similarly, in the matter of CCE, Surat-II v/s. Astik Dyestuff

P. lid., the Hon'ble CESTAT, Ahmedabad held that "the law laid down by Hon'ble High Court of Gujarat in the

matter of Commissioner of Central Excise. Ahmedabad-II vs/. Cadila Healthcare Limited (supra) is squarely

applicable to the facts of the present case. The lon'ble CESIXI, Ahmedabad also held that nu discincticht can be

made between the commission paid to foreign agent and the agent operating within the territ ory of India because

nature of the services provided by both the categories of the agents are same. They stared that the present show

cause notice is merely based on the judgment of CCU, Ahmedabad-I1 V/s. Cadila Healthcare lid (Supra) which is in

fact in clear contradiction of the accepted position of the revenue department, circular issued by the Board

(943/04/2011). Even the said judgment is appealed with the Hon'ble Apex Court and the same is not reached its

finality. There are various contradictory judgment favoring the eligibility of the cenvat credit of service tax paid on

6

the subjected services. They stated that though the SCN is issued, the adjudication proves int pt in abe nce

till the matter is finally decided by the Apex Court.

15. They further stated with due respect to the Hon'ble I-figh Court of Gujarat and CESTAT. Ahmedabad, it

appeared that the said judgment is delivered without understanding the business process and function and attempts

had been made to differentiate between the various means of sales promotion. The said judgment also ignored the

Board Circular No.943/04/2011 dated 29.04.2011 (F.No.354/73/2011-11W) which was issued even after the

amended definition of 'input services' and makes it abundantly clear that not only before the amendment but even

after this amendment, service tax on commission paid to agent on sales is eligible for cravat credit. They begged to

differ from the said judgment of Hon'ble Gujarat I ligh Court and CESTAd , Ahmedabad. which had been appealed

with the Hon'ble Supreme Court and the appeal has been admitted for hearing.

. They Further narrated that -

a) The Board's Circular No.943/4/2011-CX dated 29.0411 clarified that even after the deletion of expression "activities related to business" or 'such as' from the definition of input services, the credit of Service fax paid on the sales promotion activities and on the services of sales of dutiable goods on commission basis would be admissible as credit. Therefore, even after the activities related to business, stand deleted from the definition of inputs senices. As per the Board's Circular credit of the Service Tax paid on sales Commission paid to agents services would be available. Unfortunately, this circular has not been considered and referred in this judgment which allowed the Cenvat Credit of the service tax paid on service rendered by the commission agent and is to be considered as Sales promotion which is analogous to the activity mentioned in the definition would fall within the ambit of the express "activity relating to business. Had this circular been considered and argued, the decision would have certainly been different, as this lion'bie High Court itself has held in case of Intercontinental (India) Vs's. ti01 reported in

2003(164)ELT 37(GM) that circular issued by the Board arc binding upon the officers of the Department Yet the position would be different with regard to an assessee who was always entitled to contest validity or legalits of such

instructions. Therefore, the captioned Board Circular is binding upon the department.

b) the Hon'ble Supreme Court of India in the matter of Union of India versus Antiva Industries (1) Ltd -

2008 (10)STR 534 (Sc:) has held the same view. In this judgment, it has been held Mat Circulars issued under Section 119 of the Income Tax Act, 1961 and Section 37B of the Central Excise Act, 1944 are binding on the revenue. This Court in Commissioner of Customs, Calcutta & Others vs. Indian Oil Corporation Limited and Another, (2004)3 SCC 488, after examining the entire case law, culled out the following principles:

1).Although a circular is not binding on a court on an assessee, it is not open to the Revenue to raise a contention that is contrary to a binding circular by the Board. When a circular remains in operation, the Revenue is bound by it and cannot be allowed to plead that it is not valid nor that it is contrary to the terms of the statute.

2). Despite the decision of this Court, the Department anima be permitted m take a stand amtran to the

instructions issued by the Board.

3) . A show cause notice and demand contran the existing circulars of the Board are ab initio bad.

4). It is not open to the Revenue to advance an argument or file an appeal contrary to the circulars"

5). They drawn attention to the definition of input service and stated that the service tax paid on commission paid

to commission agent is covered under the main definition of 'input sewices' in clearance of final product unto the

place of removal. The 'sale is the crux of entire process of manufacturing and business. Therefore, unless Mere is

sale or prospect of sale, no one would like to do the manufacturing. In case of promotion thru commission agents,

the commission agent explain the product and its suitability to their requirement and having satisfied, the customer

places the order, agent collects the order and thereafter the processing of order, planning for production (some

times, stock are also kept based on past trend and experience) and clearance takes place. Therefore, availing of

commission agent services (where ever required/availed) is a precursor to manufacturing and business of

manufacturing and hence, the activities of commission agents, in fact, cause the removal of goods and are ci included

before the removal, though the payment is differed till the sales is completed or the proceeds are realized, as the case

may be.

16. They cited the case of Hon'ble Supreme Court in the case of Escort JCB Ltd vs. Commissioner of Central

Excise, Delhi 2002(146) ELT 3ICSC) wherein it was clearly defined that when the ownership or property in goods

transfer to the buyer. As per the above Apex Court decision this will depend on the terms (or conditions of

contract) of the sale.

17. They further stated that in the matter of Commissioner of C.Fx. & Customs v. Parth Pole Woven Pvt. 14d.

2012(25)S-1R 4 (GM.) wherein the lion'He Court bearing in mind various judicial pronouncements on the question

of interpretation, held that the definition of input service which is coined in the phraseology of means and includes is

vide in its expression and includes a large number of services used by the manufacturer. Such sen-ices may have

been used either directly or indirectly. To qualify for input service, such service should have been used for the

manufacture of the final products or in relation to manufacture of Final product or even in the clearance of the final

product from the place of removal. The expression 'in relation to manufacture' is wider than for the purpose of

manufacture.

18. Further, it has been held by Hon'ble Larger Bench in case of .13B Ltd. vs. Commissioner of C.Ex. & S.T..

Bangalore, 2009(15)STR23(Tri-LB) that the definition of "input service" has to be interpreted in the Light of the

requirements of business and it cannot be read restrictively so as to confine only up to the factory or up to the depot

of manufacturers and the said decision has been upheld by the HonIle I Ugh Court of Karnataka

(2011(23)STR97(Kar).

19. In the matter of Commissioner of C.Ex., Bangalore-III vs. Stanzen TOVOICI till India (P) Ltd., 2011(23 STR

444(Kar), the Hon'ble High Court of Karnataka in the context of the definition of 'input sen-ice' as contained in

rule 2(1) of the Rules held that test is whether the services utilized by the assesses for the manufacture of final

product.

20. The I lon'ble Supreme Court in the case of All India Federation of Tax Practitioners and ors. Vs. Croon of

India (2207) 7 SCC 527 held that "6. at this stage we may refer to the concept of 'Value AcIderl 'Fax ( \ (Al) which is

general tax that applies, in principle, to all commercial activities involving produccirm of goods and provision of

sen - ices. VAT is a consumption tax as it borne by the consumer. In the light of what is stated above, it is clear that

service tax is a VAT which in turn is destination based consumption tax in the sense that it is commercial activities

and is not a charge on the business but on the consumer.-

91. Any activity relating to business is input service — input service definition, the rule making authority - has not

employed any qualifying word before activities like main activities or essential activities etc. Therefore, it must follow

that all and any activity relating to business falls within the definition of input service provided thee is relation

between the manufacturer of product and the activity. This has been also held in Coca Cola India Pvt. 1-td. vs.

Commissioner of C.Ex., Pune-III-2009(242) ELT 168(Rom.)

22. They stated that based on this wider concept, in the matter of Commissioner of Central Excise v/s WItra

Tech Cement Ltd. — 2010(20)S'IR 577(Born), the Honble Court held that "the expression activities in relati on to

business" is inclusive part of the definition of "input services - further widens the scope of wut services so as to

cover all the services used in the business of manufacturing of the final product and the said definition is not

restricted to the services enumerated in the definition of input service itself. The court rejected the condition of the

revenue that a service to qualify as an input service must be used in or in relation to We manufacture of Final product

and held that any service used in relation to the business of manufacturing the final product would be an eligible

input service". Reliance was also placed upon the decision of this court in the case of Commissioner of Central

Excise vs. Excel Crop Care Ltd. 2008(12)STR436(Gui).

8

23. They further submitted that there are various decision which are favourable to them be various other

Hon'ble Courts and Tribunal considering the factual position and practical aspect of the lx' nets therehoe, the

judgment in the matter of Cadila Healthcae Idinited can not be treated as the law of land and be the basis of present

show cause notice, as the matter involves the 'interpretation of law' and already been appealed with.

They cited the case of Hon'ble High Court of Punjab & Haryana in the matter of Commissioner of Central

Excise, Ludhiana vs. Ambika Overseas as reported in 2012(25)SRT 348(P&H), wherein it is held in para 8 that "The.

Tribunal while affirming the order of Commissioner (Appeals) and adjudicating the issue in favour of the respondent

had come to the conclusion that the activities in respect of which cenvat had been filed, were pre-removal activities

and the same could not be held to be post-removal. It was further observed that canvassing and procuring orders

were in relation 'sales promotion' and would fall under sales promotion activities. These activities were, thus,

included in the definition of input services and the assessee was entitled to benefit of cenvat credit of service tax. It

would be advantageous to notice here the findings recorded by the tribunal in para 6 of order reads as under-

"1 have carefully considered the submissions from both sides. The canvassing and procuring orders are activities

preceding removal of the goods by the manufacturers. Without the firm order, the respondents were not expected

to remove the goods to a foreign destination. Therefore, the submission of the learned DR that these activities are

post-removal activities cannot be accepted. Further, the definition of the 'input services' includes services used in

relation to 'sales promotion' and these activities can rightly be described as sales promotion activities. Sales

promotion activities undertaken at given point of time also aims at sales o goods which are to be manufactured and

cleared on future. Any advertisement given as a long term impact cannot be treated as post-clearance activities and,

therefore, sales promotion has been specifically included in the definition of input sew ices. :3s regards the other

contention that the documents on which the respondent has taken the credit is not the prescribed document, it is to

be noted the respondent is not a service provider per se. They are basically the service recipients. They are required

to pay service tax as a deemed service provider. Under these circumstances, the respondents have paid service tax

using TR-6 challans and taken credit treating the said documents as documents covered by Rule 9(1) of the Cenvat

Credit Rules, 2004. There is nothing irregular about it".

In commissioner of C.Ex. jalandhar Versus Ambika Forgings as reported in 2010(259) ELT 593(Tri.Del) in

para 4 of the said order it is held that "4. it may be stated that where there is a legislative meaning of a term used in

law, it is unsafe to adopt dictionary meaning. In common business or commercial parlance business promotion adds

to earning of revenue for a seller or a manufacturer. Whether addition to revenue earning by a manufacturer is made

by manufacture of extra quantity goods has earned excise duty is also relevant. If business promotion activity adds

to revenue by manufacture and sale of incremental quantity, the business promotion activity may have nexus to such

sales. Accordingly, service tax paid on such service may be attributable to input service tax. Claim of cenvat credit is

made to avoid cascading effect under Rule 2(I)(ii) of the Cenvt Credit Rules, 201)4. On ce 1(Ni:tame mandate

apparent, no technical meaning need to be assigned to deny relief to the respondent. In absence of Revenue's

finding that the business promotion has not resulted with any promotion of business activities there would have

been a case for revenue. But that is not coming out from show cause notice. When the order suffers from such an

infirmity there is nothing to impeach the order of the Id. Commissioner (Appeals). In terms of the word "includes"

in Rule 20)(u) of the Cenvat Credit Rules, 2004, broad activities which are having nexus to business and integrally

connected are brought to the fold of input service. Therefore, a pedantic view cannot be taken. Revenue's appeal is

dismissed accordingly".

In the following other judgmenet, it is held that sales promotion also wavy selling agent's commotion:

1. M/s. Wadpack Pvt. Ltd. vs. the Commissioner of Central Excise, Bangalore 2013(30) STR 51(Tn-Bang.)

2. Birla Corp Ltd. vs. CCE, Lucknow (Fri-New Delhi) 2013-36 Tasmann.com .426.

3. Pan Asian Corporation vs. Commissioner of Central Excise, Mumbaid I 20(9(16) SIR 587 itri.NIumbati.

9

4. Commissioner of C.Ex. Raipur vs. Bhilai Auxiliary Industries 2009(14) ST 536(Tri. -Del)

5. Commissioner of Customs & Central Excise, Raipur vs. I IEG Ltd — 2010(18) SIR 446 (TriDel).

6. Lanco Industries Ltd. vs. Commissioner of cEntral Excise, Tirupathi 2009 (15) S'IR 259 (Tn. Bang).

7. Vishal Natural Food Products vs. Commr. of Customs, Bangalore — 2011 (266) ELF 369 (Tri. Bang.)

26. They quoted the following judgments wherein it was held that where there are contradictory decisions on

any issue, those favouring the assessees will prevail. (I) CCE, Jamshedpur vs. Tara Iron & Steel Co. Ltd. — 1999

(114) ELT 160 (TEKolkata), (2) CCE, Trichy v/s. Dalmia Cements (1') Ltd. — 1999 (114) ELT 836 (Tri. Madras)

and (3) Cromption Greaves Ltd. vs. CCE, Mumbai-11 — 1997 (94) ELT 629 (Tn.-Mumbai).

27. They stated that in view of the clear legal position as spelt out in captioned circular and supported by judicial

pronouncement, they have correctly availed the cenvat credit of service tax paid on sales commission paid on

commission agent and that department has no merit in issuing the captioned SCN. Therefore, they requested ro

withdraw the SCN and proceeding initiated for recovery of wrongly availed cenvat credit and to drop and/or vacate

the SCN.

28. They added that despite their disagreement with the contention of the revenue and knowing the fact about

the eligibility of service tax paid on such services, as a bonafide assessee and to honour the judicial decision of

HoMble Gujarat High Court, they made payment 'under protest' of the credit so availed during the period under

discussion. The SCN failed to state the correct facts (or rather Ms-stated the facts) that they have already made

payment 'under protest' of Cenvat credit so availed, as has been admitted in final audit report No 01/2014-15 claret]

10.04.2014 (which pre-dates to the present show cause notice) vide debit entry No.1360 dated 31.01.201-1 in cenvat

credit register with an intimation to jurisdictional range officers and audit section of the department. They submitted

a copy of the said audit report and abstract of relevant page of Cenvat credit register.

uu. They further stated that as the demand is not legal and sustainable, no interest under the provision of Rule

14 of CCR, 2004 read with Section 11AA of the Central Excise Act, 1944 can be charged and recovered from them.

The interest is compensator in nature and where the government is not denied its legitimate dues in time without

any liability, to pay interest under Section 1 IAA of Central Excise Act, 1941 or Rule 14 of CCR, 2004 does not arise.

as they had sufficient balance of Cenvat during the relevant period, in their books. They had not committed

contravention of any of the rules. Neither there is violation of any nature by them nor they committed breach of

any rules. Since penalty is quasi criminal in nature, it can not be imposed merely on assumption and presumption.

Therefore, no penalty could be justifiably imposed on them in law.

30. They cited the case of Marini Suzuki Ltd vs. Commissioner of Central Excise, Delhi-Ill reported in 2009

(240) EEL' 641 (SC) wherein the Hon'ble Apex Court held that on account of repeated amendments in the Cenvat

Credit Ruts, huge litigation in the country stands generated. In the circumstances, we are of the view that penalty is

not leviable on appellant/assessee, particularly when in large number of other cases, on account of conflict of views

expressed by various Tribunals/High Court, the assessees have also succeeded. I lence, although 'Sfis. Manni Suzuki

Ltd. (appellant) has failed in their civil appeals the Department will not impose penalty".

They requested for a personal hearing before the case is decided.

PERSONAL HEARING:

31. Personal hearing was held on 03.09.2014. Shri Manohar Nlaheshwari, GM (Commercial)

appeared for the personal hearing. He referred to their written reply dated 21.07.2014.

10

FINDINGS.

32. 1 have carefully gone through the case records and submissions made by the assessee in then

defense. I find that the issue to be decided in this case is admissibility of Cenvat Credit taken and

utilized by the said assessee of ST paid on commission for sales to local/foreign commission agents

for the period from May 2013 to December, 2013 for sale of their finished goods amounting to

Rs.2,22,243/-

33. The definition of "input service" as defined under Rule 20) of CCR, 2004 which read as under:-

"(I) "input service" means any service,

used by a provider of taxable service for providing an output service; or

0-0 used by a manufacturer, whether directly or indirectly, in or in relation to the manufarture of

products and clearance of final products upto the place of removal,

and includes services used in relation to setting up, modernization, renovation or repairs of a factory.

premises of provider of output service or an office relating to such factor or premises, advertisement or sales

promotion, market research, storage up to the place of removal, procurement of inputs, activities relating to

business such as accounting, auditing, financing, recruitment and quality control, coaching and training,

computer networking, credit rating, share registry and security, inward transportation of inputs or capital

goods and outward transportation up to the place of removal; "

34. The assessee had taken and utilised Cenvat Credit of Service Tax paid by them on

commission paid to Sales Agents. I find that set-vices of Sales Commission Agent used by the

manufacturer are used neither directly nor indirectly in or in relation to the manufacture of final

products and as such this service does not fall within the purview of definition of input service. The

said service had been availed by the said assessee after the clearance of fmished goods from the

factory gate i.e. beyond the place of removal. Since the services of Sales Commission agent have no

relation with the manufacturing activity and also do not appear to fall within the ambit of definition

of input services as defined under Rule 20) of the Cenvat Credit Rules, 2004, the manufacturer shall

not be allowed to take credit on such ineligible services as per Rule 3 of Cenvat Credit Rules, 2004.

Therefore, the said assessee wrongly availed Cenvat Credit of Service Tax paid on commission paid

to such commission agent.

35. Further, services of the sales commission agent also do not fall under the category of sales

promotion. As per the definition of commission agent defined under clause (a) to the Explanation

under Section 65(19) of the Finance Act, 1994 a commission agent is a person who acts On behalf of

another person and causes sale or purchase of goods. In other words, the commission agent appears

to be directly responsible for selling or purchasing on behalf of another person and that such activin -

cannot be considered as sales promotion. There has to be a clear distinction between sales

promotion and sale. A commission agent is directly concerned with sales rather than sales

promotion. Therefore, the services provided by commission agent does not fall within the purview

of the main or inclusive part of the definition of 'input service' as laid down in rule 2Q) of the

Cenvat Credit Rules, 2004 and the said assessee is not eligible for CENVAT credit in respect of the

service tax paid on commission given to commission agents.

11

36. I and that Honlble High Court of Gujarat in case of Commissioner of Central Excise,

Ahmedabad-II Vs. Cadila Health Care Ltd., 2013-TIOL-12-HC-AHM-ST, while dealing with the

issue of admissibility of service tax paid on commission paid to overseas agents as Cens-at credit has

observed:-

"(v) As noted hereinabove, according to the assessee, the services of a commission agent would fall

within the ambit of sales promotion as envisaged in clause(i) of section 63(19) of the Finance Act,

1994, whereas according to the appellant a commission agent is a person who is directly concerned

with the sale or purchase of goods and is not connected with the sales promotion thereof Under the

circumstances, the question that arises for consideration is as to whether services rendered by a

commission agent can he said fall within the ambit of expression 'sales promotion'. It would,

therefore, be necessary to understand the meaning of the expression sales promotion.

(vii) The expression 'sales promotion' has been defined in the Oxford Directionary of Business to

mean an activity designed to boost the sales of a product or sen-ice, it may include an advertising

campaign, increased PR activity, a free-sample campaign, offering free gifts or trading stamps,

arranging demonstrations or exhibitions, setting up competitions with attractive prizes, temporary

price reductions, door-to-door calling, telephone selling, personal letters etc. In the Oxford

Directionary of Business English, sales promotion has been defined as a group of activities that are

intended to improve sales, sometimes including advertising, organizing competitions, providing free

gifts and samples. 'I' hese promotions may form part of a wider sales campaign. Sales promotion has

also been defined as stimulation of sales achieved through contests, demonstrations, discounts,

exhibitions or tradeshows, games, giveaways, point-of sale displays and merchandising, special offers

and similar activities. The Advanced Law Lexicon M P.Ramanatha Aiyar, third edition, describes the

term sales promotion as use of incentives to get people to buy a product or a sales drive. In the case

of Commissioner of Income-tax V. Mohd.lshaque Gulam, 232 FUR 869, a Division Bench of the

Madhya Pradesh High Court drew a distinction benveen the expenditure made for sales promotion

and commission paid to agents. It was held that commission paid to the agents cannot be termed as

expenditure on sales promotion.

(viii) From the definition of sales promotion, it is apparent that in case of sales promotion a large

population of consumers is targeted. Such activities relate to promotion of sales in general to the

consumers at large and are more in the nature of the activities referred to in the preceding

paragraph. Commission agent has been defined under the explanation to business auxiliary service

and in so far as the same is relevant for the present purpose means any person who acts on behalf of

another person and causes sale or purchase of goods, or provision or receipt of services, for a

consideration. Thus, the commission agent merely acts as an agent of the principal for sale of goods

and as such sales are directly made by the commission agent to the consumer. In the present case, it

is the case of the assessee that service tax had been paid on commission paid to the commission

agent for sale of final product. However, there is nothing to indicate that such commission agent

were actually involved in any sales promotion activities as envisaged under the said expression. The

term input service as defined in the rules means any sen-ice used by a provider of taxable service for

providing an output service or used by the manufacturer whether directly or indirectly, in or in

relation to Ave manufacture of final products and clearance of final products from the place of

12

removal and includes services used in relation to various activities of the description provided

therein including advertisement or sales promotion. Thus, the portion of the definition of input

service insofar as the same is relevant for the present purpose refers to any sen-ice used by the

manufacturer directly or indirectly in relation to the manufacture of final products and clearance of

anal products from the place of removal. Obviously, commission paid to the various agents would

not be covered in this expression since it cannot be stated to be a service used direct]) or indirectly

in or in relation to the manufacture of anal products or clearance of final products from the place of

removal. The includes portion of the definition refers to advertisement or sales promotion. It was in

this background that this court has examined whether the services of foreign agent availed by the

assessee can be stated to services used as sales promotion. In the absence of any material on record,

as noted above to indicate that such commission agents were involved in the activity of sales

promotion as explained in the earlier portion of the judgment, in the opinion of this court, the claim

of the assessee was rightly rejected by the Tribunal. Under the circumstances, the adjudicating

authority was justified in holding that the commission agent is directly concerned with the sales

rather than sales promotion and as such the services provided by such commission agent would not

fall within the purview of the main or inclusive part of the definition of input service as laid down in

rule 2(1) of the Rules.

(ix) As regards the contention that in any event the service rendered by a commission agent is a

service received in relation to the assessee activity relating to business, it may be noted that the

includes part of the definition of input service includes activities relating to the business, such as

accounting, auditing, financing, recruitment and quality control, coaching and training, computer

networking, credit rating, share registry and security. The words activities relating to business are

followed by the words such as. Therefore, the words such as must be given some meaning. In Royal

Hatcheries (P) Ltd. V. State of A.P. 1994(Supp(1)SCC 429, the Supreme Court held that the words

such as indicate that what are mentioned thereafter are only illustrative and not exhaustive. Thus, the

activities that follow the words such as are illustrative of the activities relating to business which are

included in the definition of input service and are not exhaustive. Therefore, activities relating to

business could also be other than the activities mentioned in the sub-rule. However, that does not

mean that every activity related to the business of the assessee would fall within the inclusive parr of

the definition. For an activity related to the business, it has to be an activity which is analogous to

the activities mentioned after the word such as. What follows the words such as is accounting,

auditing, financing, recruitment and quality control, coaching and training, computer networking,

credit rating, share registry and security. Thus, what is required to be examined is as to whether the

service rendered by commission agents can be said to be an activity which is analogous to any of the

said activities. The activity of commission agent, therefore, should bear some similarity to the

illustrative activities. In the opinion of this court, none of the illustrative activities viz. accounting,

auditing, financing, recruitment and quality control, coaching and training, computer networking,

credit rating, share registry and security is in any manner similar to the services rendered by

commission agents nor are the same in any manner related to such services. Under the

circumstances, though the business activities mentioned in the definition are not exhaustive, the

service rendered by the commission agents not being analogous to the activities mentioned in the

definition, would not fall within the ambit of the expression activities relating to business.

13

Consequently, CENVAT credit would not be admissible in respect of the commission paid to

foreign agents.

(x) For the reasons stated hereinabove, this court is unable to concur with the contrail- view taken

by the Punjab and Haryana High Court in Commissioner of Central Excise, Ludhiana Vs. Ambika

Overseas (supra). Insofar as this issue is concerned, the question is answered in favour of the

revenue and against the assessee".

37. I also find that Hon'ble CESTAT, Ahmedabad, in the case of Commissioner of Customs &

Central Excise, Surat-II Vs. Astik Dyestuff Pvt.Ltd vide order No.Ad10339/W73/AFID/2013

dated 01.03.2013 held that "the law laid down by the Hon'ble High Court of Gujarat in the case of

Cadila Healthcare (supra) is squarely applicable to the facts of the present case. No distinction can

be made between the commission paid to foreign agents and the agents operating within the

territory of India because natures of services provided by both the categories of the agents arc the

same. Consequently, Cenvat Credit would not be admissible in respect of commission paid to local

sales (Commission) Agents".

38. Thus, in the light of the above decision of Hon'ble High Court and Hon'ble CESTAT,

which are squarely applicable to the case on hand, I find that the said assessee is not eligible for

Cenvat Credit of Service Tax paid on commission paid to the sales agents.

39. I also find that Rule 2(1)(ii) of Cenvat Credit Rules, 2004, defines the eligible category of

Services for availing credit. The said definition of input service fixes the meaning of that expression

and the services, used by the manufacturer, are required to have a nexus with the manufacture of the

Final product and clearance of the final product upto the place of removal. Place of removal is well

defined in Section 4(3) ( c ) of the Central Excise Act, 1944 and the services which are enumerated

in the inclusive clause, which applies both, in the context of the provider of output services as well

as the manufacturer, cannot be read dehors the meaning of input service under Rule 2(1) of Cenvat

Credit Rules, 2004. Therefore, all the activities relating to business, which are input services used by

the manufacturer in relation to the manufacture of final product and clearance of the Final products

upto the place of removal alone would be eligible. After the final products are cleared beyond the

place of removal, there will be no scope for subsequent use of sen-ice to be treated as input set-vices.

Therefore, services utilized beyond the stage of manufacturing and clearance of the goods from the

factory cannot be treated as input service. Thus, for purpose of ascertaining the admissibility of

Cenvat Credit on services, the nature of service availed should he in consonance with the above

parameters. It is evident that the above services in question does not have any nexus with the

manufacturing activities and as such does not fall within the ambit of definition of 'input service'.

40. Further, I find that the said assessee could not establish nexus between the service availed

by them and the manufacture of the finished excisable goods as per the ruling in the case of Vikram

Ispat Vs CCE, Raigad — 2009 (16)STR 195. It was also held in the said case that any service to be

brought within the ambit of definition of 'input service' should be done which should satisfy the

essential requirement contained in the main part of the definition. This requirement is equally

applicable to the various items mentioned in the inclusive part of the definition as well. The Tribunal

14

also held that no credit can be allowed unless the assessee provides evidence to establish the nexus

between the services and the manufacture of the final products. Based on the above decision also, I

find that the services in the subject issue are not falling within the definition of 'input service'.

41. I also tend to rely upon the decision in the case of Commissioner of C.Ex., Chennai Vs

Sundaram Brake Linings — 2010 (19) SIR 172(Tri-Chennai) which is applicable in the present case.

In the said case of Commissioner of C.Ex., Chennai Vs Sundaram Brake Linings, Hon'ble CESTAT,

Chennai, relying on a decision of the Hon'ble Supreme Court in case of Maruti Suzuki Ltd V. CC!),

Delhi 2009(240)ELT 641 (SC), held that use of the input service must be integrally connected with

the manufacture of the final product. The input service must have nexus with the process of

manufacture. It has to be necessarily established that the input service is used in or in relation to the

manufacture of the final product. One of the relevant test would be - can the final product emerge

without the use of the input service in question. In the present case the sen-ices of the sales agent

were utilized beyond the factory gate, hence the nexus theory and Relevance test as broadly

discussed by the Hon'ble Supreme Court in case of Maruti Suzuki (supra) is not established.

42. The Hon'ble Tribunal in the case of CCE, Nagpur Vs Manikgarh Cement Works — 2010

(18) STR 275 has also held that to fall within the scope of definition of input sen-ice, a service must

have been used in or in relation to the manufacture or clearance of final product, directly or

indirectly. Moreover it is further held that by Tribunal that the Hon'ble Supreme Court in the case

of Maruti Suzuki Ltd, Vs CCE, Delhi — 2009 (240) ELT 641 (SC) has overruled the decision of the

Bombay High Court in the case of Coot Cola India Pvt.l.td Vs CCE, Pune — 2009(15)STR 657

(Born) = 2009 (242) ELT 168(Bom). The jfribunal has also held that in view of the main part of

definition that the decision of the Hon'ble Supreme Court in Maruti Suzuki (supra) though rendered

in a case relating to 'inputs' is also applicable to a case of 'input service'.

43. I also note that in the case of Maori Suzuki Vs Commissioner (2009 (240) ELI 641 (SC),

the Hon'ble Supreme Court has laid down that the nexus has to be established between the inputs

or input service on one hand and finished goods on the other hand. Even the larger Bench of

Tribunal in the case of Vandana Global Ltd. Vs CCE, Raigad — 2010(253) I i.l..T.440 (fri—LB), has

applied the decision of the Hon'ble Supreme Court in the case of Maori Suzuki (supra) according to

which credit in respect of input or input service is admissible only if it is integrally connected to the

manufacture of the finished excisable goods.

44. Thus, in view of the above judicial pronouncements including the decision of Hon'ble High

Court of Gujarat in the case of M/s.Cadila Healthcare Ltd, as discussed in foregoing paras, I am

inclined to hold that the assessee is not entitled to Cenvat Credit on the services in question and the

same is required to be recovered from them along with interest.

45. The said assessee in support of their defense, has argued on the admissibility of the Cenvat

Credit in question. I find that as already discussed above, the issue as to whether the service of

commission agents falls under the ambit of definition of 'input service' under Rule 2(1) ibid is no

more res integra and as it has been categorically held by Hon'ble H.C. of Gujarat to be out of ambit

of definition of input service in case of NI/s.Cacitla Healthcare Ltd (supra). 'Ihus, when the service in

15

question is not covered under the category of 'input service' as defined under the statute, the

question of compliance of other provisions of CCR 2004 does not arise.

46. As regards reliance placed by the assessee on the decision of various Courts/Tribunals with

regards to the admissibility of Cenvat Credit on such commission agent's service, I find that as per

the decision of Apex Court in the case of Kamalakshi Finance Corporations Ltd (supra), I am bound

to pay the utmost regards to the judicial discipline and as such decision of Hon'ble FIG. of Gujarat

relied upon by me is more binding than the decisions of Tribunals relied upon by the assessee.

47. I find that the case laws relied upon by the Department in the show cause and also in my

above findings are on the same issue and as such, following the judicial discipline, the same are

squarely applicable to the present case. In the light of my findings supported by judicial

pronouncements as discussed in the foregoing paras, I hold that the service of sales commission

agent does not fall within the ambit of definition of "input service" as defined under the statute as

discussed above and the said assessee was as such not entitled to Cenvat Credit of Service Tax paid

on cotnmission paid to such sales agents. In view of the said facts, I find that the assessee had

contravened the provisions of Rule 2(1) read with Rule 3 of the Cenvat Credit Rules, 2004 in as

much as they had taken credit of Service Tax paid on service which did not qualify as 'input service'.

48. The assessee has argued that there was no mak Fide intention on their part till the contradict on

view was taken by Gujarat High Court in the case of M/s.Cadila Healthcare Ltd (supra) the

admissibility of Cenvat Credit on the Service Tax paid on commission paid to such corrunission

agents were ruled in favour of the trade by various Tribunals and also Hon'ble Punjab and Haryana

High court. It is also evident that CBEC in their aforesaid Circular has also clarified that the Cenvat

Credit was admissible on services of commission agents. Their action of availing Cenvat Credit in

question at the relevant time was thus in accordance with such circular and case laws. Thus, in light

of these facts, I tend to hold that there was judicial discipline and give effect to orders of higher

appellate authorities which are binding on them. With due respect to the said decision of Hon'ble

High Court of Punjab & Haryana, I find that applying the ratio of decision of Apex court in the case

of Kamlakshi Finance Corporation I Ad (supra), the decision of the Hon'ble FIG. of Gujarat in case

of M/s. Cadila Health Care Ltd (supra) is binding and I tend to follow the ruling of the Hon'ble

H.C. of Gujarat in the case of M/s.Cadila Healthcare Ltd (supra) as the decision of Hon'ble H.C. of

Gujarat relied upon by me is more binding than decisions of High Courts/Tribunals relied upon by

the assessee.

49. Thus, in light of my findings supported by judicial prouncements as discussed in foregoing

paras, I hold that the service of sales commission agent does not fall within the ambit of definition

of "input service" as defined under the statute as discussed above and the said assessee was as such

not entitled to Cenvat Credit of service tax paid on commission paid to sales agents. I find that the

assessee had contravened the provisions of Rule 2(l) read with Rule 3 of Cenvat Credit Rules, 2004

in as much as they had taken credit of service tax paid on service which did not qualify as 'input

service'.

16

50. The assessee, in reply to the SCN has stated that they reversed the amount of wrongly availed

Cenvat Credit 'under protest' vide entry No.1360/31.01.2014 and it has been admitted in the Final

Audit Report No.01/2014-15. They stated that they intimated the jurisdictional range officers as

well. This has been confirmed from the )RS. The JRS vide letter F.No.AR-111/N111./Sales

Comm/2013 dated 08.10.2014 has intimated that thepavment of Rs.222243/- has been reflected in

the column 5 (Details of Cenvat Credit taken and utilized) of the ER-I for the month of January

2014 filed by the assessee. The JRS also enclosed copy of the ER-1 for January 2014. On perusal of

the copy of the said ER-1, it is seen that an amount of Rs.222243/- (Rs.215770+4316+2157) has

been debited against `Cenvat Credit utilized for other payment).

51. I find that provisions of Rule 14 of the CCR, 2004 clearly provides that where the Cenvat

Credit has been taken and utilized wrongly or has been erroneously refunded, the same along with

interest shall be recovered from the manufacturer or the provider of output service and the

provisions of Section I IA & Section 11AA of the CEA, 1944 shall apply mutatis mutandis for

effecting such recoveries. Thus, the wrongly availed and utilized Cenvat Credit is required to be

recovered from said assessee along with interest in terms of provisions of Rule 14 of CCR, read with

Section 11A (1) & 11AA ibid. The amount of Cenvat Credit Rs.2,22,243/- reversed "under protest"

by the assessee is required to be adjusted and appropriated against the wrongly utilized Cenvat

Credit availed and utilized by them. They are also liable for penalty in terms of Rule 15(1) of Cenvat

Credit Rules, 2004.

52. In view of the above findings, I pass the following orders.

ORDER

(I) 1 disallow the Cenvat Credit of Rs.2,22,243/- (Rupees two lakhs twenty two thousand

two hundred forty three only) for the period from May 2013 to December 2013 and

order to recover the same from M/s. Meghmani Industries Ltd rut-II, Plot No.27,

Phase-1, GIDC, Van", Ahmedabad 382445 in terms of the provisions of Rule 14 of the

Cenvat Credit Rules, 2004 read with Section 11A (1) of the Central Excise Act, 1944. As

the said amount has been reversed by the assessee 'under protest' vide entry No.1360

dated 31.01.2014, I appropriate the same against the amount demanded in the Show

Cause Notice for wrongly availed Cenvat Credit of Rs.222243/-. Protest of the assessee

is hereby vacated.

(II) I order to recover interest at the prescribed rate from 131/s. Nleghmani Industries IA

Unit-II, Plot No.27, Phase-1, GIDC, Varva, Ahmedabad 382445 under Rule 14 of the

Cenvat Credit Rules, 2004 read with Section 11AA of Central Excise Act, 1944 on the

amount of Rs.2,22,243/-.

(III) I impose penalty of Rs.60,000/- (Rupees sixty thousand only) upon NI/s. Meghmani

Industries Ltd Plot No.27, Phase-1, GIDC, Van", Ahmedabad 382445 under

the provisions of Rule 15(1) of the Cenvat Credit Rules, 2004.

17

53. The Show Cause Notice issued to NI/s. Nleghmani Industries Ltd, Unit-II, Plot

No.27, Phase-I, GIDC, \ larva, Ahmedabad-382445 vide F.NcyV.32/3-8/3111.-.312-1I1/14- 13 dated

30.06.2014 stands disposed of in the above manner.

a esh Kumar) eputy Commissioner,

Central Excise, Division-11, Ahmedabad-I

F.No. C h.32 / 3 -8/ M I I L/AR- I II/1 4 - 1 5

Dated 10.10.2014

BY R.P.A.D./HAND DELIVERY

To M/s.Nleghmani Industries Ltd, Unit-II, Plot No.27, Phase-1, CIDC, Vatva Ahmedabad 382 445,

Copy to:

1. The Commissioner of Central Excise, Ahmedabad-I Commissionerate (As tt/Dv. Commissioner, RRA,

edabad-I Commissionerate, by name).

2. he Superintendent (Systems) Central Excise, Ahmedabad-1.

3. The Superintendent, Central Excise, AR-IV, Division-III, Ahmedabad-I for information.

4. Guard file