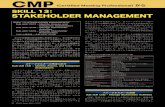

1st GET FIT STAKEHOLDER MEETING GET FIT STAKEHOLDER MEETING Frontier Markets Fund Managers A Fund...

Transcript of 1st GET FIT STAKEHOLDER MEETING GET FIT STAKEHOLDER MEETING Frontier Markets Fund Managers A Fund...

1

Kampala, 9 April 2013

Frontier Markets Fund Managers

Orli Arav, Head of Project Finance

1st GET FIT STAKEHOLDER MEETING

Frontier Markets Fund Managers

A Fund Management Company with USD 1.1 billion under management

Managing two funds:

- Emerging Africa Infrastructure Fund; and

- GuarantCo

Our mission is to find commercial solutions to overcome development challenges

Based in London

Financed 61 projects to date with a total exposure of USD 1.1 billion

2

Emerging Africa Infrastructure Fund & GuarantCo

EAIF

First dedicated infra debt fund for sub-Saharan Africa

Size: USD 750 million

Shareholders: 4 European Governments (UK, Sweden,

Netherlands, Switzerland)

Lend to private sector owned, managed and controlled

entities with infrastructure sector focus

- Power

- Transport

- Telecoms

- Water

- Manufacturers of components of infrastructure

e.g. cement, steel

- Infrastructure within mining, agribusiness projects

Investment size per project: USD 10 - 35 million

Tenor: up to 15 years

Instruments: Senior and Mezzanine Debt (possibly with

equity features)

In principle, no requirement for Political Risk Insurance

(PRI)

GuarantCo:

“Credit enhancement of local currency debt issuance by the

private, municipal and parastatal infrastructure sectors in lower

income countries”

Initial capital of USD 165m leveraged to USD 300m by

KFW Barclays and FMO.

Covers similar infrastructure sectors to EAIF, operates

globally

GuarantCo offers:

Partial credit guarantee covering default risk on a portion

of a loan or bond - generally on demand and

unconditional

Partial risk guarantee covering default risk due to specific

events - such construction failure or revenue shortfall

Cover for senior, mezzanine or sub debt; maturity, coupon

or principal strips; Loans, bonds or securitisation

Other methods of risk transference considered (e.g.

insurance / reinsurance or CDS / derivatives)

Preference for risk sharing - defined on a case-by-case

basis

3

4

EAIF Power Portfolio

To date EAIF financed 13 power projects with a total exposure of USD 250 million

- AES-Sonel , Cameroon

- Tronder Power, Uganda

- Rabai, Kenya

- SAEMS I, Uganda

- Olkaria III, Kenya

- Aldwych Corporate Finance

- Tower Power Abeokuta, Nigeria

- KivuWatt, Rwanda

- Kalangala Renewables, Uganda

- SAEMS II,Uganda

- Addax Bioenergy, Sierra Leone

- Takoradi, Ghana

- Azito Energie, Ivory Coast

EAIF is currently evaluating several other power projects in Uganda, Zambia, Rwanda, Tanzania, Kenya, Senegal, Nigeria, Burkina Faso, Ghana and South Sudan

Bio Mass 10% Combined Fuel

4%

Gas 24%

Geothermal 6%

Hydro 21%

Integrated Utility 12%

Renewable 11%

Thermal 12%

EAIF Power Portfolio by Source

5

EAIF financed 3 mini Hydros in Uganda

To date EAIF financed 3 mini hydro power projects in Uganda with a total exposure of USD 52 million

Tronder Power 14MW

USD 35m Underwritten Facility for a run of river small hydro Power Plant;

Total Transaction Size:

USD 56m;

EAIF Role: Arranger and

Underwriter.

USD 14m senior secured

debt facility;

Total Transaction Size:

USD 85m;

Co Financiers: FMO,

Finnfund and DEG;

SAEMS I 18MW

Signed: May 2008 Signed: Sept 2008

SAEMS II 9MW

USD 6m secured senior debt facility.

Total Transaction Size: USD 30m;

Co Financiers: FMO, Finnfund and DEG;

Signed: Jan 2012

Typical Project Structure

6

Lenders

EAIF

Others

Project Company or Holdco

“Borrower”

Loan agreement

UETCL

GoU /Ministry of

Energy

EPC

O&M

Insurance provider

Shareholders

Per

mit

s/ L

icen

ses/

Im

ple

men

tati

on

Agr

eem

ent

EPC

Insurances

PPA

WorldBank/PRG

KfW/GetFIT

LC Provider

Payment Support

Termination Payment support

Tariff Subsidy

UETCL/

Distribution Concession

Interconnection Agreement

Land owners

Lan

d L

ease

O&M Agreement

The PPA will be credit enhanced by:

‐ LC payment support: The World

bank might provide payment

support under the PPA by

providing back up financial support to a local LC provider

‐ Termination payment support

through MIGA .

‐ Tariff subsidy provided by KFW

under GetFIT programme.

FMFM can offer

Fast track Due Diligence and Closing process

Role FMFM: Debt Arranger

Standardized DD ‐ Legal DD: PPA, IA, Permits, licenses etc; ‐ Insurance DD; ‐ Market DD; ‐ Financial model; ‐ Dedicated group of lenders advisers.

Project specific DD

‐ EPC, O&M, transmission/interconnect arrangements; ‐ Technology, hydrology; ‐ E&S; ‐ Sponsor; ‐ Contractors.

Standardized debt Syndication/Financing process

‐ DD sharing process, credit approval sharing process; ‐ Suite of standardized finance documents (Loan documentation, direct agreements etc); ‐ Dedicated group of lenders that will follow FMFM based on standardized DD process.

7

Possible Financing structures

Gearing assumptions:

‐ In general Projects could be financed on a Debt/Mezzanine to Equity basis of 65-80%/20-35%.

‐ Final gearing ratios will be determined after assessment of the financial projections and the cash flow profile of the

company.

‐ The minimum equity requirement will be approx 20% of total project costs.

FMFM can provide the following services for SHP projects:

‐ Senior Term Facility: Arrange and partly finance an up to [15] year Senior Term Facility.

‐ Mezzanine Facility: Arrange and (partly) finance a up to [15] year Mezzanine tranche.

‐ Standby/Reserve Facility: Such a facility can be considered but needs to be reviewed in context of the project budget,

contingencies, sponsor support, EPC terms etc.

‐ Working Capital : The need for initial working capital can be included in the project budget and financed accordingly.

‐ EAIF could considering financing portfolio’s of SHP projects.

‐ EAIF is not in a position to underwrite the transaction or to provide a stand-alone working capital facility.

‐ EAIF intends to hold up to USD [15-30] million per transaction in either the Senior Term Facility and/or through a mix

of Senior Debt and Mezzanine.

‐ FMFM will syndicate the transaction mainly through DFI’s but also will approach (local) commercial banks.

8

Get Fit Premium

9

0

1

2

3

4

5

6

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034

Base Fit COD Grant

Financing options

10

Equity

25-35%

Senior Debt

65-75%

Mezzanine

5-15%

Senior Debt

65-75%

Equity

20 -30%

Pro

ject

co

st

Traditional limited-recourse project financing.

Advantage: Simple structure and straightforward. Limited intercreditor issues.

Addition of Mezzanine tranche as a partly subsitute for equity.

Limits equity requirement and boosts Equity IRR.

Allows lenders to share in potential upside and GETFIT payment Mechanism

Slightly more complicated financing structure but certainly manageable.

Indicative terms Senior Debt Facility

11

Facility : Senior Secured Term loan facility

Facility Amount Up to 65-75% of project costs

Tenor : Up to 15 years

Grace period : 2 years , to reflect the construction period of the Project.

Repayment : The loan will be repaid in semi annual instalments. Some sculpting of the repayment profile could be considered to cater for the start up period or hydrology patterns.

Availability Period

: Up to [2] years. Any undrawn portion of the Facility Amount will be automatically cancelled at the end of the Availability Period.

Interest : 6 months Libor + Margin (EAIF can provide fixed interest rates)

DSRA : An amount equal to 6 months of debt service so as to cover the each next installment of debt service under the Facility (principal and interest).

MRA : To be determined during due diligence

Covenants :

Customary for this type of project financings: Historic/Projected DSCR, LLCR, Net debt / Ebitda, Dividend restrictions, Capital expenditure not to exceed amounts as agreed for the Bank Case Model, restrictions on debt, assets sale, investments, liens, merges, consolidations, capital expenditures, transactions with affiliates, change of business, [other]

Security package : 1st ranking security package including: i) Fixed and floating charge over all the Borrower’s assets; ii) Pledge of the Borrowers business; iii) Pledge of shares in the Borrower; iv) Assignment of insurances and reinsurances; v) Security over project accounts.

Indicative terms Mezzanine Debt

12

Facility : Mezzanine Term loan facility (Subordinated to Senior debt but senior to equity providers)

Facility Amount Up to 5-15% of project costs.

Tenor : Up to 15 years

Grace period : In general to reflect the construction period of the Project.

Repayment : Sculpted to reflect cash flow profile and target Mezzanine IRR.

Options : Subordinated Debt Mezzanine (A + B,C,D or a combination of B,C,D)

A. Base Cash Margin:

+

B. PIK toggle payments:

C. EBITDA Kicker: D. Warrants:

Compensation

[x] % Interest per annum compounded and payable semi annually in cash in arrears

[x%] per annum compounded and payable semi annually in cash in arrears.

[x%] per annum compounded and payable semi annually in cash/in kind in arrears. Borrower has the option to PIK up to [x] semi annual cash payments for each tranche.

x% of EBITDA (a percentage which results in the Target IRR in the base case projections).

% share in Borrower: (a percentage which results in the Target IRR in the base case projections).

Target IRR to be agreed in relation to projected equity IRR and overall project risk assessment.

EAIF Transactions 2003-2009

Oct 2004

MOMA

GBP 594 million

Construction and operation of a Greenfield mineral sands project (ilmenite, rutile, zircon)

near Moma, Northern Mozambique

US$ 5m - Senior Debt

US$ 24.5m – Mezzanine Debt

Jan 2003

MSI-Cellular / Celtel

US$ 260 million

Expansion of a GSM network across selected countries in Africa

US$ 30m - Mezzanine Debt

Feb 2007

Eleme Petrochemicals

US$ 400 million

Financing of a post privatisation turnaround program for a petrochemical plant in Nigeria

US$ 20m - Senior Debt

February 2007

Celtel Nigeria

US$ 190 million

Corporate facility for the expansion of CeltelsGSM network in Nigeria

US$ 35m - Senior Debt

June 2007

Celtel Africa

US$ 320 million

Corporate facility for expansion of GSM network in 5 African countries

US$ 24m - Senior Debt

Nov 2007

Seacom

US$ 600 million

Debt financing for equity participation of IPS Kenya (AKFED) in Seacom, the first submarine

fibre optic cable along the Eastern coast of Africa

US$ 36.5m lender to IPS CSH

for Seacom equity

Jan 2009

Orpower 4

US$ 180 million

Expansion of the Olkaria III Geothermal power project to 48MW

US$ 15m - Senior Debt

Mar 2008

Safal Investments

US$ 211 million

Construction of a 150,000MT p.a. Greenfield rolling mill and galvanising plant at Durban

and expansion of the processing facilities in a number of Eastern & Southern African

countries

US$ 15m - Senior Debt

US$ 14m - Sub Debt

May 2008

Tronder Power

US$ 56 million

Construction of a 13MW run of river hydro power plant in Uganda

US$ 35m - Senior Debt

Underwriter and Arranger

Sept 2008

Rabai Power Project

EUR 120 million

Construction of a 90MW HFO fired power plant in Kenya

EUR 19.75m - Senior Debt

EUR 2.82m - Sub Debt

Arranger

September 2008

SAEMS

US$ 85 million

US$ 14m - Senior Debt

Corporate facility for a portfolio of 12 small hydro power plants in Sri Lanka and Uganda

Aug 2003

AES Sonel

EUR 240 million

Construction of an 85MW HFO fired power plant in Cameroon; in 2006 the facility was

increased to EUR 240 million and EAIF acted as a co-lender

EUR 24m - Senior Debt

Arranger

Nov 2004

MTN Nigeria

US$ 200 million

Corporate facility for the expansion of MTN’s GSM network in Nigeria

US$ 10m - Senior Debt

September 2005

Obajana Cement

US$ 798 million

Construction and commissioning of a Greenfield cement production plant with a capacity of 4.4 million tons per annum in

Nigeria

US$ 30m -Senior Debt

Nov 2004

SPM Ghana

US$ 47.3 million

Financing of a Single Point Mooring system and a conventional buoy mooring system in

the waters outside Tema Port, Ghana

US$ 12m - Senior Debt

14

EAIF Transactions 2009-2011

July 2010

ALAF Limited

US$ 35 million

Construction of a Metal Coating and Roofing facility in Tanzania

US$ 5m - Senior Debt

October 2010

Tema Osonor Power Ltd

US$ 128 million

Construction of a 126MW gas-fired power plant in Tema, Ghana

US$ 15m - Senior Debt

Co-Arranger

November 2010

DPW Dakar

EUR 216 million

Upgrade & expansion of the container terminal in the Port of Dakar, Senegal

EUR 12.5m - Senior Debt

November 2010

O3b Networks

US$ 1.2 billion

Satellites and ground facilities to deliver fibre quality broadband communications services

to emerging markets

US$ 12.5m - Senior Debt

US$ 12.5m - Sub Debt

December 2009

Helios Towers Nigeria

US$ 250 million

Corporate facility for the expansion of Helios’ tower network in Nigeria

US$ 19m - Senior Debt

October 2009

Bisha Mining Share Company

US$ 460 million

Construction and operation of the first modern gold and copper mine in Eritrea

US$ 25m - Mezzanine Debt

June 2009

Zain Ghana

US$ 523 million

Construction and operation of a Greenfield mobile network in Ghana

US$ 17.5m - Senior Debt

Jan 2009

SPA Maghreb

US$ 24 million

Construction of green field steel pipe manufacturing company in Algeria

US$ 17m - Senior Debt

February 2009

Aldwych International

GBP 44 million

Round B equity and high yield debt financing for start up power plant developer Aldwych

International

EUR 7.4m - Senior debt

US$ 1m - Equity

June 2011

Tower Power Abeokuta Ltd

US$ 21.3 million

Constriction of Greenfield 12.5MW gas fired combined cycle power plant in Nigeria

US$ 15m - Senior Debt

Arranger

June 2011

Addax Bioenergy

EUR 267 million

The development of a 10,000ha sugarcane plantation, an ethanol distillery producing 82,000 m3 of ethanol p.a. and a 32MW

cogeneration power plant in Sierra Leone

EUR 20m - Senior Debt

Co-Arranger

US$ 25m - Senior Debt

Co-Arranger

August 2011

KivuWatt Ltd

US$ 142 million

The development of an Integrated Methane Gas to Power Project in Rwanda utilizing

Lake Kivu’s unique methane gas resources. The project will consist of a Gas Extraction

Facility plus a 25MW power plant

December 2011

Helios Towers Tanzania

US$ 85 million

Acquisition of >1000 telecom towers from Millicom Tanzania Ltd. Debt facility for

refurbishment and expansion of the tower network

US$ 15m - Senior Debt

December 2011

Kalangala Infrastructure

US$ 54 million

Development of road, ferry, water supply and power services for Kalangala District in

Uganda

US$ 7m - Senior Debt

December 2009

African Foundries Limited

US$ 130 million

Construction of a 150,000MT p.a. rolling mill that will produce TMT Rebars in Nigeria

US$ 20m - Senior Debt

African Foundries

Limited

15

EAIF Transactions 2012-

January 2012

SAEMS II

US$ 30 million

Increase of the corporate facility to facilitate the development of SAEMS’s 2nd hydro

power project in Uganda

US$ 6m - Senior Debt

June 2012

Expansion of Takoradi (T2)

US$ 356 million

US$ 15m - Senior Debt

Expansion of Takoradi 110 MW simple cycle power plant to 330MW combined cycle

thermal plant in Ghana

October 2012

Tunisia Steel Pipes

US$ 24 million

Construction of green field steel pipe manufacturing company in Tunisia

US$ 17m - Senior Debt

October 2012

Ethiopian Airlines

US$ 1 billion

Financing the acquisition of 10 Boeing 787-800’s (“Dreamliners”)

US$ 30m – Co Arranger

October 2012

Azito Energie Expansion

US$ 420 million

Expansion of the Azito Power Plant in Ivory Cost from 288MW to 426MW

US$ 30m - Senior Debt

February 2013

Indorama Eleme Fertilizer

and Chemicals Ltd

US$ 1.2 billion

US$ 30m - Senior Debt

Construction of a 1.4M MTPA Nitrogenous Fertilizer Complex in Port Harcourt, Rivers

State, Nigeria

16

GuarantCo Transactions 2005-2009

December 2005

CELTEL KENYA

KES 725 million (USD 12 million)partial credit guarantee to creditenhance a local bond issue to supportnetwork expansion programme of thesecond largest mobile operator inKenya.

June 2007

ALAF LIMITED

TZS 6.5 billion (USD 5.1 million) partialcredit guarantee made available toprovide credit enhancement for a localbond issue to finance the expansionof a steel plant in Tanzania.

June 2007

MABATI ROLLING MILLS

KES 750 million (USD 9.7 million)partial credit guarantee madeavailable to provide creditenhancement for a bond issue tofinance the expansion of a steel plantin Kenya.

October 2007

CELTEL CHAD

XAF 3.5 billion (USD 8 million) partialcredit guarantee for Afriland Bank toprovide additional lending to theleading mobile telecommunicationsoperator in Chad.

December 2008

SHRIRAM I

INR 900 million (USD 19 million)partial credit guarantee of themezzanine tranche of a truck financereceivables securitisation in India.

January 2009

WATANIYA PALESTINE TELECOM

USD 10 million partial risk guaranteeof two Palestinian banks lending to astart-up mobile telecommunicationsoperator in the Palestinian Territories.

September 2009

CALCOM CEMENT

INR 1,120 million (USD 25 million)partial credit guarantee of two Indianbanks’ lending to a new cement plantin Assam, India.

November 2009

ACKRUTI CITY LIMITED

INR 940 million (USD 20 million)partial credit guarantee for lending toseveral slum redevelopment project inMumbai, India.

17

GuarantCo Transactions 2010-2011

September 2010

SHRIRAM II

INR 916 million (USD 20 million)partial credit guarantee of Tier IIcapital raising by truck financecompany in India.

September 2010

HOME FINANCE GUARANTORS AFRICA

USD 5 million stop-loss insurance forHome Finance Guarantors Africa whowill reinsure Collateral ReplacementIndemnities for low and lower middleincome households in Sub SaharanAfrica.

October 2010

SPENCON

USD 15 million performance bondguarantee facility for a local EastAfrican construction company.

September 2010

SOUTH AFRICAN TAXIS

ZAR 139 million (USD 20 million)partial credit guarantee of the seniortranche of a loan programme for aminibus leasing company in SouthAfrica.

March 2011

KUMAR URBAN DEVELOPMENT LIMITED

INR 920 Million (USD 20 million)partial credit guarantee to support thefinancing of one of the largest slumredevelopment projects in Pune, India.

September 2011

TOWER ALUMINIUM GROUP LIMITED

Partial credit guarantees totalling NGN2.21 Billion (USD 14.2 million) tocredit enhance the maiden bond issueof the largest manufacturer ofaluminium roofing in West Africa.

December 2011

KALANGALA RENEWABLES

USD 1 million partial credit guaranteeto help support construction of ahybrid solar plant and associateddistribution and supply facilities onKalangala Island, Uganda.

December 2011

KALANGALAINFRA. SERVICES

USD 1.8 million partial creditguarantee to support a note issuanceprogramme funding a range ofinfrastructure initiatives on KalangalaIsland , Uganda.

18

GuarantCo Transactions 2012 -

December 2012

KALUWORKS LIMITED

Partial credit guarantees totalling KSH750 million (USD 9 million) to creditenhance the maiden bond issue of thelargest manufacturer of aluminiumroofing in East Africa.

December 2012

CAMEROON TELECOMMUNICATIONS

LIMITEDPartial credit guarantee totalling XAF20 billion (USD 20 million) toovercome regulatory single obligorlimits and increase its lending toCamTel to support the roll out of aNational Broadband Network

19

Contact details

Orli Arav Head of Project Finance Frontier Markets Fund Managers (FMFM) Add: 20 Gresham Street, London, EC2V 7JE Tel: +44 203 145 8610 Email: [email protected]

www.emergingafricafund.com www.frontiermarketsfm.com www.guarantco.com `

20