1Q15 Business Update - Singha Estate · 02-06-2015 · As of 29 May 2015 at the share price of...

Transcript of 1Q15 Business Update - Singha Estate · 02-06-2015 · As of 29 May 2015 at the share price of...

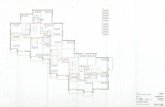

Singha Complex, due to open in 2017

The Pride of Property Business

This information was prepared by Singha Estate Public Company Limited solely for information and discussion purposes

Singha Complex, due to open in 2018

1Q15 Business Update

Opportunity Day, at The Stock Exchange of Thailand

2 June 2015

Disclaimer

2

The information contained in this material has been prepared by Singha Estate Public Company Limited (“S”)

solely for information purpose and does not constitute an offer or invitation to sell or the solicitation of an

offer or invitation to purchase or subscribe for share in Singha Estate Public Company Limited (“S” and

shares in S, “shares”).

Some statements made in this material are forward‐looking statements with the relevant assumptions, which

are subject to various risks and uncertainties. These include statements with respect to our corporate plans,

strategies, and beliefs. The statements are based on our management’s assumptions and beliefs in light of the

information currently available to us. These assumptions involve risks and uncertainties which may cause

the actual results, performance, or achievements to be materially different from any future results,

performance, or achievements expressed or implied by such forward‐looking statements.

Please note that S and executives/staff do not control and cannot guarantee the relevance, timeliness, or

accuracy of these statements. S undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

None of S’s executives/staff or any of its agents, or all of their respective affiliates, or representatives shall

have any liability (in negligence or otherwise) for any loss howsoever arising from any use of this document or

its contents or otherwise arising in connection with this material.

Investor Relations

Singha Estate Public Company Limited

3

Overview

Singha Estate – Part of Boon Rawd Brewery Group

4

Boon Rawd Brewery

46%

Khun Santi

Bhirombhakdi

33%

Public

shareholders

18%

Nirvana's

shareholders

3%

• Singha Estate Public Company Limited (“S”) is a

real estate investment and development company

and a property arm of Boon Rawd Brewery Co.,

Ltd. (“Boon Rawd Brewery” or “BRB”) – the first

and the largest brewery in Thailand.

• Formerly Rasa Property Development Public

Company Limited (“RASA”), S was created through a

reverse acquisition and a result of entire business

transfer of companies under BRB and Khun Santi

Bhirombhakdi.

• S’s business currently spans across 3 major sectors of

property business: residential, commercial, and

hopitality.

Shareholding Structure /1

Paid-up share (shares) : 4,898,860,524

Paid-up capital (Bt.mn.) : 4,898.86

Par value (Bt./share) : 1.00

Security symbol : S

Sector : Property

Market cap. (Bt.mn.)/2

: 33,802.14

Note: 1. As of 27 May 2015.2. As of 29 May 2015 at the share price of Bt.6.90 per share.

The Reverse Acquisition

5

Boon Rawd Brewery

Khun Santi Bhirombhakdi

CORE BUSINESS

Beer & Alcohol:

Market leader in Thailand and

neighboring countries

DIVERSIFICATION

Non-alcohol Beverage:

soda water, drinking water,

mineral water, and energy

drinks

Packaging: glass bottle,

carton, crate, and PET

Other F&B: food, restaurant

Founded in 1933, started from beer business, Boon Rawd Brewery Co., Ltd. has

expanded its business into food & non-alcohol beverage, packaging, and real estate.

BRB’s first listed company

Real Estate

With the goal of entering into real

estate development and investment

business, S was created in 2014.

A 11.3-rai land (Asoke-Petchaburi)1

A 2.0-rai land (Asoke-Montri)2

A 30.5-rai land (Ekamai-Ramindra)3

4Santiburi Beach Resort

& Spa – 5-star resort on

Samui Island

Rasa Property Public Company Limited

Paid-up share (shares) 549,998,401

Paid-up capital (Bt.mn.) 550.00

Par value (Bt./share) 1.00

Security symbol RASA

Sector Property

New shares

New shares

A 13.5-rai land (Ramintra)

A 1.5-rai land (Watcharapol)

A 143.8-rai land (Lumlookka)

A 33.7-rai land (Don Muang)

Real estate

Note: The reverse acquisition was completed on 12 September 2014 with the change of the company’s name from “Rasa Property Development Plc.” to “Singha Estate Plc.”.

Business and Shareholding Structure

6

Singha Property ManagementKhun Santi Bhirombhakdi

100%

3% /133% /1 46% /1

Boon Rawd Brewery

Note: 1. As of 27 May 2015.

Following the business integration, S restructured its business operations ; its subsidiaries

currently engage in residential, commercial, and hospitality.

Residential

Development & Investment

Commercial

Development & Investment

Hospitality

Investment & Management

Max Future Singha Property

DevelopmentS Hotel

Management

S Hotel Phi Phi

Island.

(99.99%)

Nirvana

Development

(51.00%)

(99.99%) (99.99%)

(99.99%)

Phi Phi Village

Asset Management

(94.99%)

Singha Estate (“S”)

Nirvana’s shareholders

Public Shareholders

18% /1

Value Proposition

7

Support from

Boon Rawd Brewery

Professional

management

with good

governance

M&A of recurring

income-based

assets

Partnership &

Joint Investment

Funding

through REIT

and spin-off

Professionally run

by professionals

with in-depth real

estate expertise

Rapid growth with well-

balanced earning profile thru

smart investment and

product differentiation

Property

development in

favorable market

Strong support from the wealth and

landbank accumulated over 80 years in

addition to business alliance and network

with its beer distributors nationwide

Key Initiatives

8

Expand into

commercial / mixed-use

properties

Reinforce

residential expertise

Optimize

hospitality asset

• Capitalize on existing property and

opportunities to further improve profits

- Refurbishments and enhancements

- Room rate and occupancy

optimization

• Provide recurring earnings platform for

expansion

- Hospitality majority of earnings in

early stages

• Build a quality-oriented brand

- Continue with the development

of quality low-rise and high-rise

projects

• Capitalize on team’s retail and

commercial asset management and

expertise

- Introduce differentiated mixed-

use concept

Rapid expansion through investment and M&A

9

Operations

APR

Strategically invested

51% in “Nirvana

Development Co., Ltd.”

– a well-established

low-rise residential

developer

Key Milestones

10

With an ambition to be market leader across real estate sectors, S has continuously expanded

through acquisition of green and brown-field assets, investments and partnership.

2014 2015

SEP

Completed its business

integration and change

corporate name to

“Singha Estate Plc.”

NOV

Acquired “Phi Phi Island

Village Beach Resort” – a

112 keys 3-star hotel

with 167.3 rais of land

SEP – DEC

Fully refurbished an initial asset

“Santiburi Beach Resort & Spa” – a

5-star hotel and re-opened in Dec 2014

SEP

Pre-sale of the

condo in AsokeNOV

Acquired a 4.5-rai

land plot

(Bangrakyai)

FEB

Acquired a 7.8-rai

land plot

(Rattanathibet)

JUN

Increase capital

through Rights

Offering & Private

Placement

DEC (tentative)

Groundbreaking

“Singha Complex”

Note: As of 31 May 2015 and subject to change.

Our Assets

11Note: 1. As of 31 December 2014.

Residential Commercial Hospitality

Inventories (developed by

RASA)

• Intro Condo (Pradipat)

• Maxx Ville Townhomes

(Don Muang)

Landbank

• A 2.5-rai land (Asoke-Montri)

• A 30.5-rai land

(Ekamai-Ramindra)

• A 4.5-rai land (Bangrakyai)

• A 13.5-rai land (Ramindra)

• A 7.8-rai land (Rattanathibet)

Investment in Nirvana

• 51% stake in Nirvana

Development Co., Ltd.

• Registered capital of

Bt.879mn.

• 10 years in operation

• Products include single-

detached house, home

office, townhome, and

condo

Retail space (developed

by RASA)

• The Lighthouse – a

approx. 3,300-sqm NLA

retail space in Charoen

Nakorn area

Landbank

• A 11.3-rai land (Asoke-

Petchaburi)

5-star hotel

• Santiburi Beach Resort &

Spa (Samui Island, south

of Thailand) – 78 keys

3-star hotel

• Phi Phi Island Village

Beach Resort (Phi Phi

Island, south of Thailand)

– 112 keys

S’s existing assets comprise residential properties for sales, retail space, unique hotels in

Thailand’s top tourist destinations, and landbank in strategic locations for future development.

Low-Rise Residential Projects – Nirvana Development

12

Nirvana Development Co., Ltd. (a 51%-owned subsidiary) is a well-established residential

developer with a strong presence in low-rise products. Its assets comprise on-going projects and

landbank in strategic locations.

Note: As of 31 December 2014.

On-going Projects Product TypeTotal Project Value

(Bt.mn)

Remaining Project

Value /1

(Bt.mn.)

Nirvana Icon Wongwean - Rama 9 2-Storey SDH 572 207

Nirvana Intro 2-Storey SDH 307 34

The Tara 2-Storey SDH 280 136

Nirvana Beyond Lite Rama 9 2-3-Storey SDH 1,289 342

Beyond Kaset – Nawamin (phase 1) 3-Storey SDH 1,214 521

Beyond Rama 9 3-Storey SDH 995 76

Beyond Suan Luang 3-Storey SDH 1,031 949

Beyond @ Beach Pattaya 3-Storey SDH 310 269

Cover On-Nut 65 Townhome 530 469

@ Work Kaset-Nawamin 5-storey home office 792 152

Total 7,320 3,153

Nirvana BeyondNirvana Icon Nirvana Intro Nirvana @WorkNirvana Cover

High-Rise Residential Project – Max Future

13

Inventories (developed by RASA)

• Intro Condo (Pradiphat, BKK) – 3 units remaining

• Maxx Ville Townhomes (Don Muang, BKK) – 7 units remaining

Landbank

• A 2.5-rai land (Asoke-Montri, BKK CBD)

• A 30.5-rai land (Ekamai-Ramindra, BKK)

• A 4.5-rai land (Bangrakyai, BKK vicinity)

• A 13.5-rai land (Ramindra, BKK)

• A 7.8-rai land (Rattanathibet, BKK vicinity)

Focusing on high-rise residential and luxury housing products, Max Future (a 99.99%-owned

subsidiary) has continuously secured landbank in high-potential locations and will be soon

taking-off with its ‘best-in-class’ condo project (in Asoke-Montri) in 3Q15.

Continue sales and marketing works

Continue sales and marketing works

Develop a condo. Pre-sale in 3Q15

Develop a luxury low-rise project

Develop a condo for sales

Develop a condo for sales

Develop a condo for sales

Existing Assets Development Plan

Note: As of 31 May 2015 and subject to change.

Immediate Development : Condo in Asoke-Montri

14

Located in BKK central business area, the land plot on Asoke-Montri Road will be soon

developed into the highest condo development in Asoke vicinity. Total investment cost is

Bt.2,300 mn./1

The 2.5-rai land plot on Asoke Montri Road (BKK CBD), next to :

• Asoke commercial district

• Petchaburi and Sukhumvit MRT stations

• Asoke BTS station

• Schools and university

As of 31 May 2015 and subject to change.Note: 1. Excludes land cost.

Q3/14

Design &

Obtain permit

Q1/19

Transfer

Q3/15

Pre-sale

Hospitality and Commercial Projects

15

S engages in rental and service businesses through hospitality and commercial assets which

generate recurring income. The key strategy is to acquire and reposition the properties through

value enhancement initiatives.

Retail space (developed by RASA)

• The Lighthouse (Charoen Nakorn, BKK)

Landbank

• A 11.3-rai land (Asoke-Petchaburi, BKK CBD)

Commercial

Renovate and re-merchandizing in 2015

Develop a mixed-use project – “Singha

Complex”

5-star hotel

• Santiburi Beach Resort & Spa (Samui Island,

south of Thailand) – 78 keys with FY2013

occupancy of 80%

3-star hotel

• Phi Phi Island Village Beach Resort (Phi Phi

Island, south of Thailand) – 112 keys with FY2014

occupancy of 83%

Hospitality

Recently re-opened with new look in

December 2014 after a full refurbishment

Add keys in 2015-2016.

Refurbish existing rooms in 2016-2017

Note: As of 31 May 2015 and subject to change.

Existing Assets Development Plan

Existing Asset : Santiburi Beach Resort & Spa

16

Program

• Face lift with new interior design

• Upgrade entertainment system

• Add keys

Operations

Location• 57 rais of land (beachfront)

• On Samui Island, South of Thailand

An initial asset, Santiburi Beach Resort & Spa – a 5-star beachfront resort on Samui Island –

underwent a major refurbishment and value enhancement project during low season last year

and re-opened with new look on 20 December 2014.

Before refurbishment New look

• 78 keys (villa and duplex)

• 2011-13 Average occupancy 80%

Refurbishment & Value Enhancement (Completed)

Period • Refurbishment: Sep-Dec 2014

• Room expansion: Sep 2014-May 2015

Santiburi Beach Resort & Spa – New Look

17

Standard Villa Beach Bar Restaurant

Spa Pool Villa Santiburi Lounge

Existing Asset : Phi Phi Island Village Beach Resort

18

Operations

Location• 167.3 rais of land (beachfront)

• Phi Phi Island, South of Thailand

Interior design Exterior design

• 112 keys (villa) and 5 clusters

• 2014 Average occupancy 83%

A Bt.2,700mn newly acquired asset, Phi Phi Island Village Beach Resort is a 3-star beachfront

hotel on Phi Phi Island, Krabi Province. Room expansion is now under works.

Program and

Period

Phase 1: June – October 2015

• Add 46 keys and facilities

• CAPEX Bt.200mn.

Phase 2: 2016-17

• Add keys

• Face lift existing assets

Renovation & Value Enhancement

Note: As of 31 May 2015 and subject to change.

Add keys

(Phase 1)

Immediate Development : Singha Complex

19

Previously owned and used by Japanese government as its embassy, the strategic land plot will be

soon developed into a world-class mixed-use development – “Singha Complex”.

Opening

The 11.3-rai land plot on Asoke-

Petchaburi intersection (BKK CBD),

next to :

• Asoke commercial district

• Petchaburi MRT station

• Makkasan Airport Rial Link station

Program

• Office tower (10,000-sqm BRB’s HQ and an

approx. 31,000-sqm NLA office for rent)

• Boutique hotel (approx. 30 keys)

• Multi-purpose hall (approx. 4,000 PAX)

• Retail space (approx. 6,000-sqm NLA)

1H’2018 (Tentative)

Note: As of 31 May 2015 and subject to change.

20

Financial Performance

Basis of Accounting

21

Consolidated Financial Statements

• The accounting standard for “Reverse Acquisition” was applied to S’s.

• The consolidated financial information of S were prepared as if the companies

transferred from BRB and Khun Santi Bhirombakdi were amalgamated with one

another from the start and acquired RASA on the 12 September 2014.

Consolidated Company

1Q15 S and its existing subsidiaries S only

1Q14 Companies transferred from BRB and Khun

Santi Bhirombhakdi /1

S only (previously RASA)

Statements of Comprehensive Income

Consolidated Company

31 March 15 S and its existing subsidiaries S only

31 December 14 S and its existing subsidiaries S only

Statements of Financial Position

Note: 1. Max Future Co., Ltd, Singha Property Development Co., Ltd., Bhiromphat Co., Ltd., and Santiburi Co., Ltd.

Financial Performance

22

Abbreviation: STB : Santiburi Beach Resort & Spa

PP : Phi Phi Island Village Beach Resort

1Q14 4Q14 1Q15 yoy qoq

(Unit: Bt.mn) change change

Revenues 82.8 178.7 308.5 225.7 129.8

Revenues from sales of house and condominium units 0.0 118.5 75.3 75.3 (43.2)

Revenues from services 82.8 60.2 233.2 150.3 173.0

Costs 15.7 176.1 186.7 170.9 10.5

Costs of house and condominium unit sold 0.0 95.1 67.5 67.5 (27.7)

Costs of services 15.7 81.0 119.2 103.5 38.2

Gross profit 67.1 2.6 121.8 54.7 119.3

Gross profit from house and condominium unit sold 0.0 23.4 7.9 7.9 (15.5)

Gross profit from services 67.1 (20.8) 114.0 46.9 134.8

Selling and admin expenses 53.4 147.1 125.7 72.3 (21.4)

Profit (loss) from operation 13.7 (144.5) (3.9) (17.6) 140.6

Other income 4.4 20.9 14.2 9.8 (6.7)

Profit (loss) before interest and income taxes 18.1 (123.6) 10.3 (7.8) 133.9

Financial costs 0.2 25.1 36.2 36.0 11.2

Income taxes 6.7 (5.9) (0.3) (6.9) 5.6

Frofit (loss) for the period 11.3 (142.8) (25.7) (36.9) 117.1

Non-controlling interests 0.0 (1.2) (1.9) (1.9) (0.7)

Net Profit (loss) 11.3 (144.0) (27.6) (38.8) 116.4

Gross profit margin 81% 1% 39% (42%) (43%)

Profit margin from house and condominium unit sold n/a 20% 10% n/a n/a

Profit margin from services 81% (35%) 49% (32%) 2%

- Fewer units of Intro and

Maxx Ville transferred in

1Q15

- Full quarter contribution

from STB and PP

- Full quarter cost of PP

- Additional depreciation of

STB’s renovation work

- One-time expenses in

4Q14

- Increased headcount at

head office to support

business expansion

- Full quarter interest

expense of new loan raised

to acquire PP

- Re-opening of STB (closed

most of 4Q14 for

refurbishment)

Consolidated Statements of Comprehensive Income

Financial Position

23

(Unit: Bt.mn / % to total assets)

Assets

Cash and Short-term investments 898.2 9% 578.0 6%

Costs of property development 794.8 8% 439.4 4%

Inventories 11.7 0% 12.0 0%

Others 92.9 1% 111.7 1%

Total current assets 1,797.7 18% 1,141.0 11%

Investments in subsidiaries 0.0 0% 0.0 0%

Land held for development 1,499.6 15% 2,716.2 26%

Investment property 2,820.0 29% 2,848.1 28%

PP&E 3,122.9 32% 3,169.0 31%

Others 481.6 5% 466.7 5%

Total assets 9,721.7 100% 10,341.0 100%

Liabilities

Short-term loans 3,166.9 33% 4,083.8 39%

Current portion of long-term loans 38.3 0% 11.0 0%

Others 429.3 4% 213.7 2%

Total current liabilities 3,634.4 37% 4,308.5 42%

Long-term loans 504.8 5% 471.6 5%

Others 31.3 0% 34.5 0%

Total liabilities 4,170.5 43% 4,814.7 47%

Shareholders' equity

Paid-up capital 4,712.4 48% 4,712.4 46%

Retained eanrings 307.6 3% 280.0 3%

Others 531.3 5% 534.0 5%

Total shareholders' equity 5,551.2 57% 5,526.3 53%

End of 2014 End of 1Q15

- New land plots (additional Asoke and

Rattanathibet) acquired in 1Q15

- New debt (bridging loan facility)

raised to acquire new land plots

Net IBD to equity 0.51 0.72

Consolidated Statements of Financial Position

Short-term

90%

Long-term

10%

1Q15 Outstanding borrowings: Bt.4,566.4mn.

24

Right Offerings

Capital Increase and Rights Offering

25

New common shares 2,635,940,054 shares

- Nirvana Development Placement 186,509,792 shares (completed)

- Rights Offering 816,476,754 shares

- Reserve for exercise of warrants “S-W1” 1,632,953,508 shares

Capital Increase

Ratio (old share : new share : warrant) 6 : 1 : 2

Share subscription price Baht 3.00 per share

S-W1 offering price Baht 0.00

Ex-rights date (XR) 14 May 2015

Subscription and payment period 8 to 12 June 2015 (by 16.00)

First day trade of new share 23 June 2015 (tentative)

First day trade of S-W1 10 July 2015 (tentative)

Subscription agent

Maybank Kim Eng Securities

Rights Offering (“RO”)

S-W1 Warrant

26

Information of the S-W1

Warrant symbol S-W1

Exercise ratio (warrant : share) 1 : 1

Exercise price Baht 15.00 per share

Term of warrants Not exceeding 4 years and 2 months

- 1st exercise date 15 January 2018

- 2nd exercise date 16 July 2018

- 3rd exercise date 15 January 2019

- 4th exercise date 15 July 2019

Issuance and offering date 24 June 2015 (tentative)

First day trade of S-W1 10 July 2015 (tentative)

Secondary market SET

27

Q & A

28

Contacts

Investor Relations

Choenporn Subhadhira

Tel: (+66) 2632 4533 ext.101Email: [email protected]: www.singhaestate.co.th

29

Appendix

New Land Plots

30

RattanathibetBangrakyai