11.1 Percent - hcusd2.org › vimages › shared › vnews › ... · 11.1 – Percent 1) The US...

Transcript of 11.1 Percent - hcusd2.org › vimages › shared › vnews › ... · 11.1 – Percent 1) The US...

Chapter 11 Worksheet Packet Finite Math Name: ___________________________

11.1 – Percent

1) The US Department of Agriculture’s recommended daily allowance (USRDA) of potassium for adults is 3500 mg. One serving of Cheerios provides 95 mg of potassium. What percent of the USRDA of potassium does one serving of Cheerios provide?

2) As of April 19. 2003, tickets for one day at Disney World are $50 for adults and $40 for children. In addition, if the tickets are purchased at Disney World, visitors must pay a 6% sales tax and a 6% tourist tax. However, if the tickets are purchased at any AAA office in Florida, visitors only pay the 6% sales tax. How much can Clarence and Joy Greenhalgh and their two children Martin and Thompson save by purchasing their tickets at a Florida AAA office?

3) One serving of whole milk contains 8 grams of fat. Reduced-fat milk contains 41.25% less fat per serving than whole milk. How many grams of fat does one serving of reduced-fat milk contain?

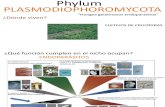

4) Use the graph to answer the following: In 2002 US companies lost $32.3 billion due to “inventory shrinkage.” Each sector of the circle graph shows

the percent of this total due to each of four sources.

a. Determine the amount lost to administrative error.

b. Determine the amount lost to vendor fraud.

5) In 1990 the population of Pittsfield, Massachusetts was 48,622. In 2000, the population had decreased to 45,793. Determine the percent decrease in Pittsfield’s population from 1990 to 2000.

Vendor Fraud

6%

Administrative Error

17%

Shoplifting31%

Employee Theft46%

Inventory Shrinkage

6) The population of the United States rose from approximately 248.7 million in 1990 to approximately 288.4 in 2002. Determine the percent increase then approximate the population in 2014 should the population continue to increase at the same rate?

7) What is 15% of $45.00?

8) What percent of 96 is 24?

9) Five percent of what number is 15?

10) According to the Original Tipping Page (www.tipping.org) it is proper to tip waiters and waitresses 15 – 20% of the total restaurant bill, including the tax. Mary and Keith’s dinner costs $43.50 before tax, and the tax rate is 8.25%.

a. What is the tax on Mary and Keith’s dinner?

b. What is the total bill, including tax, before tip?

c. If Mary and Keith decide to tip 15% of the total bill, how much is the tip?

d. What is the total cost of the dinner including tax and tip?

11) The Gordon and Stallard Charter Fishing Boat Company has recently increased the number of crewmembers by 25%, or 10 crew members. What was the original number of crewmembers?

12) In a mathematics class, eighteen students received an A on the third test, which is 150% of the students who received an A on the second test. How many students received an A on the second test?

13) Qami Brown’s present salary is $26,500. He is getting an increase of 7% in his salary next year. What will his new salary be?

14) The cost of a fish dinner to the owner of the Golden Wharf restaurant is $7.95. The fish dinner is sold for $11.95. Find the percent markup.

15) Quincy Carter purchased a used car for $1000. He decided to sell the car for 10% above his purchase price. Quincy could not sell the car so he reduced his asking price by 10%. If he sells the car at the reduced price, will he have a profit or loss or will he break even? Defend your answer.

16) Determine which is greater: a. $100 increased by 25% or $200 decreased by 25%

b. $100 increased by 50% or $200 decreased by 50%

c. $100 increased by 100% or $200 decreased by 100%

17) You are going to go shopping at a store’s special sale. The ad in the paper said that on Wednesday only there will be an additional 15% off of all current sale prices. The current sale price is 10% off of clearance. If the clearance rate 75% off and the item you wish to purchase was originally $125, how much will it cost you on Wednesday if you go to the special sale?

11.2 – Personal Loans and Simple Interest

REMEMBER: Always assume 360 days in a year unless told differently for application problems. 18) What is interest?

19) What is credit?

20) What is security (or collateral)?

21) What is a cosigner?

22) What is the United States Rule?

23) Determine the simple interest when the rate is an annual rate unless otherwise noted. a. P = $300 r = 4% t = 5 years

b. P = $900 r = 3.75% t = 30 days

c. P = $365.45 r = 11.5% t = 8 months

d. P = $587 r = 0.045%/day t = 2 months

e. P = $2,756.78 r = 10.15% t = 103 days

f. P = $1,372.11 r = 1.365%/month t = 3 years

24) Determine the missing value when the rate is an annual rate unless otherwise noted. a. P = $1500 r = ? t = 3 years I = $450

b. P = ? r = 3% t = 90 days I = $600

c. P = $800 r = 6% t = ? I = $64

25) Steve and Laurie Carah borrowed $4500 from their credit union to remodel their kitchen. The simple interest rate was 6.75% and the length of the loan was 3 years.

a. How much did the Carrahs pay for the use of the money?

b. What was the amount due to the credit union on the date of maturity?

26) Kelly Droessler borrowed $2500 from the bank for 6 months. The bank collected 7.5% simple interest on the date of maturity. How much was Kelly charged for the use of the money? How much money did she have to repay on the date of maturity?

27) Kwame Adebele borrowed $2500 for 5 months from his bank using US government bonds as security. The bank discounted the loan at 8%.

a. How much interest did Kwame pay the bank for the use of its money?

b. How much did he receive from the bank?

c. What was the actual rate of interest he paid?

28) Kwame Adebele borrowed $7000 for 8 months from his bank using US government bonds as security. The bank discounted the loan at 5%.

a. How much interest did Kwame pay the bank for the use of its money?

b. How much did he receive from the bank?

c. What was the actual rate of interest he paid?

29) You are getting the last student loan necessary for your freshman year of college. The bank will offer you a discounted note at 9.25% for six months if your parents cosign. You know that you need an additional $9,025 to cover the last of your tuition, room and board, textbooks, and to have spending money for the year.

a. How much should you borrow so that you receive the $9,025 that you need? (HINT: What you want = money you borrow minus discount)

b. How much interest will you pay for the use of the money?

c. What was the actual interest rate at which the money was borrowed?

30) You need $17,000 for the next school year and know that you will be given the money at a discount rate of 6% for nine months. How much should you ask for so you receive the $17,000 you need?

31) Determine the exact time from the first date to the second date. Assume the year is not a leap year unless otherwise indicated.

a. January 17 to July 4

b. February 12 to June 19, leap year

c. December 21 to April 28

32) Determine the due date of the loan, using exact time, if the loan is made on the given date for the given number of days.

a. April 15 for 60 days

b. November 25 for 120 days, leap year

c. July 5 for 210 days

33) A partial payment(s) is(are) made on the date indicated. Use the United States Rule to determine the balance due on the note and the date of maturity. Assume the year is not a leap year.

Principal Rate Effective Date

Partial Pmt Amount

Partial Pmt Date

Maturity Date

a. $2000 5% March 1 $400 April 1 May 1

Principal Rate Effective

Date Partial Pmt Amount

Partial Pmt Date

Maturity Date

b. $2500 12.5% January 1 $300 January 15 February 15

Principal Rate Effective

Date Partial Pmt Amount

Partial Pmt Date

Maturity Date

c. $11,600 6% March 1 $2000 May 15 December 1 $4000 October 15

34) On March 1 the Zwick Balloon Company signed a $6500 note with simple interest of 10.5% for 180 days. The company made payments of $1750 on May 1 and $2350 on July 1. How much will the company owe on the date of maturity?

11.3 – Compound Interest

REMEMBER: Always assume 360 days in a year unless told differently for application problems. 35) Compute the total amount received on an investment compounded as indicated. Then determine the interest

earned. a. $2000 for 3 years at 2% compounded annually

b. $3500 for 4 years at 1.5% compounded semiannually

c. $2500 for 2 years at 6.25% compounded monthly

d. $4000 for 4 years at 0.625% compounded daily

36) Lyane Sakshaug, a textbook author, deposited her $7500 advance in a money market account that pays 2.66% interest compounded semiannually. How much money will Lynae have in this account after 4 years?

37) Bill Palow sells his vintage 1974 Plymouth Road Runner for $9500. He uses the money to invest in a 36-month CD that pays 1.2% interest compounded monthly. How much money will Bill receive when he cashes in the CD at the end of the 36 months?

38) When Richard Zucker was born, his father deposited $2000 in his name in a savings account. The account was paying 1.1% interest compounded semiannually.

a. If the rate did not change, what was the value of the account after 15 years?

b. If the money had been invested at 1.1% interested compounded monthly what would the value have been after 15 years?

39) When Lois Martin was born her father deposited $2000 in a savings account in her name at a savings and loan association. At the time the savings and loan was paying 6% compounded semiannually. After 10 years the savings and loan association changed the interest rate of 4.5% compounded quarterly. How much had the $2000 amounted to after 18 years when withdrawn to help with college expenses?

40) Rikki Blair borrowed $6000 from her brother. She repaid the $6000 at the end of 2 years at an interest rate of 5.5% compounded quarterly. How much did her brother charge her for borrowing the money?

41) Determine the effective annual yield for $1 invested for 1 year at 3.5% compounded semiannually?

42) What is the APY for an account with an interest rate of 2.4% compounded monthly? If the bank claimed the APY was 2.6% would they be exaggerating or underestimating the interest?

43) What is the APY for an account with an interest rate of 3.6% compounded daily? If the bank claimed the APY was 3.9% would they be exaggerating or underestimating the interest?

44) Dave Dudley won a photography contest and received a $1000 cash prize that he wishes to invest. Would he do better investing the money for 1 year in a simple interest account paying 5% or in an account that pays 4.75% compounded monthly?

45) The village of Kieler completes an exploratory study and finds that the current village water tower will need replacement in 10 years at a cost of $290,000. To finance this amount, the village board will at this time assess its 958 homeowners with a one-time surcharge and then invest this amount in a 10-year CD paying 8.25% interest compounded semiannually.

a. How much will with village of Kieler need to invest at this time in this CD to raise the $290,000 needed in 10 years?

b. What amount should each homeowner pay as a surcharge?

46) Jim Roznowski wants to invest some money now to buy a new tractor in the future. If he wants to have $30,000 available in 5 years, how much does he need to invest now in a CD paying 2.2% interest compounded monthly?

47) If the cost of bread was $1.35 in 2004 and the annual average inflation rate is 2.5% what will be the cost of a loaf of bread in 2009? In 2014?

48) What is the interest rate on a $2000 investment yielding a total of $3,589.58 over a period of 5 years in an account that was compounded monthly?

11.4 – Installment Buying

49) Pablo Silonto purchased a new boat for $43,000. He paid 15% as a down payment and financed the balance of the purchase with a 60-month fixed installment loan with an APR of 7.5%.

a. Determine Pablo’s total finance charge.

b. Determine Pablo’s monthly payment.

50) Becky Kubiac wishes to purchase new appliances for her home. The total cost for the appliances is $4200. To

finance the purchase, Becky must pay 20% down with the balance being financed with a 24-month installment loan with an APR of 8.5%.

a. Determine Becky’s total finance charge.

b. Determine Becky’s monthly payment.

51) Joni Gile has a total of $13,000 in student loans that will be paid with a 60 month installment loan with an APR of 4.5%.

a. Determine Joni’s total finance charge.

b. Determine Joni’s monthly payment.

52) Cheryl Sisson is a hair designer and wishes to convert her garage into a hair salon to use for her own business. The entire project would have a cash price of $3200. She decides to finance the project by paying 20% down with the balance paid in 60 monthly payments of $53.14.

a. What finance charge will Cheryl pay?

b. What is the APR to the nearest half percent?

53) Mr. and Mrs. Chan want to buy furniture that has a cash price of $3,450. On the installment plan they must pay 25% of the cash price as down payment and make six monthly payments of $437.

a. What finance charge will the Chans pay?

b. What is the APR to the nearest half percent?

54) Ray Flagg took out a 60-month fixed installment loan of $12,000 to open a new pet store. He paid no money

down and began making monthly payments of $232. Ray’s business does better than expected and instead of making his 24th payment, Ray wishes to repay his loan in full.

a. Determine the APR of the installment loan.

b. How much interest will Ray save using the actuarial method?

c. What is the total amount due to pay off the loan?

55) Nina Abu buys a new sport utility vehicle for $32,000. She trades in her old truck and receives $10,000, which she uses as a down payment. She finances the balance at 8% APR over 36 months. Before making her 24th payment, she decides to pay off the loan.

a. What is the total interest Nina would pay if all 36 payments were made?

b. What were Nina’s monthly payments?

c. How much interest will Nina save using the actuarial method?

d. What is the total amount due to pay off the loan?

56) Robert Malena wishes to purchase new equipment worth $7,345 for his landscaping business. Robert is able to secure a no-money-down, 48 month, 8.5% APR fixed installment loan from his local bank. Before making his 12th payment, Robert decides to pay off the loan with some of his yearly profits.

a. What was Robert’s original finance charge?

b. What was Robert’s original monthly payment?

c. How much interest will Robert save using the Rule of 78s?

d. What is the total amount due to pay off the loan?

57) Roger Golden purchased woodworking tools for $2375. He made a down payment of $850 and financed the balance with a 12 month fixed payment loan. Instead of making his sixth monthly payment of $134.71, he decides to pay off the loan.

a. How much interest will Roger save using the Rule of 78s?

b. What is the total amount due to pay off the loan?

58) To pay for his trip to Portland, Oregon for a teaching conference in November, David Dean charged the following expenses to his credit card

i. Airfare $365 ii. Hotel $180

iii. Conference fee $195 iv. Meals $84

David had a previous balance of zero, he bought no other items with his credit card, and on December 1 he made a payment of $200. The bank that issued the card requires repayment within 48 months and charges an interest rate of 19.4% per month.

a. What is the minimum payment due on December 1?

b. What is the balance due on January 1?

59) Brian Hickey uses his credit card in August to purchase the following college supplies: i. Books $425

ii. Bus Pass $175 iii. Meal Ticket $450 iv. Season Tickets $125

On September 1, he used $650 of his financial aid check to reduce the balance. The issuing bank charges 11.5% interest per month and requires full payment within 36 months. Brian had a previous balance of zero and he makes no other purchases with this card.

a. What is the minimum payment due on September 1?

b. What is the balance due on October 1?

60) On the April 5 billing date, Michaelle Chappell had a balance due of $1097.86 on her credit card. From April 5 through May 4, Michaelle charged an additional $425.79 and makes quadruple her minimum payment. The terms of her credit card are that the balance is paid in full in 36 months at an interest rate of 15.5%.

a. Determine the payment amount made by Michaelle and the unpaid balance.

b. Determine the finance charge on May 5 using the unpaid balance method.

c. Find the new balance and minimum payment on May 5.

61) Gracie Keller had some emergency expenses arise. Her credit card balance was $979 before she bought new tires. She made a scheduled payment October 1 of $200 and had to charge $525 for the tires on October 21. The issuing bank charges 22.5% interest and requires full repayment within 36 months. Gracie saves this card for emergencies and makes no other purchases.

a. What is the balance due on November 1?

b. What is the minimum payment on November 1?

c. Assuming Gracie pays another $200 on November 1, what is balance on December 1?

62) On February 3, the billing date, Carol Ann Bluesky had a balance due of $124.78 on her credit card. Her bank charges an interest rate of 29.5% per month. She made the following transactions during the month:

i. February 8 Charge: Art supplies $25.64 ii. February 12 Payment $100.00

iii. February 14 Charge: Flowers $67.23 iv. February 25 Charge: Music $13.90

a. Find the finance charge on March 3 using the unpaid balance method.

b. Find the new balance on March 3.

63) The balance on the Razazada’s credit card on May 12, their billing date, was $378.50. For the period ending June 12, they had the following transactions:

i. May 13 Charge: Toys $129.79 ii. May 15 Payment $50.00

iii. June 1 Charge: Clothing $135.85 iv. June 8 Charge: Housewares $37.64

a. Find the average daily balance for the billing period.

b. Find the finance charge to be paid on June 12 using the average daily balance method. Assume an interest rate of 13% per month.

c. Find the balance due on June 12.

64) The Levy’s credit card statement shows a balance due of $1578.25 on March 23, the billing date. For the period ending April 23, they had the following transactions:

i. March 26 Charge: Party Supplies $79.98 ii. March 30 Charge: Restaurant $52.76

iii. April 3 Payment $250.00 iv. April 15 Charge: Clothing $190.52 v. April 22 Charge: Car repairs $290.95

a. Find the average daily balance for the billing period.

b. Find the finance charge to be paid on April 23 assuming a 22.25% interest rate per month using the average daily balance method.

c. Find the balance due on April 23.

65) John Richards borrowed $876 against his charge account on September 12 and repaid the loan on October 14 (32 days later). Assume that the interest rate is 0.04273% per day.

a. How much interest did John pay on the loan?

b. What amount did he pay the bank when he repaid the loan?

66) Travis Thompson uses his credit card to obtain a cash advance loan of $1150 to pay for his textbooks in medical school. The interest rate charged for the loan is 0.05477% per day. Travis repays the money plus the interest after 27 days. Determine the interest due on the loan and the total amount needed to repay it.

67) Grisha Stewart needs to borrow $1000 for an automobile repair. She finds that State National Bank charges 5% simple interest on the amount borrowed for the duration of the loan and requires the loan to be repaid in 6 equal monthly payments. Consumer’s Credit Union offers loans of $1000 to be repaid in 12 monthly payments of $86.30.

a. How much interest is charged by the State National Bank?

b. How much interest is charged by the Consumer’s Credit Union?

c. What is the APR to the nearest half percent on the State National Bank loan?

d. What is the APR to the nearest half percent on the Consumer Credit Union loan?

e. Which bank should Grisha go with?

11.5 – Buying a House with a Mortgage

68) Sally Jacobs wishes to buy a house selling for $250,000. Her credit union requires her to make a 15% down payment. The current mortgage rate is 4.5%.

a. Determine the amount of the required down payment.

b. Determine the monthly mortgage payment for a 15-year loan with a 15% down payment.

69) Mary Beth and Ken are buying a new condominium for $210,000. Their bank is requiring a minimum down payment of 10%. The current mortgage rate is 5%.

a. Determine the amount of the required down payment.

b. Determine the monthly mortgage payment for a 20-year loan with the minimum down payment.

70) Martha Cutler is buying a house selling for $195,000. The bank is requiring a minimum down payment of 20%. To obtain a 20-year mortgage at 6% interest she must pay 2 points at time of closing.

a. What is the required down payment?

b. With the 20% down payment, what is the amount of the mortgage?

c. What is the cost of 2 points?

71) Peter and Helga Guenther’s gross monthly income is $3200. They have 25 remaining car payments of $335. The Guenthers are applying for a 15-year, $150,000 mortgage at 5% interest to buy a new house. The taxes and insurance on the house are $225 per month.

a. Determine the Guenther’s adjusted monthly income.

b. Determine the maximum monthly payment a lender feels the Guenthers can afford.

c. Determine the monthly mortgage payment plus taxes and insurance.

d. Do the Guenthers qualify for this mortgage?

72) Ting and Zu Zheng’s gross monthly income is $4100. They have 18 remaining boat payments of $505. They are

applying for a 20-year $275,000 mortgage at 9% interest to buy a new house. The annual taxes and insurance on the house are $6300.

a. Determine the Zheng’s adjusted monthly income.

b. Determine the maximum monthly payment a lender feels the Zhengs can afford.

c. For the first monthly payment, how much goes towards interest? How much goes towards principal?

d. Determine the monthly mortgage payment, plus escrow (taxes and insurance).

e. Do the Zheng’s qualify for the mortgage?

73) Ingrid Holzer obtains a 30-year $63,750 conventional mortgage at 8.5% on a house selling for $75,000. Her monthly payment , including principal and interest is $490.24.

a. Determine the total amount Ingrid will pay for her house.

b. How much of the cost will be interest?

c. How much of the first payment on the mortgage is applied to the principal?

74) The Rosens found a house selling for $113,500. The taxes on the house are $1200 per year and the insurance is $420 per year. They are requesting a conventional loan from the local bank. The bank is currently requiring a 28% down payment and 3 points, and the interest rate is 10%. The Rosen’s monthly income is $4750, the have more than 10 monthly payments remaining on a car, a boat and furniture. The total monthly payments for these items are $680.

a. Determine the required down payment.

b. Determine the value of the mortgage.

c. Determine the cost of the 3 points.

d. The Rosens have to pay the down-payment, points and closing costs to get the keys to the house. If the bank says the closing costs are 1.5% of the mortgage value, how much total will they have to pay at the time of closing?

e. Determine their adjusted monthly income.

f. Determine the maximum monthly payment the bank’s loan officer believes they can afford.

g. Determine the monthly payments of principal and interest for a 20-year loan.

h. Determine their total monthly payment, including insurance and taxes.

i. For the first monthly payment, how much goes towards interest? How much goes towards principal?

j. Determine whether the Rosen’s qualify for the 20-year loan.

k. Determine if the Rosens were to get the house what the total cost of the house would be (down-payment, principal, interest, points).

l. Determine how much the Rosens paid for their house in interest alone (i.e. total paid compared to purchase price).