100 Crore Bank Deposit

Transcript of 100 Crore Bank Deposit

-

8/14/2019 100 Crore Bank Deposit

1/14

Annual Report AnalysisIndusInd Bank

-

8/14/2019 100 Crore Bank Deposit

2/14

Of

-

8/14/2019 100 Crore Bank Deposit

3/14

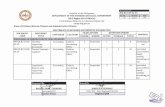

BALANCE SHEET AS AT MARCH 31, 2009

SCHEDULE As at 31.03.09CAPITAL AND LIABILITIES

Capital I 3,551,921Employee Stock Options Outstanding XVIII (9) 11,510Reserves and Surplus II 13,080,511

Deposits III 221,102,527Borrowings IV 18,564,553Other Liabilities and Provisions V 19,835,803

TOTAL 276,146,825

ASSETS

VI 11,907,898

VII 7,329,049

Investments VIII 80,834,055Advances IX 157,706,359Fixed Assets X 6,231,934

Other Assets XI 12,137,530TOTAL 276,146,825

Contingent Liabilities XII 442,991,733Bills for Collection 29,377,335

Principal Accounting Policies XVIINotes on Accounts XVIII

Cash and Balances with ReserveBank of IndiaBalances with Banks and Money atCall and Short Notice

-

8/14/2019 100 Crore Bank Deposit

4/14

2,211,025.27

-

8/14/2019 100 Crore Bank Deposit

5/14

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED MARCH

SCHEDULE

I. INCOMEInterest Earned XIIIOther Income XIV

TOTALII. EXPENDITUREInterest Expended XVOperating Expenses XVI

Provisions and ContingenciesTOTAL

III. PROFITProfit brought forward

AMOUNT AVAILABLE FOR APPROPRIATION TOTALIV. APPROPRIATIONSTransfer toa) Statutoryb) Capitalc) Investment Reserve Accountd) Dividende) Corporate

Balance transferred to Balance SheetTOTAL

Earnings per share (basic)(Rupees) XVIII(10.6)Earnings per share (diluted)(Rupees) XVIII(10.6)Principal Accounting Policies XVIINotes on Accounts XVIII

-

8/14/2019 100 Crore Bank Deposit

6/14

1, 2009

Year ended31.03.09

23,094,7444,562,535

27,657,279

18,504,4145,470,3412,199,136

26,173,891 2,211,025.27

1,483,3882,429,907

3,913,295

370,847534,029

15,323447,115

75,9871,443,3012,469,994

3,913,2954.284.27

-

8/14/2019 100 Crore Bank Deposit

7/14

CASH FLOW STATEMENT FOR THE YEAR ENDED MAR

A. Cash Flow from Operating ActivitiesNet Profit after taxesAdjustments for non-cash charges :Depreciation on Fixed AssetsProvision on Investments

Tax Provisions (Income Tax/ Wealth Tax/ Deferred Tax)Employees Stock Option ExpensesLoan loss and Other ProvisionsInterest on Tier II / Upper Tier II bonds (treated separately)(Profit) / Loss on sale of Fixed assetsOperating Profit before Working Capital changesAdjustments for :Increase in trade and Other Receivables (Advances and Other Assets)Increase in Inventories (Investments)Increase in Trade Payables (Deposits, Borrowings and Other Liabilities)Cash generated from OperationsDirect taxes paidNet Cash from Operating Activities

B. Cash Flow from Investing ActivitiesPurchase of Fixed AssetsSale of Fixed Assets (Proceeds)Net Cash used in Investing Activities

C. Cash Flow from Financing ActivitiesProceeds from GDR issue Capital

PremiumDividends paidProceeds from Issue of Unsecured Non-Convertible RedeemableSubordinated Tier II BondsProceeds from Unsecured Non-convertible Redeemable Non-CumulativeSubordinated Upper Tier II BondsRedemption of Sub-ordinated Tier II capitalInterest on Tier II / Upper Tier II bondsNet Cash used in Financing ActivitiesNet increase in Cash and Cash EquivalentsCash and Cash Equivalents as on the first day of the yearCash and Cash Equivalents as on the last day of the year

-

8/14/2019 100 Crore Bank Deposit

8/14

H 31, 2009

For the year ended 31.3.2009

148.34

44.17(3.09)79.15

0.64143.85

77.27 2,211,025.272.6

492.93

(3311.17)(1450.62)

3946.23(322.63)

67.22(389.85)

51.052.06

48.99

35.19187

24.92

100

35.5

77.27184.5

254.342178.031923.69

-

8/14/2019 100 Crore Bank Deposit

9/14

BALANCE SHEET AS AT MARCH 31, 2009

SCHEDU As at 31.03.09

Capital I 2

XVIII (9) 0.0052Reserves and Surplus II 6

Deposits III 100Borrowings IV 8

V 9

TOTAL 125

ASSETS

VI 5

VII 3

Investments VIII 37Advances IX 71

Fixed Assets X 3

Other Assets XI 5TOTAL 125

Contingent Liabilities XII 200Bills for Collection 13

XVIINotes on Accounts XVIII

LIABILITIES

Employee Stock OptionsOutstanding

Other Liabilities andProvisions

Cash and Balances withReserve Bank of IndiaBalances with Banks andMoney at Call and ShortNotice

Principal AccountingPolicies

-

8/14/2019 100 Crore Bank Deposit

10/14

1.00

-

8/14/2019 100 Crore Bank Deposit

11/14

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED MARCH

SCHEDULE

I. INCOMEInterest Earned XIIIOther Income XIV

TOTALII. EXPENDITUREInterest Expended XVOperating Expenses XVI

Provisions and ContingenciesTOTAL

III. PROFITProfit brought forward

AMOUNT AVAILABLE FOR APPROPRIATION TOTALIV. APPROPRIATIONSTransfer toa) Statutoryb) Capitalc) Investment Reserve Accountd) Dividende) Corporate

Balance transferred to Balance SheetTOTAL

Earnings per share (basic)(Rupees) XVIII(10.6)Earnings per share (diluted)(Rupees) XVIII(10.6)Principal Accounting Policies XVIINotes on Accounts XVIII

-

8/14/2019 100 Crore Bank Deposit

12/14

1, 2009

Year ended31.03.09

10.44526462.0635382

12.5088028

8.36915542.47411960.9946227

11.8378977

0.67090501.0989956

1.7699006

0.16772630.24153000.00693030.20222070.03436730.65277451.1171261

1.76990060.00000190.0000019

-

8/14/2019 100 Crore Bank Deposit

13/14

CASH FLOW STATEMENT FOR THE YEAR ENDED MAR

A. Cash Flow from Operating ActivitiesNet Profit after taxesAdjustments for non-cash charges :Depreciation on Fixed AssetsProvision on Investments

Tax Provisions (Income Tax/ Wealth Tax/ Deferred Tax)Employees Stock Option ExpensesLoan loss and Other ProvisionsInterest on Tier II / Upper Tier II bonds (treated separately)(Profit) / Loss on sale of Fixed assetsOperating Profit before Working Capital changesAdjustments for :Increase in trade and Other Receivables (Advances and Other Assets)Increase in Inventories (Investments)Increase in Trade Payables (Deposits, Borrowings and Other Liabilities)Cash generated from OperationsDirect taxes paidNet Cash from Operating Activities

B. Cash Flow from Investing ActivitiesPurchase of Fixed AssetsSale of Fixed Assets (Proceeds)Net Cash used in Investing Activities

C. Cash Flow from Financing ActivitiesProceeds from GDR issue Capital

PremiumDividends paidProceeds from Issue of Unsecured Non-Convertible RedeemableSubordinated Tier II BondsProceeds from Unsecured Non-convertible Redeemable Non-CumulativeSubordinated Upper Tier II BondsRedemption of Sub-ordinated Tier II capitalInterest on Tier II / Upper Tier II bondsNet Cash used in Financing ActivitiesNet increase in Cash and Cash EquivalentsCash and Cash Equivalents as on the first day of the yearCash and Cash Equivalents as on the last day of the year

-

8/14/2019 100 Crore Bank Deposit

14/14

H 31, 2009

For the year ended 31.3.2009

148.34

44.17(3.09)79.15

0.64143.85

77.272.6

492.93

(3311.17)(1450.62)

3946.23(322.63)

67.22(389.85)

51.052.06

48.99

35.19187

24.92

100

35.5

77.27184.5

254.342178.031923.69

![DESIGNED - NABARD - National Bank For Agriculture And Rural … · 2018-09-22 · [ 2 ] [2] crore and annual loan offtake of crore and loan outstanding of nearly crore crore households](https://static.fdocuments.net/doc/165x107/5e9f618ec5785a18cf42b9a3/designed-nabard-national-bank-for-agriculture-and-rural-2018-09-22-2-2.jpg)