1 NEDPower Mount Storm Wind Farm Project Update 10/20/2009.

-

Upload

duane-ball -

Category

Documents

-

view

216 -

download

0

Transcript of 1 NEDPower Mount Storm Wind Farm Project Update 10/20/2009.

1

NEDPower Mount StormWind Farm Project Update

10/20/2009

2

Grant County, West Virginia

.Mt. Storm

Coal-Fired Station

Site Location264 MW on8000 Acresof Leased Property

Wind project site is approximately 2 miles east of Dominion’s Mt. Storm coal-fired facility

Maximum Turbine Height – 388 ft Turbine Blades – 127 ft long & 262 ft diameter rotor Cut-in/Cut-out Speed – 4 m/s (9 mph) / 25 m/s (56 mph)

Project Location

3

Project Data

• Location Grant County, West Virginia

• Status OPERATING

• Facility Owners Dominion (50%) / Shell (50%)

• Total Capacity 264 Megawatts

• Number of turbines 132

• Maximum Output per Turbine 2 Megawatts

• Commercial Operation Date December 2008

• Total Capital Cost: $530 million

• Turbine Supplier Gamesa (Model G80-2.0)

• Source of Turbine Manufacturing U.S. and Spain

• Land Area Covered ~8,000 acres (12 miles of ridgeline)

• Regional Transmission Operator PJM Interconnection

4

CompletedWind Turbine

Turbine Dimensions:Rotor Diameter: 262 ftTower Height: 256 ft

Total Height to Blade Tip: 388 ft

Distance from Bottom of Blade Tip Arc to Ground: 125 ft

125 ft

388 ft

262 ft

256 ft

Turbine Dimensions

5

Project Benefits

• Taxes Over 25 YearsPayments to Land Owners: $17.45 million (35 land owners)

Property Taxes: $14.23 million (county)

State Taxes: $ 6.87 million

B&O Taxes: $ 3.79 million

Schools: $ 1.74 million

Construction provided over $30 million in revenues for local companies

Jobs – reached 300 during construction and one dozen full time for operation

Each 2 megawatt turbine provides enough electricity for 500 homes

Entire project will provide power for 66,000 homes

Excellent working relationship with local elected officials

6

Project Timeline

• Discussions Initiated with Land Owners & County 2001

• WV CPCN Site Certificate Application Submitted 2002

• WV CPCN Site Certificate Approved 2003

• Pre-Construction Conditions Completed 2006

• Construction Started 2006

• Construction Completed 2008

• Project Financing 2008

7

What is Project Finance?

• Financing of long-term infrastructure

• Relies on external debt and contributed equity

• Loans are secured by the project assets

• Relies on project cash flow for repayment

• Lenders evaluate project risk

• Special Purpose Entity (SPE) used to hold project assets

• Loan is made to SPE

• Lenders include – Banks, Insurance Companies, Private Equity Firms, ect.

8

Why Project Finance?

• Limit Recourse to Project- Possible non-recourse and off-balance sheet treatment

• Have multiple project owners- 50/50 partnership or other options

• Lever the project- Increase debt and returns

Dominion’s Investment in Equity MethodAccounting Projects (2008 & 2007)

9

Consolidated Balance Sheets At December 31, 2008 2007 (millions) ASSETS Current Assets

Cash and cash equivalents $ 66 $ 283 Customer receivables (less allowance for doubtful accounts of $32 and $37) 2,354 2,130 Other receivables (less allowance for doubtful accounts of $7 and $10) 205 226 Inventories:

Materials and supplies 509 427 Fossil fuel 328 341 Gas stored 329 277

Derivative assets 1,497 775 Assets held for sale 1,416 1,160 Prepayments 163 387 Other 794 664

Total current assets 7,661 6,670 Investments

Nuclear decommissioning trust funds 2,246 2,888 Investment in equity method affiliates 726 331 Loans held for resale (less allowance for loan losses of $7 in 2007) — 323 Other 285 338

Total investments 3,257 3,880 Property, Plant and Equipment

Property, plant and equipment 35,448 33,331 Accumulated depreciation, depletion and amortization (12,174 ) (11,979 )

Total property, plant and equipment, net 23,274 21,352 Deferred Charges and Other Assets

Goodwill 3,503 3,496 Pension and other postretirement benefit assets 514 1,565 Intangible assets 712 598 Regulatory assets 2,226 957 Other 906 621

Total deferred charges and other assets 7,861 7,237 Total assets $ 42,053 $ 39,139

Dominion’s Investment in Equity Method Accounting Projects (2008 & 2007)

10

Equity Method Investments Investments that we account for under the equity method of accounting are as follows:

Company Ownership % Investment Balance Description

As of December 31, 2008 2007 (millions) Iroquois Gas Transmission System, LP 24.72% $ 114 $ 97 Gas transmission system Elwood Energy LLC

50%

83

77

Natural gas-fired merchant generation peaking facility

Fowler I Holdings LLC 50% 292 — Wind-powered merchant generation facility NedPower Mount Storm LLC 50% 154 67 Wind-powered merchant generation facility Other various 83 90 Total $ 726 $ 331

Project Financing Process

• Determine if construction financing and term financing will be required, and the target loan period

• Develop cash flow model for the project with desired debt size and anticipated financial results

• Develop a Project Information Memorandum to market the project

• Hire borrower’s counsel/attorney

• Solicit interest with banks and sign confidentiality agreements

• Hire an independent engineer who is a recognized leader in the field and have the banks’ trust

• Sign off on lender’s selected counsel/attorney

• Negotiate high-level project economics / perform market analysis / “stress-test” the economic model

• Acquire credit committee approval from candidates for lead arranger banks

• Select 1 to 3 lead arrangers for project financing

• Negotiate and sign engagement letter and term sheet with selected lead arrangers

• Negotiate financing agreement and other ancillary documents

• Proceed with syndication (lead arrangers sell down their hold amounts)

• Acquire credit committee approval from bank syndicate

• Independent engineer, insurance agent, and other consultants sign off

• Finalize debt size using latest project data approved by the independent engineer, banks, borrower, and sponsors

• Acquire consents / opinions from contract counterparties

• Close the transaction

11

Project Financing – Debt Service Coverage Ratio

• Debt Service Coverage Ratio (DSCR)

• DSCR = Funds from OperationsDebt Payment in the same period

• Banks want to stress test the project cash flows to have debt repayment certainty

• Is used to size the debt

• Usually a six-month or annual test during operation of the facility and entire term of the loan

• Is the project generating cash flows sufficient to repay debt?

• Usually requires dual test:– DSCR is usually 1.0 to 1.2 for P95/P99 stress test

– DSCR is usually 1.2 to 1.5 for P50 stress

• After closing and during operation of the project, if DSCR requirements are not met, the banks will require the sponsor(s) to inject cash to meet DSCR tests

12

Project Financing – Important Negotiating Points

As the borrower, you want to achieve:

• Balance between high debt size and low risk of debt repayment occurrences

• Terms that allow flexibility if market disruptions occur

• Hiring the best attorney money can buy – it is worth it

• Paying the lowest possible bank fees due at closing (but still market price)

• Lowest debt-service-coverage-ratio for debt sizing and equity injection thresholds

• Non-recourse treatment to sponsor(s)

• Use of more probable revenue projections (use P90 or P95 rather than P99 projections)

• Finding a bank group that wants the project & sponsor(s) to succeed

• Finding a bank group that has experience financing the technology/locations

• Increase in returns to the sponsors compared to no financing

13

14

Thank YouQuestions?

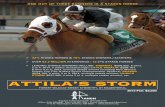

NedPower Mount Storm Wind Farm