1 4 compound-interest

-

Upload

pad-batinga -

Category

Technology

-

view

2.596 -

download

6

Transcript of 1 4 compound-interest

1.4 Compound Interest1.4 Compound Interest

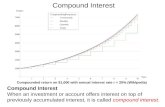

Compound Interest

1.4 Compound Interest1.4 Compound Interest

• Compound interest – a type of interest which results from the periodic addition of simple interest to the principal.

• This type of interest often applies to savings accounts, loans, and credit cards.

• Compound amount – the amount at the end of the term (after several compounding).

• It is the sum of the original principal and its compound interest.

1.4 Compound Interest1.4 Compound Interest

• Formula for the compound amount F:

€

F = P(1+ i)n

€

P - original principal

j - rate of interest per year

m - frequency of conversion

i - interest rate per priod; i = jm

t - length of term in years

n - total number of conversion periods; n = tm

1.4 Compound Interest1.4 Compound Interest

Example. Find the compound amount at the end of 12 periods if the principal is Php25,000 and the interest per period is 10%.

€

F = P(1+ i)n

€

=25,000(1+ .10)12

€

F = Php78,460.71

1.4 Compound Interest1.4 Compound Interest

Example. What is the maturity value of a 75,000-peso, three-year investment earning 5% compounded monthly?

€

F = P(1+ i)n

€

=75,000 1+ .0512( )

12

€

F = Php87,110.42

€

Do this ifi is not exact.

1.4 Compound Interest1.4 Compound Interest

Example. Find the compound amount after 5 years and 9 months if the principal is Php150,500 and the rate is 7% compounded annually.

€

F = P(1+ i)n

€

=150,000(1.07)5 912⋅1

€

=Php221,333.92

1.4 Compound Interest1.4 Compound Interest

More Formulas:

€

j = mF

P

⎛

⎝ ⎜

⎞

⎠ ⎟

1

n−1

⎡

⎣

⎢ ⎢

⎤

⎦

⎥ ⎥€

P = F(1+ i)−n

€

n =log F

P( )

log(1+ i)

1.4 Compound Interest1.4 Compound Interest

1. Given P = Php25,200, i = 3%, n = 16, find F.

€

F = P(1+ i)n

€

=25,200(1.03)16

€

=Php40,438.60

1.4 Compound Interest1.4 Compound Interest

3. Given P = Php1.8M, j = 11%, t = 7.5 years, m = 2, find F.

€

F = P(1+ i)n

€

=1,800,000(1.055)15

€

=Php4,018,457.69

1.4 Compound Interest1.4 Compound Interest

5. Given F = Php46,000, j = 12%, t = 6.25 years, m = 12, find P.

€

P = F(1+ i)−n

€

=46,000(1.01)−75

€

=Php21,809.96

1.4 Compound Interest1.4 Compound Interest

7. Given F = Php56,471.27, P = Php25,000, t = 8 years 3 months, m = 4, find j.

€

j = mF

P

⎛

⎝ ⎜

⎞

⎠ ⎟

1

n−1

⎡

⎣

⎢ ⎢

⎤

⎦

⎥ ⎥

€

=456,471.27

25,000

⎛

⎝ ⎜

⎞

⎠ ⎟

1

33

−1

⎡

⎣

⎢ ⎢

⎤

⎦

⎥ ⎥

€

=10%

1.4 Compound Interest1.4 Compound Interest

11. Given F = Php34,500, P = Php30,000, j = 15%, m = 12, find n.

€

n =log F

P( )

log(1+ i)

€

=log 34,500

30,000( )

log(1.0125)

€

=11.25 periods

1.4 Compound Interest1.4 Compound Interest

13. Given F = Php72,157.25, P = Php48,200, j = 9%, m = 12, find n.

€

n =log F

P( )

log(1+ i)

€

=log 72,157.25

48,200( )

log(1.0075)

€

=54 periods

1.4 Compound Interest1.4 Compound Interest

23. Find the compound amount due in 6 years and 2 months if Php350,000 is invested at 12% compounded monthly.

€

F = P(1+ i)n

€

=350,000(1.01)74

€

=Php730,886.10

1.4 Compound Interest1.4 Compound Interest

27. How much must Ella deposit in a bank that pays 11% compounded quarterly so that she will have Php400,000 after 4 years?

€

P = F(1+ i)−n

€

=400,000(1.0275)−16

€

=Php259,149.70

1.4 Compound Interest1.4 Compound Interest

28. A personal computer was bought on installments – Php5,000 downpayment and the balance of Php22,000 in 2 years. What is the cash price if the interest rate is 20% compounded quarterly?

€

P = F(1+ i)−n

€

=22,000(1.05)−8

€

=Php14,890.47

€

CP = DP + P

€

=5,000 +14,890.47

€

=Php19,890.47

1.4 Compound Interest1.4 Compound Interest

30. On April 15, 2011, Justin borrowed Php1.4M. He agreed to pay the principal and the interest at 8% compounded semi-annually on July 15, 2016. How much will he pay then?

€

F = P(1+ i)n

€

=1,400,000(1.04)10 12

€

=Php2,113,382.46

1.4 Compound Interest1.4 Compound Interest

33. At what rate converted quarterly will Php30,000 become Php40,000 in 7 years?

€

j = mF

P

⎛

⎝ ⎜

⎞

⎠ ⎟

1

n−1

⎡

⎣

⎢ ⎢

⎤

⎦

⎥ ⎥

€

=440,000

30,000

⎛

⎝ ⎜

⎞

⎠ ⎟

1

28

−1

⎡

⎣

⎢ ⎢

⎤

⎦

⎥ ⎥

€

=4.13%

1.4 Compound Interest1.4 Compound Interest

37. If Php80,000 is invested at the rate of 6 ½% compounded annually, when will it earn interest of Php15,000?

€

t =log F

P( )

m log(1+ i)

€

=log 95,000

80,000( )

log(1.065)

€

=2.73 years

1.4 Compound Interest1.4 Compound Interest

• Equation of values – a mathematical statement which says that the dated values of two sets of amounts are equal when brought to a particular point in time (the comparison date).

• In the context of borrowing, the equation of values says that

obligations = payments• These sums are obtained by either accumulating

or discounting the debts incurred or the payments made toward the comparison date.

1.4 Compound Interest1.4 Compound Interest

45. What single payment at the end of 6 years would replace the following debts?

a) Php29,000 due in 1 year without interestb) Php690,000 due in 8 years at 14% compounded

quarterly Money is worth 8.5% effective.

€

29,000

€

690,000(1.035)32

€

x

Obligation(s)

Payment(s) 1 6 8

1.4 Compound Interest1.4 Compound Interest

€

29,000(1.085)5

€

+ 690,000(1.035)32(1.085)−2

€

=x

€

x = Php1,805,909.97

€

29,000

€

690,000(1.035)32

€

x

Obligation(s)

Payment(s) 1 6 8

1.4 Compound Interest1.4 Compound Interest

47. For an amount borrowed from a credit cooperative, Janice needs to pay Php100,000 in 5 years. After 2 ½ years , she made a Php50,000 payment. If money is worth 8% compounded semi-annually, how much would she have to pay on the 5th year to fully settle the loan?

€

100,000

€

50,000

€

x

Obligation(s)

Payment(s) 2.5 5

1.4 Compound Interest1.4 Compound Interest

€

100,000

€

=50,000(1.04)5

€

+ x

€

x = Php39,167.35

€

100,000

€

50,000

€

x

Obligation(s)

Payment(s) 2.5 5

1.4 Compound Interest1.4 Compound Interest

49. If money is worth 8% effective, what single payment in 5 years will repay the following two debts:

a) Php125,000 due at onceb) Php500,000 due in 8 years

€

500,000

€

125,000

€

x

Obligation(s)

Payment(s) 1 5 8

1.4 Compound Interest1.4 Compound Interest

€

125,000(1.08)5

€

+ 500,000(1.08)−3

€

=x

€

x = Php580,582.13

€

500,000

€

125,000

€

x

Obligation(s)

Payment(s) 1 5 8

1.4 Compound Interest1.4 Compound Interest

51. As payments for debts of Php300,000 due at the end of 4 years and Php485,000 at the end of 8 years, Jane agrees to pay Php50,000 at once and Php250,000 at the end of 5 years. She will make a third and final payment at the end of 10 years. How much would it be if money is worth 14% compounded semi-annually.

€

485,000

€

300,000

€

50,000

Obligation(s)

Payment(s) 1 4 5 8 10

€

250,000

€

x

1.4 Compound Interest1.4 Compound Interest

€

300,000(1.07)12

€

+ 485,000(1.07)4

€

=

€

x = Php626,121.48

€

50,000(1.07)20

€

+ 250,000(1.07)10

€

+ x

€

485,000

€

300,000

€

50,000

Obligation(s)

Payment(s) 1 4 5 8 10

€

250,000

€

x