06-PMS-TROPICAL HARDWOOD IN DENMARK

Transcript of 06-PMS-TROPICAL HARDWOOD IN DENMARK

-

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

1/16

Product Market Study 5/2008

THE MARKET FOR TROPICAL HARDWOOD IN DENMARK

Introduction

Denmark is the southernmost country of both Scandinavia (Denmark, Sweden, and Norway)and of the so-called Nordic Region (which additionally includes Finland and Iceland). To thesouth, it borders on Germany.

Although it has a relatively small population of about 5.5 million, Denmark is a good market fortropical hardwood; this is due to the fact that the Danes pride themselves for their unique stylein architecture and interior design, commonly known as Danish design, which is characterizedby minimalist, pure forms and often the use of bare, beautifully patterned wood. Danisharchitects use a lot of wood, both on the inside as well as on the outside of their buildings. Also,

Denmark has an internationally renowned furniture industry which uses wood a lot; however,Denmarks indigenous forests are very small. (See http://www.visitdenmark.com/uk/en-gb/menu/turist/inspiration/detkulturelledanmark/design/danish-design.htm for more backgroundon Danish design).

As an example of the larger Scandinavian welfare state model, Denmark has experiencedstrong economic growth in 2005 to 2007 by an average of 3.1%. The first half of 2008 still saw ahealthy economic growth of 2.4%, but by the second half of 2008, as a result of the global creditcrisis, the Danish economy entered into recession. But yet, since the international bankingsector is not as big as in the U.K. or the Netherlands, the economy in Denmark has strongfundamentals as it relies on services, international trade, but also has a strong basis inmanufacturing, with a specialisation in sustainability (Denmark is the worlds largest producerand exporter of windmills for electricity). The Gross Domestic Product per capita is the secondlargest in Europe, at 35,900 (or US$ 50,260) per annum. On the basis this high GDP percapita, welfare benefits, a low income distribution, and political stability, the Danish peopleenjoy high living standards.

The Danish economy at large

The Danish production industry is dominated by small and medium-sized enterprises with niche

productions of a high technical standard. Compared to other industrialized countries, even thelargest Danish companies are, with few exceptions, only medium-sized. Due to an increasingspecialisation, division of tasks, and seasonality, however, a large range of products is alsoimported to Denmark. The Danish industry is mainly constituted of light manufacturing andreprocessing, and production is often characterized by a high degree of specialization in aparticular, well-defined field.

Denmark has a small, open economy highly dependent on trade with other countries. As foreigntrade accounts for most of the GDP, Denmark has a strong interest in the free exchange ofgoods and services between countries. Foreign trade accounts for two thirds of GDP andaround two thirds of the total foreign trade are with other EU countries. In 2007, total Danish

imports amounted to US$ 78,443.9 million, and total Danish exports were valued at US$82,248.3 million.

1

http://www.visitdenmark.com/uk/en-gb/menu/turist/inspiration/detkulturelledanmark/design/danish-design.htmhttp://www.visitdenmark.com/uk/en-gb/menu/turist/inspiration/detkulturelledanmark/design/danish-design.htmhttp://www.visitdenmark.com/uk/en-gb/menu/turist/inspiration/detkulturelledanmark/design/danish-design.htmhttp://www.visitdenmark.com/uk/en-gb/menu/turist/inspiration/detkulturelledanmark/design/danish-design.htm -

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

2/16

Denmarks international outlook is reflected in the fact that the population commands excellentlanguage skills, English being considered a natural second language. Cross-bordercommunication in Scandinavia is aided by the fact that Danes, Norwegians and Swedes arehighly adept at understanding each other's languages. Among the younger generations

especially, it is common to be skilled in several European languages, including German, Frenchand Spanish.

Market definition & size

This market survey covers import of tropical hardwood as defined by the CombinedNomenclature (CN) for statistics in the European Union as follows:

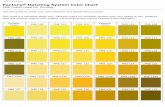

CN number* description4403 Wood in the rough, whether or not stripped of bark or roughly squared

4407 Tropical sawn timber wood sawn lengthwise, sliced or peeled, whether ornot planed, sanded or finger jointed, of a thickness exceeding 6 mm

4408 Veneer and other sawn wood lengthwise, sliced or peeled, whether or notplaned, sanded or finger-jointed of a thickness not exceeding 6 mm

4412 Plywood, veneered panels and similar laminated wood4418 Builders joinery and carpentry of tropical wood (doors, windows and frames)

*) CN is an 8-digit trade classification system used by the European Union for tariff purposes. Thesystem is directly linked to the 6-digit Harmonized System (HS) used by the vast majority of tradingnations throughout the world.

Danish imports of unprocessed wood, sawn wood, veneer and plywood in 2007 amounted to avalue of almost 5.5 billion DKK. Two thirds of this originated in the neighbouring countriesSweden, Finland and Germany. The import of wood products for construction (such as joineryand carpentry) amounted to a value of approximately 5.5 billion DKK. The value of imports ofunprocessed wood and of wood products thus totals to about 11 billion DKK; the total value ofimports of tropical hardwood, (raw and sawn) veneer, plywood, carpentry and joinery in 2007amounted to about DKK 450 million or about 4% of the total. In the EU, Denmark is the 9 th

largest importer of wood, with a very high per capita import of wood relating to the fact thatDanish exports of wood products particularly furniture is relatively high while the forest area isrelatively small (538.000 ha).

Imports

Below, please find Danish imports of timber and timber products (as defined in paragraphabove).

Denmarks imports of timber & timber products 2005-2007

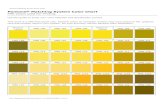

2005 2006 2007million DKK million US$ million DKK million US$ million DKK million US$

Total 5,187.5 (863.4) 5,852.0 (1,051.3) 5,450.7 (1,119.8)

Malaysia 97.3 (16.2) 92.5 (16.6) 87.2 (17.8)Source: Statistics Denmark

2

-

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

3/16

Both the total value of imports as well as the value of imports from Malaysia has decreased in2007 compared to 2006 when calculated in the Danish currency, the Danish Krona (DKK).However, when calculated in US dollars, total imports as well as imports from Malaysiaincrease this is mainly due to the depreciation of the dollar against most European currencies

in that period.

With regards to Denmarks total imports of products under CN codes 4403, 4407, 4408, 4412and 4418 Malaysia represents only less than 2 % of the total value of imports of these productgroups. But among Danish sources of timber from non-temperate areas, Malaysia has a marketshare of more than 10%.

Malaysias most important competitors in tropical hardwood for Denmark are:

China with a value of Danish imports in timber and timber products amounting to US$33.6 million. China is growing fast as a source of imports for the Danish timber andfurniture industry. China, however, is not so strong in sawn logs, but more in plywoodand joinery & carpentry; this is also helped by the fact that a few Danish companieshave outsourced production of furniture parts to China and invested in productionfacilities there.

Brazil is now the second largest source of tropical timber for Denmark. Its share oftropical hardwood timber grew by 299% between 2001 and 2005. As a reason for thissuccess, according to the large wood importing companies, is the introduction of acentralized computer-based certification system, making it possible for the Europeanimporters to control the origin and legal status of the wood. In comparison to a previous

system based on paper, the computer based system makes fraud much more difficult.

Thailand Danish imports of tropical timber and timber products from Thailandamounted to US$ 8.8 million in 2007. Veneer is increasingly being used in industrialproduction of furniture and kitchen cupboards. Like Burma, Thailand is a producer ofhigh quality teak and mahogany. Thailands share of the export of builders joinery andcarpentry to Denmark declined. According to Danish importers the requirementspecifications to joinery and carpentry are complex and change quickly. Therefore thereis a tendency to buy these products from high productivity suppliers in Europe, oroutsource to China.

Indonesia Danish imports of plywood, veneered panels and laminated wood fromIndonesia have slowly declined in the past years, to a value of US$ 10.3 million in 2007.Indonesia has a long trading tradition with Denmark. Indonesian plywood, panels andlaminated wood are used in floor and door manufacturing.

Myanmar/Burma Burma used to be a very important supplier for tropical timber andtimber products to Denmark, as it is almost the only country in the world that still hasteak grown in natural forests; natural growth provides the wood with special qualities ofdurability and deep glow. There was a long tradition of using Burma teak in Danishdesigner furniture and in ship building because the Burmese teak can stand the wear ofsalt water. Tradition for trade among Burma, Thailand and Denmark dates back to thestart of the East Asiatic Company in 1897. Imports from Myanmar/Burma have beencriticized in the media. According to the EU, the country is a military dictatorship known

3

-

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

4/16

for systematic violations of human rights. As a consequence of the political situation inBurma, imports from Burma have dwindled, and amounted to less than US$ 0.3 millionin 2007.

Other, smaller competitors include the Republic of Congo, Mali, and Equador.

Malaysia managed to gain on its competitors. A reason for the increase of the export ofMalaysian tropical wood to Denmark is the existence of a Malaysian wood certification system.In comparison to other developing countries Malaysia has been proactive and has establishedthe Malaysian Timber Certification Council (MTCC), which is recognised by the Danish Ministryof Environment in its guidelines for procurement of timber. However, MTCC is criticised byimporters for not fulfilling requirements to securing legality and sustainability of wood and thusthe reputation of MTCC is mixed among stakeholders in the Danish wood sector. It is not clearwhy export of plywood, panels and laminated wood from Malaysia to Denmark has declined.This might be because China has become such a large exporter to Denmark in this area, andas in other sectors of industry, China is recognised as a stable supplier, delivering according tospecifications at low cost.

Market trends

There clearly is an unfulfilled demand for certified tropical wood and timber products inDenmark. The challenge for Malaysian suppliers lies in precision regarding specifications andstability regarding delivery.

In a publication by the Danish Import Promotion Programma (DIPP), a major importer of one of

Denmarks largest wood trading and processing companies, emphasizes that it sees the marketfor certified tropical wood as a suppliers market. According to him, all the certified tropicalwood available can be sold.

With regards to lesser known species of timber, the Chairman of the Board of the ForestStewardship Council (FSC) in Denmark views the market in this way,It is correct - in a way -that it is a sellers market today. But this is only valid for the ten to fifteen most commercialtypes of wood, which are known internationally, which are also the ones traded by theinternational companies. The less known types of wood do not have a market in Europe. Only ifthis new kind of wood is delivered with an FSC certificate it may open the door.

Still, Danish imports of tropical wood and timber products are decreasing when calculated inDanish Kroner. Several factors may be seen to contribute to the development in imports oftropical wood:

A reason for the decline in imports of tropical hardwood relates to the competition andinternationalisation of the sector. Due to competition, wood trading companies generallybecome larger in terms of turnover, internationalised and/or more specialised. Thecompanies place their warehouses, sawmills and manufacturing where it is economicallymost advantageous. For example some Danish import companies have warehouses inGermany - wood that used to be registered as imported to Denmark may thus today bere-exported without reaching Denmark.

Many manufacturers move their production to countries with lower labour cost than the

Danish or European costs; the aim is also to reduce transportation costs. As an examplesome of the large importers of garden furniture - a key commodity manufactured from

4

-

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

5/16

tropical wood - import the furniture directly from developing countries. Design often takesplace in Denmark or Europe to secure that the furniture match Danish consumerpreferences.

A market survey from the Dutch CBI (Centre for Promotion of Imports from DevelopingCountries) notes an increasing preference for temperate timber. For Denmark

preferences appear to depend on the type of product.

Some consumer or market trends which have been observed lately by DIPP: Denmark has an extensive coastline with a considerable number of harbours. The

seawater is salt and special worms in the water tend to attack the piers, the reason whytropical hardwood has been found to be the only product with sufficient strength andflexibility.

In large apartment buildings of good standards, each apartment often has a balcony. Ithas become fashion to construct such balconies from tropical hardwood, because it isdurable in the wet and harsh Danish weather.

Garden furniture is often made from tropical hardwood that is durable in the wet Danishweather, and the majority of tropical hardwood garden furniture imported is FSC certified. In parallel with media coverage related to global climate problems campaigns for

ecological and fair trade products have been run within the last year increasing theawareness and demand from consumers that products should be produced underconditions that are environmentally and socially sustainable, which again points to therelevance of FSC and/or fair trade arrangements.

Tropical hardwood is increasingly used for window frames sometimes in combinationwith metal - again the durability in the tough Danish weather conditions is an appreciatedquality.

Floors from tropical hardwood are often used in public buildings due to its durability and

they are both constructed using veneer and solid wood, the latter is preferred for longterm durability.

Specific Danish requirements regarding use of tropical hardwood

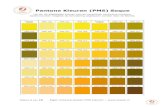

In 2003, the Danish Ministry of Environment issued guidelines for procurement of tropical timberaimed at procurement staff in public organisations, and recommended for use by privateorganisations. The guidelines recommend that requirements to forest management andhandling of wood are made before any import takes place. Three levels of requirements areoutlined:

The lowest levelrequires documentation for lawful production: i.e. that the exporter hasthe right to log the timber, that national laws are adhered to, that taxes and duties arepaid and that the timber is not vulnerable as defined in the UN Convention onInternational Trade of Endangered Wildlife and Species (CITES).

The second level is documentation for lawful production progressing towardssustainability; implying that the public authorities of the country are in the process ofmanaging natural resources in a sustainable and socially and economically responsiblemanner. The exporting organisation should be encouraged to contribute through a

strategy for sustainable management of its own forest resources.

5

-

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

6/16

The highest levelis documentation for lawful and sustainable production. This is more orless equivalent to the requirements for FSC and/or Chain of Custody certification.

In 2007, the Ministry of Environment commissioned an evaluation of the guidelines forprocurement of tropical hardwood. The main conclusions were that the guidelines are not

commonly used by public procurement officers, because the guidelines were too general andnot operational.

Based on this evaluation, the Minister for Environment has launched a 9-point plan to improvepublic procurement of timber, which includes:

1. Expand the purchasing guidelines to all types of timber2. Make guidelines more user-friendly to compliance regarding legality and sustainability of

the timber3. Call upon federations and other stakeholders to focus on legality and sustainability4. Support green procurement policies in all sector ministries5. Promote green procurement policy in general6. Promote green and environmental friendly procurement in international forums7. Promote certification of forests

Until the new guidelines are ready, the Ministry recommends that legality and sustainability ofwood to be procured are secured through use of the following types of certification:

Canadian Standard Association (CSA) FSC MTCC Programme for endorsement of Forest Certification Schemes (PEFC) the

forestry industrys answer to the FSC Sustainable Forest Initiative founded by the American Forest and PaperAssociation

Trade structure of the Danish wood sector

The majority of the tropical wood is imported to Denmark by specialised wood importingcompanies, often using purchasing agents. Some of these are international with subsidiariesworldwide, some specialise in trading of wood, whereas others combine this with sawmills,manufacturing and/or outlets and retail in Denmark. The Danish importers of wood are

organised in the Dansk Trforening or Danish Timber Trade Federation (DTTF), websitewww.dktimber.dk

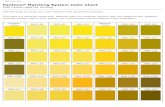

Wood and semi-manufactured wooden products including imported tropical wood are mainlyused in the construction sector and the wood manufacturing and processing industry. The mainflows of the wood from the forest to consumer product are illustrated in the model below.

6

http://www.dktimber.dk/http://www.dktimber.dk/ -

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

7/16

Source: Danish Chamber of Commerce

A large part of the wood is used in the construction sector; within the sector the wood trade ofcarpenter and joiner enterprises constitute the largest branch, with 5600 registered enterprises,23,000 employees and an annual turnover of DKK 28 billion or US$ 5.7 billion. An increasingpart of the work is done as automated and industrialised processes; at the building sitecarpenters and joiners are now mainly installing prefabricated modules or elements. In many ofthese elements wood has been substituted by other materials, although wood remains thepreferred raw material for some components. The relatively high number of enterprises reflects

that there are many smaller works in the sector and also that it is relatively easy to establish asmall carpenter or joiner business.

Another major consumer of wood are the large building companies, some of which areinternational in structure. The building companies will be contracted for large constructionworks, which in Denmark mainly are commissioned by public authorities such as a ministry,municipalities or harbour authorities.

The wood manufacturing and processing industry consisting of saw mills, minor woodprocessing workshops and factories employing a total of 14,500 persons; the value of woodprocessing products was DKK 13 billion or US$ 2.2 billion in 2005.

7

-

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

8/16

One of largest consumers of wood is the Danish furniture industry and the value of itsproduction in 2005 was approximately DKK 20 billion or US$ 3.3million. Although materials likesteel and plastic are important components of furniture, wood remains a preferred material byDanish consumers. Classical design in wooden furniture, manufactured according to traditionaljoiner and carpentry craftsmanship tend to become collectors items and fetch high prices. On

the other hand, many large furniture stores (such as IKEA from Sweden) mass-producecheaper products. In mass production of wooden furniture and kitchen cupboards - veneer ofmore expensive woods are often used in combination with a core of cheaper wood to obtain thestyle of more expensive design.

Another trend in the market for wood products is the growth of the so-called Do It Yourselfstores, where prefabricated parts for building, furniture and kitchen cupboards are bought forcompletion by the consumer. Veneer and plywood often form a substantial part of theseproducts. An area where a substantial amount of tropical wood is used is in production of floors,and normally companies have several product lines comprising solid wood floors and floorsmanufactured from veneer. Most of these laminate floors are sold through DIY stores.

Contacting Danish importers and closing a deal

Most Danish importers visit different trade fairs all over the world to meet with potentialsuppliers and to get an impression of the possibilities in the market. As close, personalrelationships are often stressed in international trade relations, this is a very good way ofmeeting potential business partners for both importers and suppliers.

There are however no specific trade fairs for wood in Denmark. In May the annual internationalfurniture fair The Copenhagen International Furniture Fair (CIFF) is held in Copenhagen andthe wood industry is normally represented at this fair, see www.furniturefair.dk.

The Danish wood importers may attend the large fairs held in Germany (Hannover) and inSweden. Information on these fairs may be found at www.expocentral.com. The Europeantimber industry exposes products at the Ligna + fair in Hannover, Germany and information canbe found at www.ligna.de. The most important timber fair in neighbouring Sweden is ElmiaWood, which is held every 4 years (next instalment will be in June 2009, seewww.elmia.se/en/wood). Other timber, veneer and building fairs in the region are the Batibouwfair in Belgium, seewww.batibouw.com and the Bautec fair in Berlin, see www.bautec.com.

Personal contact established at a trade fair is always important. If a product is of relevance tothe importers line of business, it will normally not be a problem to set up meetings directly.Danish business people are generally result oriented and well versed within their particular field.Therefore, it is advisable to be well prepared and ready to respond to very direct questionsabout quality, prices, quantities and deliveries.

It should never be assumed that the Danish importer will follow up on the business offer thefollow up is always expected to be made by the exporter. A follow up call will give an idea of theneed and purchase pattern of the Danish importer, which may help evaluate the compatibility ofthe product.

With regards to negotiating business terms, a Danish business partner is likely to be totallyfrank regarding what he expects from you and what he himself can contribute with. It is

8

http://www.furniturefair.dk/http://www.expocentral.com/http://www.ligna.de/http://www.elmia.se/en/woodhttp://www.batibouw.com/http://www.batibouw.com/http://www.bautec.com/http://www.furniturefair.dk/http://www.expocentral.com/http://www.ligna.de/http://www.elmia.se/en/woodhttp://www.batibouw.com/http://www.bautec.com/ -

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

9/16

important to be very precise when negotiating terms. Exporters should not accept any termsthat they are unable to fulfil. No, is a perfectly acceptable word in Denmark and nobody will beoffended by an explanation that delivery according to a certain specification is not possible aslong as the specification has not been agreed on. It is of paramount importance, however, notto make promises that cannot be kept 100%.

Danes like written contracts. Whereas, in some cultures, a contract is a letter of intent, and thebusiness partner is satisfied if the exporter does his best to live up to the terms, this is not thecase in Denmark where the business contract is considered irrevocable and a partner willexpect the contract to be fulfilled to the letter.

As far as transport and insurance is concerned, the so-called Incoterms 2000 form aninternationally recognized tool, developed by the International Chamber of Commerce, clarifyingthe responsibility for arranging and paying for the transport and insurance. A good descriptivepresentation of the various forms and definitions can be found onwww.iccwbo.org/index_incoterms.asp

Ethics and code of conduct

Over the last decade, consumers in Denmark have increasingly paid more attention to theethical conduct of business, which has given rise to the term political consumers.

The term political consumers implies that there is a strong tendency towards Danishconsumers placing greater demand on Danish importers and manufacturers to be able toguarantee that the products imported from developing countries have not been produced e.g.by use of child labour or has caused industrial pollution or otherwise harmed the environmentwhen manufactured. Therefore, by getting involved with Danish importers, many suppliers fromnon-EU countries will be asked to sign a contract or statement guaranteeing that the productionis carried out without violating the above mentioned issues.

A code of conduct is a voluntary written policy committing the supplier to social and ethicalbusiness operations, some enterprises have developed a policy and plans to demonstrate howthe organisation takes care of its Corporate Social Responsibility (CSR). Companies often basetheir social codes of conduct on the conventions of the ILO (International Labour Organisation).A wide variety of social codes of conduct has been developed over the years. Many companiesuse their codes as a means of promotion and marketing.

Finally, bribery is almost non-existent in Denmark. Recent studies have shown that Denmark isat the bottom of the list of countries in which bribery or corruption is found. When fraught isdetected, it has serious consequences. Producers misusing the FSC logo have been excludedfrom the Danish market with immediate effect.

Legal requirements and import regulations

Goods imported to Denmark are governed by a complex set of EU and national directives, laws,regulations and standards. The aim is to ensure consumer safety, to protect the environment

and limit other risk factors. The importer is responsible for compliance with relevant legislation,

9

http://www.iccwbo.org/index_incoterms.asphttp://www.iccwbo.org/index_incoterms.asp -

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

10/16

and authorities in Denmark will check compliance. Consequently, the importer will require fromsuppliers that products meet requirements.

First and foremost, the Convention on International Trade in Endangered Species (CITES) laysdown provisions for the protection of endangered species of flora and fauna, and has put a ban

on certain wood types originating in rainforests. An EU Regulation (Regulation (EC) No 338/97)harmonises implementation of CITES in the EU, expanding the number of species concernedand adding import restrictions. For additional information on CITES please refer tohttp://www.cites.org.

A set of environmental requirements and environmental legislation is valid for wood importedinto Europe. This legislation has two main purposes: one is to avoid that diseases enter into theDanish and European market via imported wood, the other purpose is to avoid wood wheredangerous and prohibited substances have been used and are contained.

This environmental legislation is under change. The most recent Danish regulations can be

found at the website of the Ministry of Environment www.MST.dk; however environmentalrequirements generally follow EU regulation and the relevant directives can be found at the CBI,Centre for the Promotion of Imports from Developing Countries, www.cbi.nl, where informationis provided free of charge.

Packaging

Apart from the safety aspects and the protection against damage, the focus of packaging is onenvironmentally friendly transport - as well as sales-promotion packaging. This means, amongother things, that it should be considered whether returnable systems could be used on a muchgreater scale than before. In general, the buyer indicates the packaging requirements for semi-finished products. Concerning doors, it invariably involves individual packaging in shrink foil,with a strip of corrugated carton along the sides, on which should be printed the exact sizes andthe wood species. An extra protection using hard plastic at the four corners will be required aswell. This is only one example. Finished products, such as parquet ready to be laid, should bepacked in quantities that can be carried by the final consumer without special equipment.Here again, the buyer will indicate the particulars. Packaging must be marked not only to beidentifiable during transport, but also to indicate the quantity, the weight, the timber species andthe brand. In the case of shipping in container loads, special attention has to be given to thisissue because of under/overweight claims. The official FSC logo should be applied to FSCcertified timber (products) for recognisability by consumers.

The rules are less strict for unprocessed or primary processed products. Logs, for instance,have to be numbered and to carry the logo/name of the exporter.

The requirements for wood packaging materials apply to all wood packaging material importedinto the EU from third countries other than Switzerland and also apply to wood packagingmaterials that are used to support other products during transport. Exempted are raw wood of 6mm thickness or less and processed wood produced with the use of glue, heat and pressure ora combination thereof. Wood packaging material is required to:

be treated according to one of the approved methods as specified in the internationallyaccepted standard ISPM 15, notably: heat treatment or fumigated;

display a mark with the two-letter ISO country code, a code identifying the producer andthe code identifying the approved measure applied (HT or MB);

10

http://www.cites.org/http://www.mst.dk/http://www.cbi.nl/http://www.cites.org/http://www.mst.dk/http://www.cbi.nl/ -

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

11/16

round wood packaging material shall be made from debarked round wood.See also http://ec.europa.eu/resources/import_conditions/woodpackaging.pdf

Since changes in environmental policy follow each other at a rapid pace, exporters are advisedto ask the importer about the latest regulations and/or requirements related to packaging.

Marking and labelling requirements applying to products sold in Denmark are numerous andvary from item to item, and both Danish and EU laws and regulations influence requirements.The correct labelling of the product is important as the information is to be used uponimportation to Denmark. A customs declaration always has to be filled in containing informationsuch as the TARIC code, country of origin, name of the consignor, the value of the products etc.

Custom duties

In general, all goods, including timber and timber products, entering the EU are subject toimport duties. External trade conditions in the European Union are determined by EUregulations. In the case of timber and timber products, the level of the tariffs depends on:

the country of origin; the type of product.

The import duty on timber and wood products is below 10%. Up-to-date tariff information of theEuropean Community Integrated Tariff (TARIC) can be obtained from the Internet site:http://europa.eu.int/comm/taxation_customs/dds/en/tarhome.htm

At this site you have to indicate the TARIC code and country of origin to get information of thetariff.

There are, at the moment of writing this report, no import quotas on products included in thisreport.

Rules of Origin are a set of rules to determine in which country the products have originated. Tobenefit from lower customs duties, the export product has to originate in a country covered by afree-trade agreement or a preferential arrangement. A product is generally said to confer originin a country if it is wholly obtained or sufficiently processed in that country.

To prove that the rules of origin are fulfilled, the exporter has to provide the necessarydocumentation. A GSP proof of origin must be issued by the exporter and certified by the

customs authorities of the exporting country. The following documents of origin are valid: Certificate of origin Form A; Invoice declaration.

Countries belonging to certain groups, including ASEAN have the right to use materials fromother countries in their group in the production without losing the status as country of origin.This is called cumulation.

Value Added Tax (VAT) is levied on practically all products in Denmark, imported as well asdomestic. The Danish Value-Added Tax (VAT) currently constitutes 25% and is among thehighest rates within the EU. The 25% VAT is levied on all sales, regardless of product type,country of origin etc. For further information on VAT and duties in Denmark for specific productssee http://exporthelp.europa.eu/.

11

http://ec.europa.eu/resources/import_conditions/woodpackaging.pdfhttp://europa.eu.int/comm/taxation_customs/dds/en/tarhome.htmhttp://exporthelp.europa.eu/http://ec.europa.eu/resources/import_conditions/woodpackaging.pdfhttp://europa.eu.int/comm/taxation_customs/dds/en/tarhome.htmhttp://exporthelp.europa.eu/ -

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

12/16

Conclusion

Out of all Scandinavian countries, Denmark is the most interesting export destination forMalaysian exporters of tropical hardwood and timber products. As opposed to Sweden andFinland, Denmark hasnt any large indigenous production forests, so it is dependent on imports.Furthermore, as we have observed in Market trends, many Danes have a preference for usinguntreated tropical hardwood at the exterior of their houses or apartments. Tropical timber is alsooften used in garden furniture and floorings.

Even though the Danish economy will suffer from the international credit crisis of 2008,Denmark has a very affluent population and construction will continue to grow in the long run.

MATRADE RotterdamDecember 2008

12

-

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

13/16

Annex I

USEFUL WEBSITES

Government of Denmark

www.denmark.dk

EU Export Helpdesk for Developing Countrieshttp://exporthelp.europa.eu

Kompass - The Business to Business Search Enginewww.kompass.com

Europages The European Business Directorywww.europages.com

Market Acces DatabaseDatabase of European Commission on import regulations, duties and trade barriershttp://mkaccdb.eu.int

The Forest Stewardship CouncilProvides information on processes of certification of woodDenmark: www.FSC.dk includes links to Danish companies active in import and certificationInternational: wwwFSC.org

The Danish Timber Trade FederationInformation and links to Danish timber importerswww.dktimber.dk

Danish Environmental Protection AgencyProvides guidelines on procurement of timber and links to relevant environmental regulationwww.mst.dk

13

-

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

14/16

Annex II

DANISH IMPORTERS OF TROPICAL HARDWOOD

Teglgaard Hardwood Aps.Langesvej 905492 VissenbjergDenmarkT +45 63 96 96 [email protected] person: Mr. Jakob Kildal

Tower WoodRdmevej 545771 Stenstrup

DenmarkT +45 62 26 21 [email protected] person: Mr. Bjarne Junker

DSHWood A/SGlarmestervej 77000 FredericiaDenmarkT +45 74 55 26 [email protected] person: Mr. Anders Bjrnkjr Nielsen

Vejle KommuneSkolegade 17100 VejleDenmarkT +45 76 81 00 00F +45 76 44 40 01

[email protected] person: Mr. Lars Rasmussen

Aarhus KommuneValdemarsgade 18, Postboks 798100 rhus CDenmarkT +45 89 40 27 55F +45 89 40 27 [email protected]

www.aarhus.dkContact person: Ms. Marie Stenild Petersen

14

mailto:[email protected]:[email protected]://www.towerwood.dk/mailto:[email protected]://www.dshwood.dk/mailto:[email protected]://www.vejle.dk/mailto:[email protected]://www.aarhus.dk/mailto:[email protected]:[email protected]://www.towerwood.dk/mailto:[email protected]://www.dshwood.dk/mailto:[email protected]://www.vejle.dk/mailto:[email protected]://www.aarhus.dk/ -

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

15/16

Tracer ApsIndustriskellet 28700 HorsensDenmark

T +45 76 82 50 [email protected] person: Mr. Kasper Kopp

Keflico A/SJuelstrupparken 249530 StvringDenmarkT +45 98 13 35 44F +45 98 16 90 12

[email protected]/Contact person: Ms. Majbritt F. Groes

Hardwood Partners ApSBentsensvej 44330 Hvals HvalsDenmarkT +45 46 46 16 [email protected] person: Ms. Tina Haagensen

Timber Team International A/SNaverland 22600 GlostrupDenmarkT +45 43 44 30 [email protected]://www.timberteam.comContact person: Mr. Niels Bock Pedersen

Skov- og NaturstyrelsenHaraldsgade 532100 Kbenhavn DenmarkT +45 72 54 20 00F +45 39 27 98 [email protected] person: Mr. Christian Lundmark

Casanti Timber A/SBirkedommervej 31

15

mailto:[email protected]://www.tra-cer.com/mailto:[email protected]://www.keflico.com/mailto:[email protected]://www.hvalsoe-sawmill.dk/mailto:[email protected]://www.timberteam.com/mailto:[email protected]://www.skovognatur.dk/mailto:[email protected]://www.tra-cer.com/mailto:[email protected]://www.keflico.com/mailto:[email protected]://www.hvalsoe-sawmill.dk/mailto:[email protected]://www.timberteam.com/mailto:[email protected]://www.skovognatur.dk/ -

8/7/2019 06-PMS-TROPICAL HARDWOOD IN DENMARK

16/16

2450 Kbenhavn NVDenmarkT +45 38 18 18 [email protected]

Contact person: Mr. Benny Pedersen

Atlas Timber & HardwoodKrondalvej 9A2610 RdovreDenmarkT +45 70 22 78 [email protected] person: Mr. Carsten Tolderlund

Hvals Savvrk A/SBentsenvej 44330 HvalsDenmarkT +45 46 46 16 [email protected] person: Ms. Tina Haagensen

16

mailto:[email protected]://www.casanti.dk/mailto:[email protected]://www.atlas-timber.dk/mailto:[email protected]%20http://www.hvalsoe-sawmill.dk/mailto:[email protected]://www.casanti.dk/mailto:[email protected]://www.atlas-timber.dk/mailto:[email protected]%20http://www.hvalsoe-sawmill.dk/